GnauzBookOfRhymes

Superstar

42% Jump in Property Tax Delinquencies as Cook County IL Treasurer Warns of Problems 'Beyond Human Imagination' – Wirepoints | Wirepoints

Cook County property tax delinquencies increase by 42%

Cook County property tax delinquencies increase by 42%

Today I spoke with Cook Country Treasurer Maria Pappas for further comment on the county’s 42 percent spike in delinquent property tax payments and the causes thereof, which she earlier said were “beyond human imagination.” More than 57,000 Cook County property owners face a May 8 deadline for sale of their taxes because they haven’t yet paid – a jump of 17,000 over this time last year.

She let it rip:

“I gotta get outta here” is the most common thing she said she hears in her office from desperate taxpayers. “We hear it constantly in Polish, Spanish, English, Chinese, Korean, you name it. On a scale from one to 10 this is a 20. People are fuming!”

Her employees in the Treasurer’s office have become like psychological counselors, she said, bombarded by endless numbers of depressed or enraged homeowners unable to pay their property tax bills. “They come into our office with their electric bills, parking bills, food bills and all the rest, and show us how much they make. They can’t pay. They just can’t pay.”

I asked if prior years were as bad as this year’s 42 percent year-over-year jump in delinquent bills. It was “not this big” before, she said.

I asked why – what’s causing the jump in delinquent payments?

“There’s no money! People have no money. Government has no money,” she said. It’s like a rubber band that’s been pulled too tight, she said, “and that rubber band is snapping…. This is not a Democratic or Republican thing, Trump or Sanders or anything like that…. In everyday life people are being squeezed.”

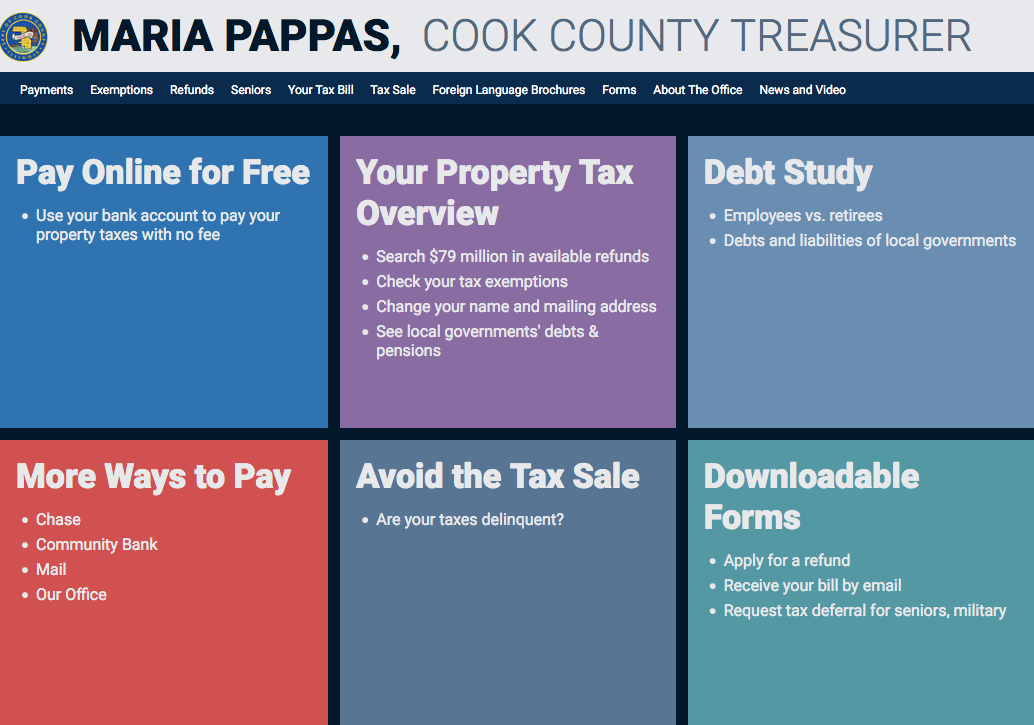

She asked me to emphasize that her office maintains a $130 million fund that’s available to homeowners entitled to refunds. Those refunds may be due in cases where exemptions weren’t properly taken in earlier years or where pro rations on buyer/seller closing statements were in error. Details are on the Treasurer’s site.

While it’s unusual to hear a politician with Pappas’ candor, none of this should come as a surprise. Wirepoints and some others have been warning for years about the death spiral of suicidal property tax rates in many Illinois communities. The disaster was earliest and most acute in Chicago’s south suburbs, and now it’s common. Hundreds of thousands of families first lost most of their life savings in the form of their home equity. Now they face loss of the homes themselves.

It’s hardly limited to Cook County. We hear the tragic stories routinely – from many other Illinois counties. Sometimes they’re written in notes attached to tiny contributions. Sometimes we hear them on voicemails left for us. The saddest are from senior citizens, often on fixed incomes, who can no longer afford their property tax bills.

We’ve said it from the start and we say it again: Our model of government is broken. Illinois simply isn’t generating the jobs, growth and revenue needed to meet the promises it has made. Drastic reforms are essential.