Man fukk Russia Putin thought he can stick it to us politically.. them sanctions hurting his boys

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

RUSSIA 🇷🇺 Thread: Wikileaks=FSB front, UKRAINE?, SNOWED LIED; NATO Aggression; Trump = Putins B!tch

- Thread starter ☑︎#VoteDemocrat

- Start date

More options

Who Replied?

Putin, Responding to Sanctions, Expels 755 U.S. Diplomats

By NEIL MacFARQUHARJULY 30, 2017

MOSCOW — President Vladimir V. Putin announced on Sunday that 755 American diplomats would be expelled from Russia by Sept. 1 in response to the new law passed in Congress last week expanding sanctions against Russia.

Although the expulsions had been announced on Friday, the president’s statement was the first to confirm the large number involved.

Speaking in a television interview on the Rossiya 1 network, Mr. Putin said that Russia’s patience in waiting for improved relations with the United States had worn out.

“We waited for quite some time that maybe something will change for the better, had such hope that the situation will somehow change, but, judging by everything, if it changes, it will not be soon,” Mr. Putin said in the interview, according to Interfax news agency.

@DonKnock @The Black Panther @SJUGrad13 @88m3 @Cali_livin @Menelik II @Hogan in the Wolfpac @wire28 @Atlrocafella @Ss4gogeta0 @smitty22 @Reality @fact @Hood Critic @ExodusNirvana @Call Me James @Blessed Is the Man @THE MACHINE @OneManGang @duckbutta @TheDarceKnight @dtownreppin214 @Ed MOTHERfukkING G

U.S. embassy in Moscow says locked out of diplomatic property

- 39m

- 0

MOSCOW (Reuters) - The U.S. embassy in Moscow accused Russian authorities on Monday of barring diplomatic staff from a property on the outskirts of Moscow, after having earlier granted access until midday on Tuesday for them to retrieve belongings.

The Russian foreign ministry did not immediately respond to requests for comment.

The property, in a picturesque spot on a bend in the Moskva river north-west of the Russian capital, is leased by the U.S. embassy for its staff to use for recreation.

Moscow has said it is taking it back as part of retaliatory measures after Washington approved a fresh round of sanctions against Russia.

A Reuters TV cameraman outside the country residence, known in Russian as a dacha, saw five vehicles with diplomatic license plates, including a truck, arrive at the site. He said they were denied entry.

An embassy spokeswoman said: "In line with the Russian government notification, the U.S. Mission to Russia was supposed to have access to our dacha until noon on Aug. 1.

"We have not had access all day today or yesterday," she said. "We refer you to the Russian government to explain why not."

(Reporting by Gennady Novik and Polina Devitt; Writing by Christian Lowe; Editing by Catherine Evans; Editing by)

Read the original article on Reuters. Copyright 2017. Follow Reuters on Twitter.

@DonKnock @The Black Panther @SJUGrad13 @88m3 @Cali_livin @Menelik II @Hogan in the Wolfpac @wire28 @Atlrocafella @Ss4gogeta0 @smitty22 @Reality @fact @Hood Critic @ExodusNirvana @Call Me James @Blessed Is the Man @THE MACHINE @OneManGang @duckbutta @TheDarceKnight @dtownreppin214 @Ed MOTHERfukkING G

Last edited:

@DonKnock @The Black Panther @SJUGrad13 @88m3 @Cali_livin @Menelik II @Hogan in the Wolfpac @wire28 @Atlrocafella @Ss4gogeta0 @smitty22 @Reality @fact @Hood Critic @ExodusNirvana @Call Me James @Blessed Is the Man @THE MACHINE @OneManGang @duckbutta @TheDarceKnight @dtownreppin214 @Ed MOTHERfukkING G

Warning of US sanctions ‘disaster’ for Russia energy projects

Industry voices fears of damage to billions of dollars of investment after Trump signs bill

yesterday

Gazprom's Yamal gas pipeline on the Yamal Peninsula in Siberia © Bloomberg

International energy investments in Russia will suffer from new US sanctionsimposed on Moscow, executives have warned, as companies scrambled to assess the impact on billions of dollars’ worth of projects.

President Donald Trump on Wednesday reluctantly signed into law sweeping new sanctions against Moscow in retaliation for Russia’s alleged meddling in the US election, despite strong opposition from oil and gas companies that fear the broad interpretation of some of its clauses could cause unintended damage to their businesses.

“The sanctions are beginning to backfire on those who are introducing them, which is positive,” said Igor Sechin, chief executive of Rosneft, Russia’s largest oil producer. “[Sanctions] are starting to work against our American partners,” he said, adding that Rosneft is in a position to take advantage.

A senior executive at a western oil group with a large presence in Russia told the Financial Times that the new sanctions “could be a disaster” given its current business in the country.

“This throws everything into confusion,” the executive said, declining to be named because of the business sensitivity of the issue.

€4.75bn

Amount pledged by European companies to help fund the Nord Stream 2 gas pipeline between Russia and Germany

The sanctions bill, which had the overwhelming support of Congress before it reached Mr Trump’s desk, in particular bans the providing of “goods, services, technology, information or support” to both the construction and the “modernisation or repair” of Russian energy export pipelines.

That clause throws into doubt the €4.75bn pledged by European companies Royal Dutch Shell, Engie, Wintershall, OMV and Uniper to help fund the Nord Stream 2 gas pipeline being built Gazprom, the Russian state-owned energy group, between Russia and Germany. It could also damage other projects by international companies.

Energy companies may have to rely on individual waivers from the White House to continue some projects, while a clause that states the imposition of sanctions requires consultation with “allies” has raised hopes that the damage could be limited.

Daniel Fried, who served as head of US sanctions policy until February, told the FT that the Trump administration would have to engage with the energy companies and "operate with some common sense" when implementing the sanctions.

“People are going to have to act with some discretion . . . They will need to take a deep breath,” he said.

Royal Dutch Shell said on Thursday it had nothing to add to comments made last week by its chief executive, Ben van Beurden. “We have to see how this bill gets implemented,” he said at the time. “We comply with the law and with any restraints or sanctions that are being put upon us.”

Mr van Beurden said Shell had authorisation from Dutch authorities to press ahead with financing of Nord Stream 2, but was waiting to see how the US situation “evolves.” “We have commitments under that arrangement and we are fulfilling those commitments as much and as best as we can,” he said.

Austria’s OMV said that it was too early for the company to draw any conclusions, and it was monitoring the situation “very carefully”.

Officials have warned that a pipeline that carries oil to the Black Sea from Tengiz, a project in Kazakhstan where Chevron and ExxonMobil agreed last year to a $37bn expansion, could also be affected by the sanctions.

The new US measures also target Transneft, the oil pipeline monopoly whose vast network many international companies rely on to carry their Russia-produced crude to export terminals. But the company’s chief executive, Nikolai Tokarev, said on Thursday that Transneft did not rely on foreign technology or financing so the new measures would not affect his business.

Publicly, major international oil and gas companies operating in Russia have said they will continue to operate as normal within the new restrictions. Gazprom and the Russian government have consistently stressed that the Nord Stream 2 pipeline will go ahead as planned.

But some western oil groups insist they can make the new regime work, with BP playing down the impact on its business. Despite owning 20 per cent of Rosneft and being one of the industry’s biggest investors in Russia, the UK-based company has no stakes in transport infrastructure.

While warning that an earlier draft of the sanctions “was full of . . . very significant unintended consequences”, chief executive Bob Dudley said this week that the most problematic language for BP had been rewritten and the company expected to be able to “work very carefully within the sanctions”.

“We’re not aware of any material adverse effect on our current income and investment in Russia or elsewhere, or our ability to work with Rosneft itself,” he said.

Senior EU, German and Austrian politicians have previously attacked the new US measures for hurting their business interests, and Mr Trump himself said after signing that it was “seriously flawed”.

Additional reporting by Ralph Atkins in Zurich

America’s new economic sanctions may hurt Russia’s recovery

But whether they will change Vladimir Putin’s behaviour is another matter

2 hours ago

But whether they will change Vladimir Putin’s behaviour is another matter

IN LATE June Daimler, a German carmaker, broke ground on a new Mercedes-Benz plant north-west of Moscow. “We are confident in the long-term potential of Russia,” Markus Schäfer, a board member, said at the ceremony. The €250m ($296m) factory marked the first investment by a Western carmaker since America and the European Union slapped sanctions on Russia as punishment for its aggression in Ukraine three years ago.

After more than two years of recession, Russia is projected to return to growth this year. Until recently, the chill that sanctions put on the investment climate seemed to be thawing. “People had begun to forget about them,” says Chris Weafer of Macro-Advisory, a Moscow-based consultancy. But in late July America’s Congress voted to expand the sanctions. Vladimir Putin responded by demanding that America reduce its diplomatic staff in Russia by some 750 people. (Most of those affected are likely to be Russian employees.) He also shut down the American diplomatic dacha in Moscow’s Serebryany Bor forest—even the barbecues had to go.

The new offensive has revived arguments over whether sanctions work. Proponents say they helped stall Russia’s military intervention in Ukraine. Naysayers reckon they just let politicians look tough. The truth is more complicated. So far they have not changed Mr Putin’s behaviour abroad, and have helped him consolidate power at home. Yet in the long term they may undermine the stability of his rule.

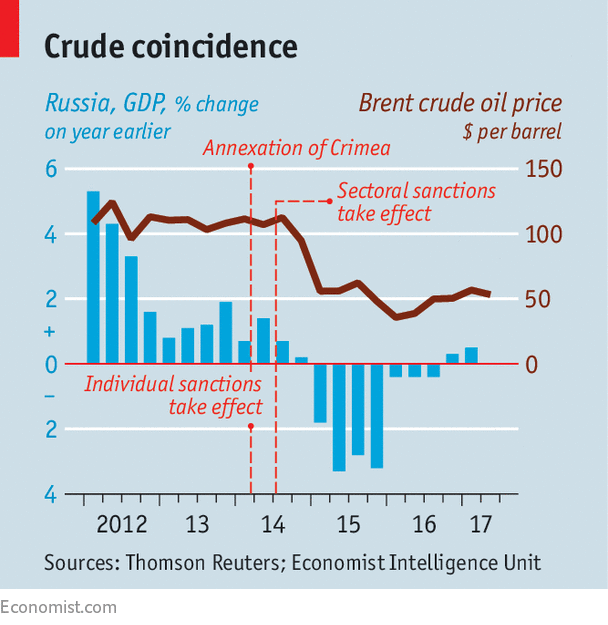

The first sanctions came in response to the takeover of Crimea in March 2014, and targeted individuals with travel bans and asset freezes. In July that year, as Russian-backed separatists rampaged in eastern Ukraine, “sectoral sanctions” followed, restricting credit to a host of Russian energy and defence firms and banks. The measures were calibrated to avoid rocking global markets and to win support from the European Union, which passed sanctions of its own. “The purpose was never to bring down the Russian economy,” says a former American official.

After the oil price collapsed in late 2014, Russia’s economy fell into crisis. Sanctions made things worse. A credit crunch led the government to dip into reserves to bail out banks and firms. Uncertainty made foreigners cautious about dealing with anyone in Russia, not just those on the lists. These “silent sanctions” chilled the business climate, says Natalia Orlova, chief economist at Alfa-Bank, Russia’s largest private bank. Foreign direct investment fell from $69bn in 2013 to just $6.8bn in 2015.

American officials seized upon this as proof that sanctions work. “Russia is isolated, with its economy in tatters,” President Barack Obama declared in January 2015. At the time Western leaders fretted that Russia might push deeper into Ukraine. Supporters of the sanctions argue that they helped prevent this, underpinning the signing of the Minsk peace agreements in February 2015.

Nonetheless, the sanctions have not altered Mr Putin’s strategy. Russia continues to support the separatist republics in Ukraine, and Crimea’s annexation has become a fait accompli. “The honest truth is that [sanctions] have yet to change their policies,” says Evelyn Farkas, the former Russia point person at the Pentagon. Russia went on to intervene in Syria and, in 2016, meddle in America’s elections.

At home, the government used the sanctions to blame the economic downturn on conniving foreigners. By cutting Mr Putin’s cronies off from global markets, sanctions “inadvertently made them more dependent on the Kremlin”, argues Andrew Weiss of the Carnegie Endowment, a think-tank. In 2015, according to the Russian version of Forbes, Arkady Rotenberg, Mr Putin’s judo buddy and a sanctioned construction magnate, received 555bn roubles’ worth of government orders. Sanctions became an object of public ridicule. A patriotic T-shirt captured the mood: a drawing of a nuclear missile captioned “The Topol is not afraid of sanctions.”

With time, business came to fear them less, too. In 2014 United States Treasury officials warned American companies off attending the St Petersburg International Economic Forum, Russia’s equivalent of Davos. By 2016 many CEOs had returned. Russia successfully placed a $1.25bn sovereign Eurobond in September 2016, with more than half bought by Americans. The United Nations reckons that 280 greenfield investment projects in Russia in 2016, below the ten-year peak of 596 announced in 2008, but an improvement over the nadir of 194 in 2014. IKEA, Leroy Merlin, Pfizer and Mars Inc all have plans for stores or factories.

The new sanctions may give foreign investors pause. That worries the Kremlin. As Mr Putin looks towards his fourth term (he is expected to win next year’s election), Russians are more concerned with their wallets than with Crimea. Growth this year is projected to be 2% or less. For the elite, the prospect of long-term stagnation and endless standoff with the West raises questions about the country’s direction. “The sense of an historic dead-end evokes panic,” writes Vladimir Frolov, a Russian analyst. Sanctions will not cause Mr Putin to reverse course, but they do make it harder for him to drive his way out.

This article appeared in the Europe section of the print edition under the headline "The punishment continues"