You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

RUSSIA/РОССИЯ THREAD—ASSANGE CHRGD W/ SPYING—DJT IMPEACHED TWICE-US TREASURY SANCTS KILIMNIK AS RUSSIAN AGNT

- Thread starter ☑︎#VoteDemocrat

- Start date

More options

Who Replied?I know exactly what Flynn was the Trump. I'm aware of things he can be charged for. What I said is I'm interested in what he is willing to give up with regard to the Trump campaign that is of value to Mueller and his investigation.You don't know what Flynn was to Trump, breh ?

Why is this confusing?

John Schindler in JANUARY:

Just seeing this on msnbcthese cats all linked to Russia

Well, well, well. Wilbur Ross, Vice Chairman at Bank of Cyprus when Manafort was stashing millions there.

"I think there is no doubt that when any foreign government tries to impact the integrity of our elections ... we need to take action. And we will — at a time and place of our own choosing. Some of it may be explicit and publicized; some of it may not be." - President Barack Hussein Obama, December 2016

Triipe

All Star

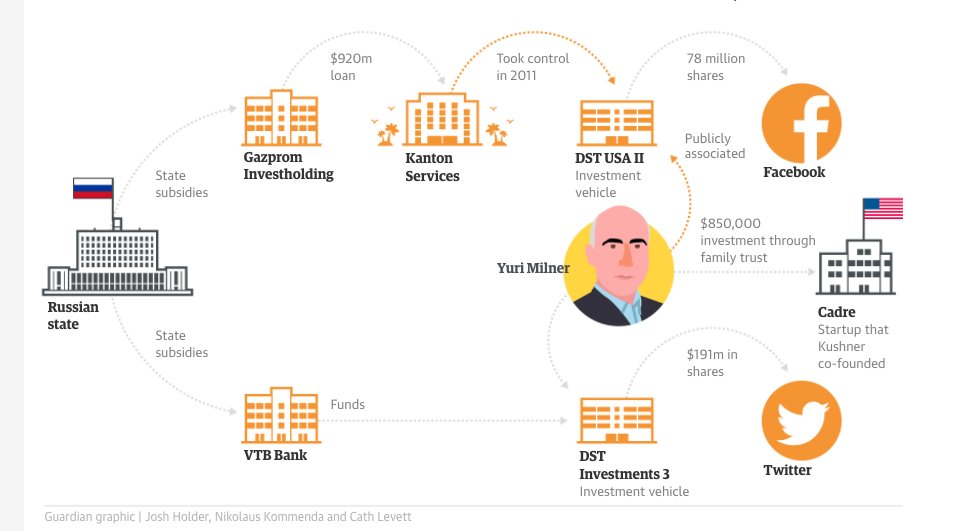

Russia’s role in exploiting Facebook and Twitter to influence the 2016 US election is an important strand of an FBI inquiry and congressional investigations. Facebook has identified 3,000 advertisements and 470 fake accounts on its network that were set up by a “troll factory” in St Petersburg. Details have been passed to Congress and to the special prosecutor, Robert Mueller, who is examining alleged collusion between the Trump campaign and Moscow.

VTB also has close ties to Putin’s FSB intelligence agency. The bank’s chairman, Andrey Kostin, is a former KGB foreign intelligence operative who has received several state decorations from Putin. Milner denied knowing about VTB’s ties to Russian intelligence. VTB funded 45 per cent of the Twitter stake.

In an email, Milner’s spokeswoman said: “Yuri Milner has never been an employee of the Russian government.” Milner said he not spoken to Medvedev nor any other Russian minister about social media, and that he and Zuckerberg had not discussed the controversy over Russian exploitation of social media. “Politics is something I’m very uninterested in,” Milner told the Guardian.

‘They operate in the shadows’

The Paradise Papers help to unravel complex arrangements that led Russian state money to fund investments in the US social media companies.

They involve a bewildering array of companies using similar names and acronyms, some registered offshore in places that offer secrecy about ownership. The arrangements are legal, but have led campaigners to demand more transparency.

The trail begins in December 2005, when Gazprom Investholding began putting money into Kanton Services, a company registered in the British Virgin Islands. Usmanov was at the time general director of Gazprom Investholding, which the Kremlin has used to renationalise assets sold off in the 1990s.

Gazprom in effect took control of Kanton in 2009 in return for $920m. In 2011, Kanton in turn took a majority stake in DST USA II, a vehicle publicly associated with Milner. By 2012, DST USA II had bought more than 50m shares in Facebook, according to filings at the US Securities and Exchange Commission, amounting to more than 3% of the social media company.

Over the following months, ownership of DST USA II was transferred to an Usmanov company, which sold off $1bn worth of the shares in Facebook at a significant profit after the social network floated on the stock market.

The ultimate owner of Kanton was not made clear, but the company has several ties to Usmanov. An executive who dealt with Kanton on another deal, who requested anonymity to discuss private details, said: “I was led to believe this was one of Usmanov’s investment companies.”

Milner said he knew who owned Kanton but declined to name them, citing a confidentiality agreement. He said he did not know where Usmanov and his other partners obtained funding. “I had no knowledge of him using state funds to invest with us – he had enough funds already from the holdings that he owned,” said Milner.

Jared Kushner. Photograph: Pablo Martinez Monsivais/AP

The company has already caused controversy for Kushner, after he initially failed to detail his stake in Cadre in financial disclosures to the US Office of Government Ethics. Kushner later added Cadre to revised paperwork, saying his stake in the firm was worth up to $25m.

Cadre initially said in a June press release that Milner’s stake in the company was held through his firm DST. A different version of the release on Cadre’s website said, however, that Milner himself was the investor in Cadre. The breakdown of the $50m funding was not made public by Cadre.

it's o.v.

I'm not concerned about Milner. His investments into U.S. tech companies are no secret. And it is no secret how every Russian billionaire acquired their wealth. So it should have been suspected ALL ALONG where the money was coming from. But if this is direct evidence Zuck went to Iowa for nothing.

Zuck went to Iowa for nothing.

Zuck went to Iowa for nothing.

Zuck went to Iowa for nothing.

Last edited: