The NBA’s new media landscape is likely to also auger more trouble for cable. The league has intentions of being on broadcast television more frequently in its next deal and less so on cable, according to a source with knowledge of the league’s thinking. That could reorient its relationships with Turner, which, unlike Disney with ABC, does not also own a broadcast channel. This past season, the NBA had 20 regular-season games on ABC, including its five Christmas Day games. That would be part of the league’s attempt to make itself more accessible to its viewers, especially as cord-cutting continues and the

sheer number of cable subscribers falls off.

That would mirror the approach the league is pushing toward with local broadcasts. With Diamond Sports filing for bankruptcy in March, impacting its RSN deals with 16 NBA teams, and the tumult with Warner Bros. Discovery’s RSNs this season,

cable television is increasingly an uncertain place for the NBA teams to air the majority of their games.

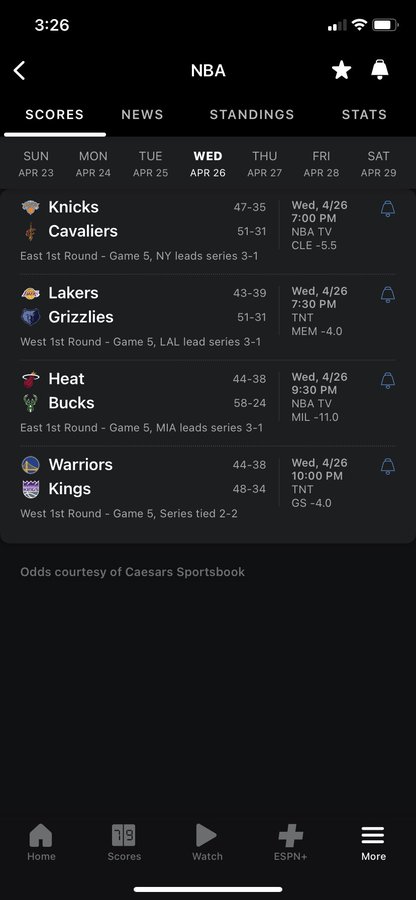

MSG Networks, which airs the

Knicks, and YES Network, which airs the

Nets, have already announced direct-to-consumer offerings where fans can buy monthly or annual subscriptions. The

Clippers launched ClipperVision this season so fans could watch Clippers games outside of just the Bally Sports channel in their market.

The Suns announced last week

they would move their games off Bally Sportsnext season to a combination of local free television and a direct-to-consumer streaming option with the intent to maximize the potential universe of viewers. A Jazz executive told

The Athletic the team

intends to move to a hybrid broadcast model next season.

“When I came into the league in the ’90s, there was a lot more local broadcast exposure, and now what we’re seeing is a lot of those broadcast stations in our teams’ local markets are coming back to the table and expressing interest in once again broadcasting our games,” Silver said recently. “That’s terrific news because obviously (we have) broad reach in those markets too if you’re on over-the-air television.”

The league has already started making preparations for this shift. It sought a new CBA now, instead of leaving the current agreement in place for the 2023-24 season, in part because it wanted to make changes in its media ecosystem and adjust to how the landscape has changed since the last CBA was signed in 2017.

And the newest CBA will try to deal with this issue. According to sources briefed on details of the negotiations, it includes language detailing how the cost of new direct-to-consumer products will be shared by the league and its players’ union.

Such moves could hit each franchise differently. The value of local broadcast rights is not equal across the board. One NBA team president told

The Athleticthe rights fees for the largest markets could be five to six times more lucrative than for teams in the smallest markets.

Most media experts agree that a shift away from the cable bundle and RSNs also would come with a decrease in revenue from local media rights, a trade-off that teams may need or want to make to prioritize access to its games for fans.

“There’s no doubt that, politely, we need to reimagine these relationships,” Silver said last month at the

SBJ World Congress of Sports conference.

The NBA also has considered a nationwide local streaming service, according to sources. It has already approached franchises about help with their DTC platforms. The economics of such a service would have to be figured out, not only in the differences of how teams are paid out but also whether fans in different local markets would be charged.

After putting together a 100-person digital team for its NBA app and creating alternate feeds, there are plans to invest in an R&D group as well. There has been consideration about using the NBA app as a universal home for games, where viewers could find the games there and then be redirected to whichever TV partners are broadcasting them with the NBA paying out the rights holders.

Along with the ultimate destination for the games, there is plenty of speculation about how much revenue the next media rights deals could bring to the NBA. These have been boom times in recent years for live sports rights. Two years ago, the NFL sold its rights for

more than $100 billion over 11 years, not including its Sunday Ticket —

almost doubling its national TV revenue. The Big Ten Conference will get

more than $8 billion over seven years. The NHL was able to

more than double its annual rights fees in its 2021 deals with ESPN and Turner Sports.

However, Disney and Warner Bros. Discovery leaders have been circumspect this year about their spending plans.

“We’ve locked in a number of deals already, including some of the biggest ones, which is in college football with the SEC as well as with the NFL. The one that’s looming is the NBA,” Disney CEO Bob Iger said during an earnings call in February. “I know that’s on people’s minds, which is a product that we’ve enjoyed having and hope to continue to enjoy having. Because of not only its volume but its quality.