The nation's first African-American president was a disaster for black wealth.

Angela Walker (3rd-L) and her daughter Nazarin (2nd-L) listen to local officials speaking on home foreclosures at their home in Suitland, MD in 2010. Walker was being threatened with foreclosure and had sought help from Rev. Jesse Jackson's Rainbow PUSH Coalition.

The following essay is adapted from “Foreclosed: Destruction of Black Wealth During the Obama Presidency,” a report out today from our friends at the People’s Policy Project.

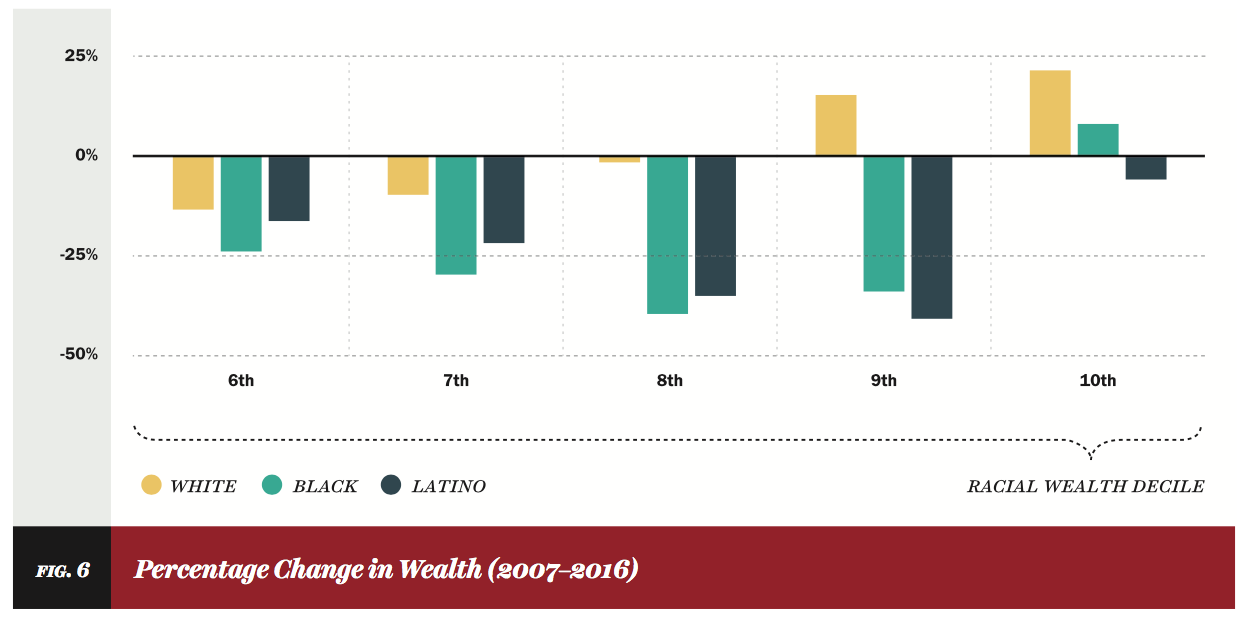

The Obama presidency was a disaster for middle-class wealth in the United States. Between 2007 and 2016, the average wealth of the bottom 99 percent dropped by $4,500. Over the same period, the average wealth of the top 1 percent rose by $4.9 million.

This drop hit the housing wealth of African Americans particularly hard. Outside of home equity, black wealth recovered its 2007 level by 2016. But average black home equity was still $16,700 lower.

Much of this decline, we will argue, can be laid at the feet of President Obama. His housing policies led directly to millions of families losing their homes. What’s more, Obama had the power — money, legislative tools, and legal leverage — to sharply ameliorate the foreclosure crisis.

He chose not to use it.

A Program Designed to Fail

After the 2008 collapse, the Wall Street banks that caused the crisis got spectacular sums in the form of the Trouble Asset Relief Package (TARP) and discount loans from the Federal Reserve. According to one estimate, they received a staggering $29 trillion in cash and loans.

For homeowners, the largest source of potential relief was, ironically, that same bank bailout, which contained an unspecified appropriation to “prevent avoidable foreclosures.” The Obama administration designed and implemented the foreclosure relief effort, calling it the Home Affordable Mortgage Program (HAMP), and set aside $75 billion for the effort.

But HAMP proved to be an abject failure. The basic problem was that the government paid mortgage servicers (who process the payments and paperwork for the mortgage owner) to conduct mortgage modifications. Servicers have an incentive to keep people paying on a high principal, since they receive a percentage of the outstanding debt. They even have an incentive to foreclose, because they are paid from the proceeds of a foreclosure sale before the actual owners.

Lax oversight from both the Treasury Department and the Department of Justice made things worse. Some servicers tricked people into foreclosure, according to several investigations and sworn testimony from Bank of America whistleblowers. And by repeatedly “losing” people’s paperwork or engaging in other tricks, the servicer squeezed out a final few payments and fees before foreclosing.

This kind of chicanery was illegal, and also violated the administration’s rules. But they didn’t bother to seriously investigate servicer abuses. The Treasury Department didn’t even permanently claw back a single one of its payments to abusive servicers.

Why not? Neil Barofsky, the bailout inspector general, later testified that protecting the banks was the actual goal. The administration’s aim was to “foam the runway” for the banks, as Barofsky witnessed Tim Geithner tell Elizabeth Warren. HAMP failed, in other words, because it was not designed to help homeowners.

As a result, in many cases HAMP actively enabled foreclosure. Its re-default rate — the fraction of people who got a modification and later defaulted out of the program — was 22 percent as of 2013. Only about $15 billion of the original $75 billion appropriation was spent by mid-2016.

Out of an initial promised 4 million mortgage modifications — itself a drastic underestimate — by the end of 2016 only 2.7 million had even been started. Out of that number, only 1.7 million made it to permanent modification, and of those, 558,000 eventually washed out of the program.

Letting off the Crooks

An epic crime spree after the crisis offered another opportunity to assist beleaguered homeowners.

During the bubble years, originators and banks had routinely mangled the paperwork while issuing loans and packaging them into securities. When they went to foreclose, they often found they did not have the correct documentation. But rather than acknowledging their indiscretions, financial institutions paid large teams of entry-level employees to commit document fraud on an industrial scale — forging signatures, falsely notarizing documents, or falsely attesting to “personal knowledge” of large mortgage files, hundreds of times per day. This was the so-called “robosigning” scandal.

These document problems eventually came to the attention of law enforcement. Forty-nine state attorneys general, the District of Columbia, and the Department of Justice banded together in a lawsuit, which resulted in a $26 billion joint settlement between them and the five largest servicers.

However, largely due to foot-dragging at the Department of Justice, the settlement ended up being toothless. Much of the cash went to “short sales” (simply selling an underwater home) instead of principal reductions, or to other weak relief. Servicers even received roughly $12 billion in credit for waiving outstanding debts from short sales in states where such a waiver is already legally mandatory. JPMorgan Chase allegedly claimed credit for forgiving loans that it had already sold.

Unsurprisingly, bending over backwards for the banks failed to stop the wave of foreclosures sweeping the nation. All told, some 9.3 million homeownerslost their homes. It was the greatest destruction of middle-class wealth since the Great Depression at least.

Angela Walker (3rd-L) and her daughter Nazarin (2nd-L) listen to local officials speaking on home foreclosures at their home in Suitland, MD in 2010. Walker was being threatened with foreclosure and had sought help from Rev. Jesse Jackson's Rainbow PUSH Coalition.

The following essay is adapted from “Foreclosed: Destruction of Black Wealth During the Obama Presidency,” a report out today from our friends at the People’s Policy Project.

The Obama presidency was a disaster for middle-class wealth in the United States. Between 2007 and 2016, the average wealth of the bottom 99 percent dropped by $4,500. Over the same period, the average wealth of the top 1 percent rose by $4.9 million.

This drop hit the housing wealth of African Americans particularly hard. Outside of home equity, black wealth recovered its 2007 level by 2016. But average black home equity was still $16,700 lower.

Much of this decline, we will argue, can be laid at the feet of President Obama. His housing policies led directly to millions of families losing their homes. What’s more, Obama had the power — money, legislative tools, and legal leverage — to sharply ameliorate the foreclosure crisis.

He chose not to use it.

A Program Designed to Fail

After the 2008 collapse, the Wall Street banks that caused the crisis got spectacular sums in the form of the Trouble Asset Relief Package (TARP) and discount loans from the Federal Reserve. According to one estimate, they received a staggering $29 trillion in cash and loans.

For homeowners, the largest source of potential relief was, ironically, that same bank bailout, which contained an unspecified appropriation to “prevent avoidable foreclosures.” The Obama administration designed and implemented the foreclosure relief effort, calling it the Home Affordable Mortgage Program (HAMP), and set aside $75 billion for the effort.

But HAMP proved to be an abject failure. The basic problem was that the government paid mortgage servicers (who process the payments and paperwork for the mortgage owner) to conduct mortgage modifications. Servicers have an incentive to keep people paying on a high principal, since they receive a percentage of the outstanding debt. They even have an incentive to foreclose, because they are paid from the proceeds of a foreclosure sale before the actual owners.

Lax oversight from both the Treasury Department and the Department of Justice made things worse. Some servicers tricked people into foreclosure, according to several investigations and sworn testimony from Bank of America whistleblowers. And by repeatedly “losing” people’s paperwork or engaging in other tricks, the servicer squeezed out a final few payments and fees before foreclosing.

This kind of chicanery was illegal, and also violated the administration’s rules. But they didn’t bother to seriously investigate servicer abuses. The Treasury Department didn’t even permanently claw back a single one of its payments to abusive servicers.

Why not? Neil Barofsky, the bailout inspector general, later testified that protecting the banks was the actual goal. The administration’s aim was to “foam the runway” for the banks, as Barofsky witnessed Tim Geithner tell Elizabeth Warren. HAMP failed, in other words, because it was not designed to help homeowners.

As a result, in many cases HAMP actively enabled foreclosure. Its re-default rate — the fraction of people who got a modification and later defaulted out of the program — was 22 percent as of 2013. Only about $15 billion of the original $75 billion appropriation was spent by mid-2016.

Out of an initial promised 4 million mortgage modifications — itself a drastic underestimate — by the end of 2016 only 2.7 million had even been started. Out of that number, only 1.7 million made it to permanent modification, and of those, 558,000 eventually washed out of the program.

Letting off the Crooks

An epic crime spree after the crisis offered another opportunity to assist beleaguered homeowners.

During the bubble years, originators and banks had routinely mangled the paperwork while issuing loans and packaging them into securities. When they went to foreclose, they often found they did not have the correct documentation. But rather than acknowledging their indiscretions, financial institutions paid large teams of entry-level employees to commit document fraud on an industrial scale — forging signatures, falsely notarizing documents, or falsely attesting to “personal knowledge” of large mortgage files, hundreds of times per day. This was the so-called “robosigning” scandal.

These document problems eventually came to the attention of law enforcement. Forty-nine state attorneys general, the District of Columbia, and the Department of Justice banded together in a lawsuit, which resulted in a $26 billion joint settlement between them and the five largest servicers.

However, largely due to foot-dragging at the Department of Justice, the settlement ended up being toothless. Much of the cash went to “short sales” (simply selling an underwater home) instead of principal reductions, or to other weak relief. Servicers even received roughly $12 billion in credit for waiving outstanding debts from short sales in states where such a waiver is already legally mandatory. JPMorgan Chase allegedly claimed credit for forgiving loans that it had already sold.

Unsurprisingly, bending over backwards for the banks failed to stop the wave of foreclosures sweeping the nation. All told, some 9.3 million homeownerslost their homes. It was the greatest destruction of middle-class wealth since the Great Depression at least.