You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

General Elon Musk Fukkery Thread

- Thread starter Armchair Militant

- Start date

More options

Who Replied?{WSJ article without paywall}

Last edited:

Last edited:

{WSJ article without paywall}

Is this a Twitter bypass where they can’t delete your tweets or account?

more of a twitter alternative...Is this a Twitter bypass where they can’t delete your tweets or account?

GitHub - nostr-protocol/nostr: a truly censorship-resistant alternative to Twitter that has a chance of working

a truly censorship-resistant alternative to Twitter that has a chance of working - nostr-protocol/nostr

The simplest open protocol that is able to create a censorship-resistant global "social" network once and for all.

It doesn't rely on any trusted central server, hence it is resilient; it is based on cryptographic keys and signatures, so it is tamperproof; it does not rely on P2P techniques, and therefore it works.

This is a work in progress. Join the Telegram group!

Very short summary of how it works, if you don't plan to read anything else:

Everybody runs a client. It can be a native client, a web client, etc. To publish something, you write a post, sign it with your key and send it to multiple relays (servers hosted by someone else, or yourself). To get updates from other people, you ask multiple relays if they know anything about these other people. Anyone can run a relay. A relay is very simple and dumb. It does nothing besides accepting posts from some people and forwarding to others. Relays don't have to be trusted. Signatures are verified on the client side.This is needed because other solutions are broken:

The problem with Twitter

- Twitter has ads;

- Twitter uses bizarre techniques to keep you addicted;

- Twitter doesn't show an actual historical feed from people you follow;

- Twitter bans people;

- Twitter shadowbans people;

- Twitter has a lot of spam.

The problem with Mastodon and similar programs

- User identities are attached to domain names controlled by third-parties;

- Server owners can ban you, just like Twitter; Server owners can also block other servers;

- Migration between servers is an afterthought and can only be accomplished if servers cooperate. It doesn't work in an adversarial environment (all followers are lost);

- There are no clear incentives to run servers, therefore, they tend to be run by enthusiasts and people who want to have their name attached to a cool domain. Then, users are subject to the despotism of a single person, which is often worse than that of a big company like Twitter, and they can't migrate out;

- Since servers tend to be run amateurishly, they are often abandoned after a while — which is effectively the same as banning everybody;

- It doesn't make sense to have a ton of servers if updates from every server will have to be painfully pushed (and saved!) to a ton of other servers. This point is exacerbated by the fact that servers tend to exist in huge numbers, therefore more data has to be passed to more places more often;

- For the specific example of video sharing, ActivityPub enthusiasts realized it would be completely impossible to transmit video from server to server the way text notes are, so they decided to keep the video hosted only from the single instance where it was posted to, which is similar to the Nostr approach.

The problem with SSB (Secure Scuttlebutt)

- It doesn't have many problems. I think it's great. I was going to use it as a basis for this, but

- its protocol is too complicated because it wasn't thought about being an open protocol at all. It was just written in JavaScript in probably a quick way to solve a specific problem and grew from that, therefore it has weird and unnecessary quirks like signing a JSON string which must strictly follow the rules of ECMA-262 6th Edition;

- It insists on having a chain of updates from a single user, which feels unnecessary to me and something that adds bloat and rigidity to the thing — each server/user needs to store all the chain of posts to be sure the new one is valid. Why? (Maybe they have a good reason);

- It is not as simple as Nostr, as it was primarily made for P2P syncing, with "pubs" being an afterthought;

- Still, it may be worth considering using SSB instead of this custom protocol and just adapting it to the client-relay server model, because reusing a standard is always better than trying to get people in a new one.

The problem with other solutions that require everybody to run their own server

- They require everybody to run their own server;

- Sometimes people can still be censored in these because domain names can be censored.

How does Nostr work?

- There are two components: clients and relays. Each user runs a client. Anyone can run a relay.

- Every user is identified by a public key. Every post is signed. Every client validates these signatures.

- Clients fetch data from relays of their choice and publish data to other relays of their choice. A relay doesn't talk to another relay, only directly to users.

- For example, to "follow" someone a user just instructs their client to query the relays it knows for posts from that public key.

- On startup, a client queries data from all relays it knows for all users it follows (for example, all updates from the last day), then displays that data to the user chronologically.

- A "post" can contain any kind of structured data, but the most used ones are going to find their way into the standard so all clients and relays can handle them seamlessly.

[/U]

More than half of Twitter’s top 1,000 advertisers stopped spending on platform, data show

Story by Clare Duffy, CNN Graphics by Christopher Hickey, CNN

Updated 1:06 PM EST, Fri February 10, 2023

New YorkCNN —

More than half of Twitter’s top 1,000 advertisers in September were no longer spending on the platform in the first weeks of January, according to data provided to CNN by digital marketing analysis firm Pathmatics, in a striking sign of how far reaching the advertiser exodus has been following Elon Musk’s acquisition of the company.

Some 625 of the top 1,000 Twitter advertisers, including major brands such as Coca-Cola, Unilever, Jeep, Wells Fargo and Merck, had pulled their ad dollars as of January, according to estimates from Pathmatics, based on data running through January 25.

Wells Fargo said it “paused our paid advertising on Twitter” but continues to use it as a social channel to engage with customers. The other brands did not immediately respond to a request for comment.

As a result of the pullback, monthly revenue from Twitter’s top 1,000 advertisers plummeted by more than 60% from October through January 25, from around $127 million to just over $48 million, according to the data.

The data demonstrate the sharp decline of what was once a $4.5 billion advertising business for Twitter. After Musk completed his takeover of the company in late October, advertisers began to worry about the safety and stability of the platform given his plans to cut staff and relax content moderation policies. In early November, Musk said Twitter had seen a “massive revenue drop.”

Although Twitter’s ad business was always much smaller than that of competitors Facebook and Google, it was still responsible for the vast majority of the company’s revenue. Musk must now fill in that gap as he stares down interest payments for the debt he took on to buy Twitter for $44 billion.

Twitter, which eliminated much of its media relations team during last year’s layoffs, did not immediately respond to a request for comment.

After initially clashing with advertisers, Musk now appears to be trying to woo them back to the platform. The company reportedly offered a Super Bowl “fire sale” deal for advertisers in an attempt to win them back for one of Twitter’s biggest audience days of the year. Twitter has also partnered with a third-party “brand safety” firm that says it can show advertisers if their ads appear alongside inappropriate or unsafe content on Twitter.

But the pushback continues. A coalition of civil society and civil rights groups renewed calls on Thursday for companies to join what they say is more than 500 advertisers who have stopped advertising on Twitter. The latest effort came after a research report from the Center for Countering Digital Hate, a member of the coalition, raised concerns about ads “appearing next to toxic content” from previously banned accounts.

In his first months in charge, Musk rolled back bans on users who had previously violated Twitter’s rules, including former President Donald Trump. He also dissolved a third-party content oversight group and halted enforcement of its Covid-19 misinformation policy.

Some advertisers also complained that the Twitter employees they previously worked with had been terminated by Musk, causing confusion. In November, Musk complained that Twitter had seen a “massive drop in revenue.”

But Musk has stood by those policy changes, and has since been scrambling to reduce costs and find new revenue streams for the company. Those efforts include dramatically cutting staff, revamping its paid subscription service and, more recently, announcing the controversial move to charge researchers and developers reliant on Twitter’s API, which allows third parties to tap into Twitter’s systems.

For now, however, Twitter remains reliant on advertising revenue as it reportedly struggles to grow its paid subscriber base.

Even among the top advertisers that remain, many have dramatically reduced their ad spending on the platform, according to Pathmatics data. HBO, for example, was Twitter’s top advertiser in September, spending nearly $12 million on ads that month, but for the month of January (as of January 25), it spent just over $54,000. (HBO, which is owned by CNN parent company Warner Bros. Discovery, did not immediately respond to a request for comment.)

A small number of Twitter’s top advertisers spent more on the platform in January than they did the month prior to Musk’s takeover, including ESPN, Salesforce and Apple, the latter of which Musk briefly and publicly feuded with for allegedly threatening to block Twitter from its app store. ESPN, Salesforce and Apple did not immediately respond to a request for comment.

Musk said in a tweet earlier this month that the previous three months had been “extremely tough, as had to save Twitter from bankruptcy,” but that the company “is now trending to breakeven if we keep at it.”

The cost of owning cost The Liberals.

ADevilYouKhow

Rhyme Reason

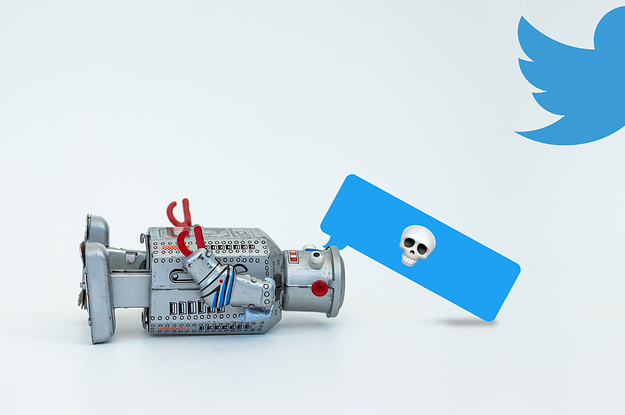

It may be lights out for some of NYC’s best Twitter bots

Automated Twitter accounts could shut down as the social media company ends free access to its backend platform, known as its application programming interface.

Super Bowl ad slams Tesla's 'Full Self-Driving' tech

Electric carmaker Tesla will face a hit on Super Bowl Sunday, when an ad will play showing the alleged dangers of its Full Self-Driving technology.

This will hurt