OfTheCross

Veteran

Seems like they're speaking out of both sides of their mouth...maybe some one more knowledgeable can break it down..

Do Corporate Profits Increase When Inflation Increases? - Liberty Street Economics

When inflation is high, companies may raise prices to keep up. However, market watchers and journalists have wondered if corporations have taken advantage of high inflation to increase corporate profits. We look at this question through the lens of public companies, finding that in general...

libertystreeteconomics.newyorkfed.org

Gross Profits Increased More for Industries with More Inflation

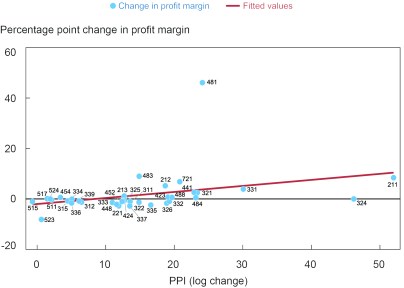

The chart below plots the change in gross margin and inflation for the first quarter of 2022 compared to the first quarter of 2021. The slope is 0.24, suggesting that on average for every one percent increase in prices, corporate gross margins increased by 24 basis points.Change in Gross Profit Margin and PPI

Some of the industries with the greatest changes in profit margins include oil and gas, and industries such as air transportation which are heavily affected by COVID-related changes in demand. To assuage concerns that these industries are distorting the observed pattern, we drop them from the graph and find that the upward slope remains. It appears that industries with higher inflation are indeed earning higher profits.

Inflation May Not Be That Great for Corporate Profits

The relationship between changes in corporate profits and inflation is positive even when inflation is unusually high. This only means that those industries with higher inflation are able to increase profits more than industries with lower inflation, not that profits are increasing. Looking back to the initial graph of the changes in profits in 2022, the change in gross profits in most industries (22 of 36) is negative. Profits are falling overall, and it’s just that companies in higher inflation industries have profits that are falling less quickly. In addition, gross margin misses many key components of profit, most notably sales, general and administrative costs (SG&A). To the extent that these other costs are changing, the overall net profitability of companies may also be changing. Finally, changes in gross margin are negatively serially correlated, meaning that decreases in profits are often followed by increases in profits. This means that profit increases may not be followed by more profit increases.