shyt crazy tho cause she's dean of the school of business ..yet business was the furthest thing from this dealSo she kept her real job as the dean of the college.

She probably had dirt on everybody so if she got all the way ousted she’d have sued.

Pathetic.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FAMU ‘pauses’ $237M donation amid scrutiny; School to audit major gift process

- Thread starter North of Death

- Start date

More options

Who Replied?

How Florida A&M University Got Scammed in a Likely $237 Million Tax Fraud Scheme

Florida A&M University got scammed in a likely $237 million tax fraud scheme, which the university negligently aided and abetted.

www.donaldwatkins.com

www.donaldwatkins.com

FAMU President Larry Robinson signed the Agreement for the FAMU Foundation (for the benefit of FAMU). Gregory Gerami signed the Agreement for the “Gregory Gerami Family Foundation,” which is not a named party to the Agreement. It appears that nobody signed the Agreement for The Isaac Batterson Family 7th Trust, even though the Agreement says Gerami represents the Trust.

The entire transaction is likely a tax fraud scam (in progress) that works as follows:

1. The scammer targets a financially unsophisticated university that unwittingly aids and abets his/her tax fraud scam.

2. The scammer makes a donation of millions of shares of stock in a private company to the targeted university.

3. The university is required to provide the donor with a completed IRS Form 8283 for “Noncash Charitable Contributions” that acknowledges its receipt of the "gift" and complies with the applicable instructions for this tax form.

4. Section B of the Form 8283 requires the donor to provide detailed information on the donated property, including: (a) the date it was acquired by the donor, (b) how it was acquired by the donor, (c) the donor’s cost or adjusted basis in the property conveyed, (d) the amount claimed for this charitable deduction, and (e) other relevant information.

5. The scammer is required to get a qualified and capable appraiser to sign the "Declaration of Appraiser" section of the Form 8283. This declaration states as follows:

"I understand that a false or fraudulent overstatement of the property value as described in the qualified appraisal . . . . may subject me to the penalty under section 6701(a) (aiding and abetting the understatement of tax liability) . . . .".

6. Once the "Declaration of Appraisal" has been signed, the university must formally acknowledge and attest to its receipt of the noncash charitable contribution.

It is not known whether The Isaac Batterson Family 7th Trust, Gregory Gerami, and FAMU completed an IRS Form 8283 for this $237 million "gift" or whether FAMU even submitted a completed and properly signed Form to the Trust. Likewise, it is not known who, if anyone, appraised the fair market value of the "gifted" stock in Batterson Farms at $237 million for the purpose of completing the required Form 8283.

FAMU rescinded $15M Blueprint request for Bragg Stadium after now-paused $237M donation

Two days after FAMU announced a $237 million donation, the university said it was no longer interested in $15 million in additional Blueprint funding for Bragg Stadium.

Turned down a real 15 million for a fake 257 million...Clown shyt

From what some from FAMU are saying she recognized the whole thing might be some bs a few weeks before the announcement was made and warned the President but the President was insistent on going forward with it.So she kept her real job as the dean of the college.

She probably had dirt on everybody so if she got all the way ousted she’d have sued.

Pathetic.

Not surprised my alma mater got scammed

I believe it .....Robinson a herbFrom what some from FAMU are saying she recognized the whole thing might be some bs a few weeks before the announcement was made and warned the President but the President was insistent on going forward with it.

YeahI believe it .....Robinson a herb

valet

The official Chaplain of the Coli

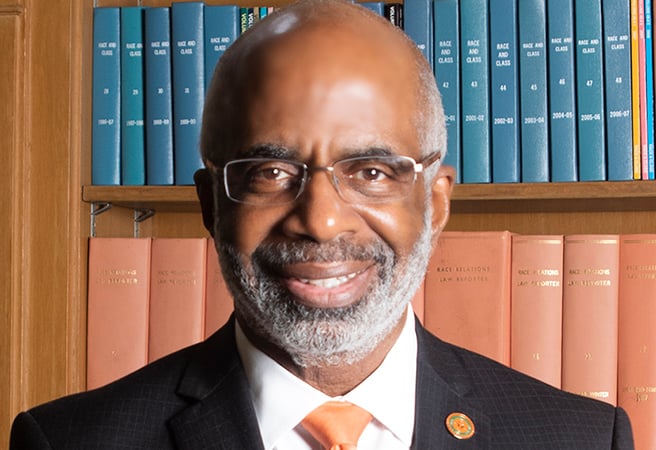

FAMU President Larry Robinson Announces He’s Stepping Down Two Months After Donation Scandal

Two months after the shocking donation scandal, FAMU president Larry Robinson has announced he is stepping down.

balleralert.com

balleralert.com

daboywonder2002

Superstar

Yo this story is crazy. But if Beard is just an interim president how can he ask for resignations? Why would u still hire someone from the inside?