Fantasia downgraded to ‘default’ as China’s property crisis worsens

Fantasia downgraded to default status by rating agencies as Chinese property sector crisis worsens

Chad Bray

Published: 12:30pm, 6 Oct, 2021

Fantasia Holdings Group chairman Pan Jun photographed at the Four Seasons Hotel in Central in 2016. Photo: Nora Tam

Fantasia Holdings Group, the debt-laden property developer founded by the niece of a former Chinese vice-president, has been downgraded to default or near default status by the three major credit rating agencies after it missed a bond repayment this week.

The default by Fantasia adds to growing concerns about the Chinese property sector as China Evergrande Group, the world’s most indebted property developer, teeters towards default.

Fitch Ratings, S&P Global Ratings and Moody’s Investors Services all cut their ratings for Fantasia late on Tuesday to indicate the company was “likely in or very near default” after the Shenzhen-based developer failed to repay US$205.7 million in remaining principal it owed on a US$500 million senior note it took out in September 2016. There was no grace period for the principal repayment.

“The non-payment of Fantasia’s October 2021 US dollar bond triggered events of default on the company’s other US dollar notes, which will become immediately due and payable if the bond trustee or holders of at least 25 per cent in aggregate principal amount of the offshore notes declare so,” Fitch analysts Samuel Hui and Edwin Fan said in a press release on Wednesday.

02:28

Angry protest at headquarters of China Evergrande as property giant faces liquidity crunch

Angry protest at headquarters of China Evergrande as property giant faces liquidity crunch

Fitch cut Fantasia’s long-term foreign-currency issuer default rating to “restricted default” status, indicating it has probably defaulted, but not yet entered bankruptcy or ceased operations.

The Hong Kong-listed property management arm of developer Country Garden separately said on Tuesday that a Fantasia-controlled unit also failed to repay the principal amount on a 700 million yuan (US$108 million bond) on Monday.

“The downgrade also reflects the inconsistent information that Fantasia had provided to the market on its exposure of privately placed bonds and raises concerns [about] the company’s disclosure and governance practices,” said Celine Yang, a Moody‘s senior analyst.

Moody’s cut Fantasia’s corporate family rating to “Ca”, indicating its debt was “highly speculative and are likely in, or very near, default”.

Fantasia’s stock has been suspended in Hong Kong since September 29 and remained suspended on Wednesday. The company’s shares have lost a third of their value since July 22, last trading at 56 Hong Kong cents a share.

Fantasia Holdings Group, the Shenzhen-based property developer founded by Zeng Jie, the former vice-president Zeng Qinghong’s niece, failed to repay US$205 million of corporate bond due on Monday. Photo: Weibo

“The board and the management of the company will assess the potential impact on the financial condition and cash position of the group under the circumstances,” Fantasia said in a regulatory announcement after it missed the US$205 million repayment on Monday. “The company will continue to closely monitor the development of this matter and will make further announcements if the company is aware of any further development in this regard.”

The missed payment came two weeks after the developer said it had no liquidity issues and had “already prepared the funds” to redeem its bonds due this month. It had obtained HK$1.1 billion (US$142 million) of financing from Chiyu Bank in June, it said at the time.

“Fantasia’s missed payment highlights its strained liquidity, despite its reported sufficient cash on hand,” S&P said in its rating action.

As of June 30, Fantasia said it had 27.1 billion yuan of unrestricted cash on its balance sheet, including 10 billion yuan at the holding company level, according to S&P.

“But as funding conditions worsened, it’s likely that the cash was utilised for other repayments or was not accessible,” S&P said. “At the same time, asset disposals have been slower than we expected, failing to bring in liquidity sources in time.”

S&P cut Fantasia’s long-term issuer credit rating to ‘“selective default”, indicating a company has defaulted on one or more financial obligations.

Fantasia has US$1.9 billion of offshore bonds and 6.4 billion yuan of onshore bonds that are either maturing this year or next year, or subject to risks that bondholders would exercise their right to demand early repayment, Fitch said in an earlier report.

The cash crunch at Fantasia and other developers comes after Beijing adopted new rules last year designed to tamp down speculative property price bubbles. The “three red lines” requirements adopted by the People’s Bank of China in August of last year limited the ability of developers to borrow, making it hard for them to cover short-term cash needs between the time flats are built and sold.

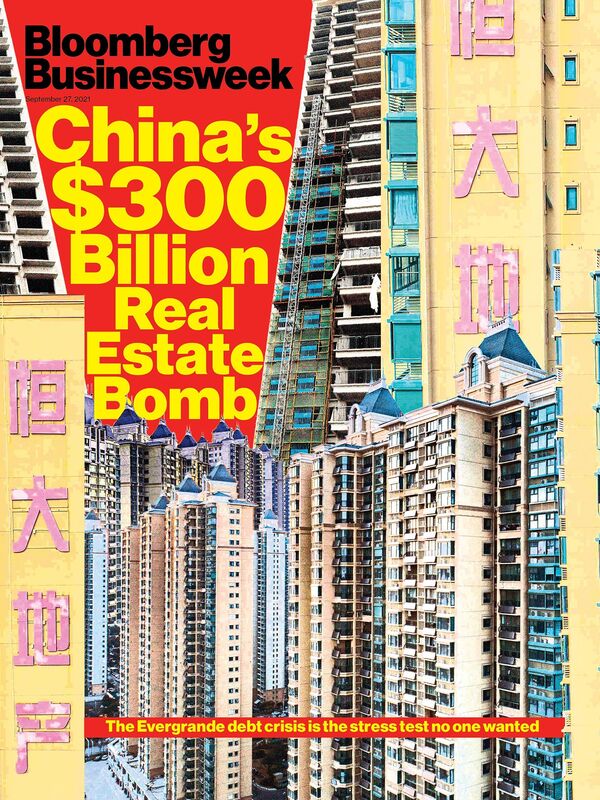

Concerns about Evergrande, China’s biggest home builder by sales, have particularly unnerved the markets in recent weeks as it appears to have missed at least two interest payment deadlines for its offshore debt and faces a staggering US$305 billion in total liabilities

Fantasia was founded in 1996 by Zeng Jie, the niece of former vice-president Zeng Qinghong.

The company reported a profit of 302.9 million yuan in the first half of this year, a 9.5 per cent increase over the prior-year period. As of June 30, it had current liabilities – those that have to be repaid within a year – of nearly 50 billion yuan, including 8.5 billion yuan in borrowings due within a year and nearly 11 billion yuan in senior notes and bonds due within a year.

Fantasia downgraded to default status by rating agencies as Chinese property sector crisis worsens

- Missed debt payment by Fantasia this week adds to China property sector concerns spawned by Evergrande’s liquidity crisis

- S&P, Fitch and Moody’s all cut Fantasia to default or near default status

Chad Bray

Published: 12:30pm, 6 Oct, 2021

Fantasia Holdings Group chairman Pan Jun photographed at the Four Seasons Hotel in Central in 2016. Photo: Nora Tam

Fantasia Holdings Group, the debt-laden property developer founded by the niece of a former Chinese vice-president, has been downgraded to default or near default status by the three major credit rating agencies after it missed a bond repayment this week.

The default by Fantasia adds to growing concerns about the Chinese property sector as China Evergrande Group, the world’s most indebted property developer, teeters towards default.

Fitch Ratings, S&P Global Ratings and Moody’s Investors Services all cut their ratings for Fantasia late on Tuesday to indicate the company was “likely in or very near default” after the Shenzhen-based developer failed to repay US$205.7 million in remaining principal it owed on a US$500 million senior note it took out in September 2016. There was no grace period for the principal repayment.

“The non-payment of Fantasia’s October 2021 US dollar bond triggered events of default on the company’s other US dollar notes, which will become immediately due and payable if the bond trustee or holders of at least 25 per cent in aggregate principal amount of the offshore notes declare so,” Fitch analysts Samuel Hui and Edwin Fan said in a press release on Wednesday.

02:28

Angry protest at headquarters of China Evergrande as property giant faces liquidity crunch

Angry protest at headquarters of China Evergrande as property giant faces liquidity crunch

Fitch cut Fantasia’s long-term foreign-currency issuer default rating to “restricted default” status, indicating it has probably defaulted, but not yet entered bankruptcy or ceased operations.

The Hong Kong-listed property management arm of developer Country Garden separately said on Tuesday that a Fantasia-controlled unit also failed to repay the principal amount on a 700 million yuan (US$108 million bond) on Monday.

“The downgrade also reflects the inconsistent information that Fantasia had provided to the market on its exposure of privately placed bonds and raises concerns [about] the company’s disclosure and governance practices,” said Celine Yang, a Moody‘s senior analyst.

Moody’s cut Fantasia’s corporate family rating to “Ca”, indicating its debt was “highly speculative and are likely in, or very near, default”.

Fantasia’s stock has been suspended in Hong Kong since September 29 and remained suspended on Wednesday. The company’s shares have lost a third of their value since July 22, last trading at 56 Hong Kong cents a share.

Fantasia Holdings Group, the Shenzhen-based property developer founded by Zeng Jie, the former vice-president Zeng Qinghong’s niece, failed to repay US$205 million of corporate bond due on Monday. Photo: Weibo

“The board and the management of the company will assess the potential impact on the financial condition and cash position of the group under the circumstances,” Fantasia said in a regulatory announcement after it missed the US$205 million repayment on Monday. “The company will continue to closely monitor the development of this matter and will make further announcements if the company is aware of any further development in this regard.”

The missed payment came two weeks after the developer said it had no liquidity issues and had “already prepared the funds” to redeem its bonds due this month. It had obtained HK$1.1 billion (US$142 million) of financing from Chiyu Bank in June, it said at the time.

“Fantasia’s missed payment highlights its strained liquidity, despite its reported sufficient cash on hand,” S&P said in its rating action.

As of June 30, Fantasia said it had 27.1 billion yuan of unrestricted cash on its balance sheet, including 10 billion yuan at the holding company level, according to S&P.

“But as funding conditions worsened, it’s likely that the cash was utilised for other repayments or was not accessible,” S&P said. “At the same time, asset disposals have been slower than we expected, failing to bring in liquidity sources in time.”

S&P cut Fantasia’s long-term issuer credit rating to ‘“selective default”, indicating a company has defaulted on one or more financial obligations.

Fantasia has US$1.9 billion of offshore bonds and 6.4 billion yuan of onshore bonds that are either maturing this year or next year, or subject to risks that bondholders would exercise their right to demand early repayment, Fitch said in an earlier report.

The cash crunch at Fantasia and other developers comes after Beijing adopted new rules last year designed to tamp down speculative property price bubbles. The “three red lines” requirements adopted by the People’s Bank of China in August of last year limited the ability of developers to borrow, making it hard for them to cover short-term cash needs between the time flats are built and sold.

Concerns about Evergrande, China’s biggest home builder by sales, have particularly unnerved the markets in recent weeks as it appears to have missed at least two interest payment deadlines for its offshore debt and faces a staggering US$305 billion in total liabilities

Fantasia was founded in 1996 by Zeng Jie, the niece of former vice-president Zeng Qinghong.

The company reported a profit of 302.9 million yuan in the first half of this year, a 9.5 per cent increase over the prior-year period. As of June 30, it had current liabilities – those that have to be repaid within a year – of nearly 50 billion yuan, including 8.5 billion yuan in borrowings due within a year and nearly 11 billion yuan in senior notes and bonds due within a year.

Last edited: