Fox News Poll: Voters favor taxing the wealthy, increasing domestic spending

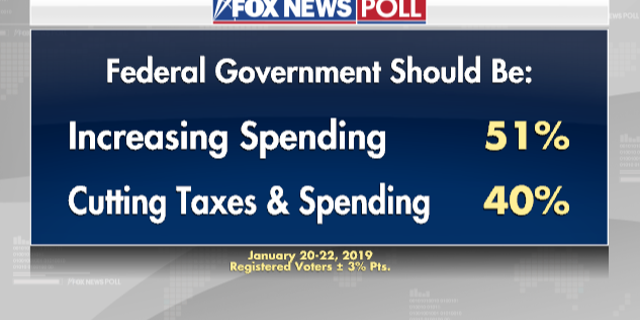

Voters prefer increasing spending on domestic programs over cutting

taxes and reducing spending, and their preferred way to

finance that spending -- is tax the wealthy.

That’s according to a Fox News Poll released Thursday.

Fifty-one percent of voters want to spend more on programs such as

infrastructure, national defense,

education, and

health care. That includes 63 percent of Democrats, 50 percent of independents, and 39 percent of Republicans.

CLICK TO READ THE COMPLETE POLL RESULTS.

Forty percent prefer the federal government cut taxes, spending, and regulations.

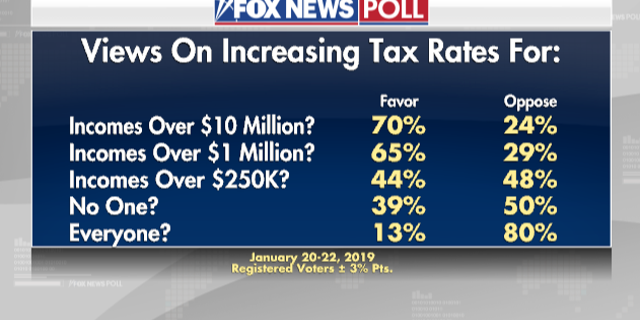

At the same time, there is broad support for increasing taxes on the wealthiest families. Voters support tax increases on families making over $10 million annually by a 46-point margin (70 percent favor-24 percent oppose), and support a hike on those making over $1 million by 36 points (65-29 percent).

There is less support for a broader tax increase: 44 percent favor raising rates on those with income over $250,000, and a small minority, 13 percent, approves of an increase on all Americans.

Both lower- and higher-income households favor raising taxes on millionaires, but views split when it comes to an increase on families making over $250,000. Lower-income households favor an increase, while a majority of those making over $100,000 opposes the idea.

Overall, more voters disapprove (50 percent) than approve (39 percent) of just leaving tax rates as they are for everyone.

Despite the appetite for raising rates, nearly 7 in 10 voters are “extremely” or “very” concerned about the amount they pay in taxes (67 percent). Only the price of health care (85 percent), the political dynamic in Washington (79 percent), and the economy (71 percent) rank higher on the list of voters’ concerns.

Democrats and Republicans find common ground on rejecting a tax increase for everyone, with about 8 in 10 disapproving. But that’s where the similarities end.

Majorities of Democrats favor raising taxes on those making over $250,000 (56 percent), $1 million (81 percent), and $10 million (85 percent).

Republicans are less sure where the sweet spot is for tax hikes. A majority of 59 percent opposes tax hikes on incomes over $250,000, while a 54 percent majority favors increases on incomes over $10 million. For incomes over $1 million, GOP views split: 47 favor vs. 43 oppose.

Pollpourri

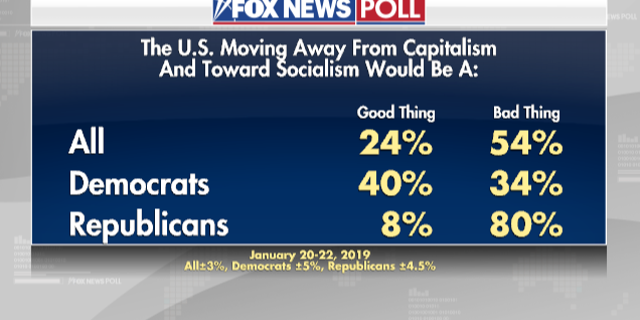

The poll asks voters if it would be a “good thing or a bad thing for the United States to move away from capitalism and more toward socialism.” A majority of 54 percent says that would be a bad thing.

Most Republicans (80 percent) say it would be bad, while a plurality of Democrats think it would be good (40 percent good, 34 percent bad, and 26 percent unsure).

The Fox News poll is based on landline and cellphone interviews with 1,008 randomly chosen registered voters nationwide and was conducted under the joint direction of Beacon Research (D) (formerly named Anderson Robbins Research) and Shaw & Company Research (R) from January 20-22, 2019. The poll has a margin of sampling error of plus or minus three percentage points for all registered voters.