Trump it’s over

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BREAKING: #FinCENFiles - The Biggest Leak of Financial Documents in history - 9/20

- Thread starter Hood Critic

- Start date

More options

Who Replied?Putin associate ‘moved millions’ through Barclays

FinCEN Files: Sanctioned Putin associate ‘laundered millions’ through Barclays

By FinCEN Files reporting team BBC Panorama

Getty Images

Getty Images

Vladimir Putin and Arkady Rotenberg have been friends since childhood

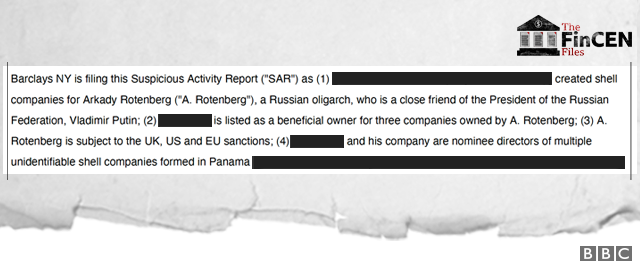

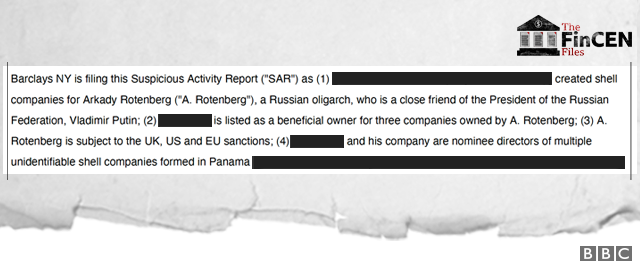

One of Vladimir Putin's closest friends may have used Barclays Bank in London to launder money and dodge sanctions, leaked documents suggest.

Billionaire Arkady Rotenberg has known the Russian president since childhood.

Financial restrictions, or sanctions, were imposed on Mr Rotenberg by the US and the EU in 2014, which means Western banks could face serious consequences for doing business with him.

Barclays says it met all its legal and regulatory duties.

A leak of confidential files - banks' "suspicious activity reports" - reveal how companies believed to be controlled by Mr Rotenberg kept the secret accounts.

The documents, known as the FinCEN Files, have been seen by the BBC's Panorama programme.

Inner circle

In March 2014 the US hit Russia with economic sanctions following the annexation of Crimea in Ukraine.

The Treasury Department designated Mr Rotenberg, 68, and his brother Boris, 63, "members of the Russian leadership's inner circle".

The pair had sparred and trained in the same judo gym as Putin when they were young.

Getty Images

Getty Images

The businessman and Russian president attending judo training in Sochi last year

In recent years, Arkady Rotenberg's companies built roads, a gas pipeline and a power station through contracts awarded by the Russian state.

The US Treasury said the brothers "provided support to Putin's pet projects" and "made billions of dollars in contracts for Gazprom and the Sochi Winter Olympics awarded to them by Putin".

In 2018, the US added Arkady Rotenberg's son Igor to its list of sanctioned individuals.

The aim of the sanctions is to cut off named people from the entire Western financial system.

Yet the Rotenbergs appear to have continued moving cash through the UK and US.

Art and money laundering

In 2008, Barclays opened an account for a company called Advantage Alliance.

The leaked documents show the company moved £60m between 2012 and 2016. Many of the transactions occurred after the Rotenberg brothers had been sanctioned.

In July this year, an investigation by the US Senate accused the Rotenbergs of using secretive purchases of expensive art to evade sanctions - one of the companies involved in the scheme was Advantage Alliance.

US investigators concluded there was strong evidence that Advantage Alliance was owned by Arkady Rotenberg, and that the company had used its Barclays account in London to buy millions of dollars of art for him.

A report noted how "secrecy, anonymity, and a lack of regulation create an environment ripe for laundering money and evading sanctions". Auction houses in the US and UK "failed to ask basic questions" about the buyers of the art.

Despite the sanctions, Arkady appears to have paid $7.5m to acquire the René Magritte painting La Poitrine.

In 17 June 2014 a company linked to Arkady sent the cash from Moscow to Alliance's Barclays account in London. The following day Barclays sent the cash to the seller in New York.

Account closed

In April 2016, Barclays began an internal investigation of multiple accounts it suspected of being linked to the Rotenbergs.

Six months later, the bank closed Advantage's account after becoming concerned that it was being used to move suspect funds.

But the leaked suspicious activity reports (SARs) show that other Barclays accounts with suspected links to the Rotenbergs remained open until 2017.

One such company was Ayrton Development Limited.

According to the files, Barclays were suspicious of Ayrton's activities and concluded that "[Arkady] Rotenberg is the true owner of Ayrton".

Reuters

Reuters

Barclays did not comment when asked by Panorama about how many accounts it suspects were owned by the Rotenbergs.

A spokesperson for Barclays said: "We believe that we have complied with all our legal and regulatory obligations including in relation to US sanctions."

"Given the filing of a SAR is not itself evidence of any actual wrongdoing, we would only terminate a client relationship after careful and objective investigation and analysis of the evidence, balancing potential financial crime suspicions with the risk of 'de-banking' an innocent customer."

The Rotenbergs declined to comment.

The FinCen Files is a leak of secret documents which reveal how major banks have allowed dirty money around the world. They also show how the UK is often the weak link in the financial system and how London is awash with Russian cash.

The files were obtained by BuzzFeed News which shared them with the International Consortium of Investigative Journalists (ICIJ) and 400 journalists around the world. Panorama has led research for the BBC.

FinCEN Files: Full coverage; follow reaction on Twitter using #FinCENfiles; in the BBC News app, follow the tag "FinCEN Files" Watch Panorama on the BBC iPlayer (UK viewers only).

FinCEN Files: Sanctioned Putin associate ‘laundered millions’ through Barclays

By FinCEN Files reporting team BBC Panorama

Vladimir Putin and Arkady Rotenberg have been friends since childhood

One of Vladimir Putin's closest friends may have used Barclays Bank in London to launder money and dodge sanctions, leaked documents suggest.

Billionaire Arkady Rotenberg has known the Russian president since childhood.

Financial restrictions, or sanctions, were imposed on Mr Rotenberg by the US and the EU in 2014, which means Western banks could face serious consequences for doing business with him.

Barclays says it met all its legal and regulatory duties.

A leak of confidential files - banks' "suspicious activity reports" - reveal how companies believed to be controlled by Mr Rotenberg kept the secret accounts.

The documents, known as the FinCEN Files, have been seen by the BBC's Panorama programme.

Inner circle

In March 2014 the US hit Russia with economic sanctions following the annexation of Crimea in Ukraine.

The Treasury Department designated Mr Rotenberg, 68, and his brother Boris, 63, "members of the Russian leadership's inner circle".

The pair had sparred and trained in the same judo gym as Putin when they were young.

The businessman and Russian president attending judo training in Sochi last year

In recent years, Arkady Rotenberg's companies built roads, a gas pipeline and a power station through contracts awarded by the Russian state.

The US Treasury said the brothers "provided support to Putin's pet projects" and "made billions of dollars in contracts for Gazprom and the Sochi Winter Olympics awarded to them by Putin".

In 2018, the US added Arkady Rotenberg's son Igor to its list of sanctioned individuals.

The aim of the sanctions is to cut off named people from the entire Western financial system.

Yet the Rotenbergs appear to have continued moving cash through the UK and US.

Art and money laundering

In 2008, Barclays opened an account for a company called Advantage Alliance.

The leaked documents show the company moved £60m between 2012 and 2016. Many of the transactions occurred after the Rotenberg brothers had been sanctioned.

In July this year, an investigation by the US Senate accused the Rotenbergs of using secretive purchases of expensive art to evade sanctions - one of the companies involved in the scheme was Advantage Alliance.

US investigators concluded there was strong evidence that Advantage Alliance was owned by Arkady Rotenberg, and that the company had used its Barclays account in London to buy millions of dollars of art for him.

A report noted how "secrecy, anonymity, and a lack of regulation create an environment ripe for laundering money and evading sanctions". Auction houses in the US and UK "failed to ask basic questions" about the buyers of the art.

Despite the sanctions, Arkady appears to have paid $7.5m to acquire the René Magritte painting La Poitrine.

In 17 June 2014 a company linked to Arkady sent the cash from Moscow to Alliance's Barclays account in London. The following day Barclays sent the cash to the seller in New York.

Account closed

In April 2016, Barclays began an internal investigation of multiple accounts it suspected of being linked to the Rotenbergs.

Six months later, the bank closed Advantage's account after becoming concerned that it was being used to move suspect funds.

But the leaked suspicious activity reports (SARs) show that other Barclays accounts with suspected links to the Rotenbergs remained open until 2017.

One such company was Ayrton Development Limited.

According to the files, Barclays were suspicious of Ayrton's activities and concluded that "[Arkady] Rotenberg is the true owner of Ayrton".

Barclays did not comment when asked by Panorama about how many accounts it suspects were owned by the Rotenbergs.

A spokesperson for Barclays said: "We believe that we have complied with all our legal and regulatory obligations including in relation to US sanctions."

"Given the filing of a SAR is not itself evidence of any actual wrongdoing, we would only terminate a client relationship after careful and objective investigation and analysis of the evidence, balancing potential financial crime suspicions with the risk of 'de-banking' an innocent customer."

The Rotenbergs declined to comment.

The FinCen Files is a leak of secret documents which reveal how major banks have allowed dirty money around the world. They also show how the UK is often the weak link in the financial system and how London is awash with Russian cash.

The files were obtained by BuzzFeed News which shared them with the International Consortium of Investigative Journalists (ICIJ) and 400 journalists around the world. Panorama has led research for the BBC.

FinCEN Files: Full coverage; follow reaction on Twitter using #FinCENfiles; in the BBC News app, follow the tag "FinCEN Files" Watch Panorama on the BBC iPlayer (UK viewers only).

Hood Critic

The Power Circle

88m3

Fast Money & Foreign Objects

Ridiculous.

London Tories have always been slow to pull the trigger on Russian investments. Now we know why.

Hood Critic

The Power Circle

This is essentially how Trump was able to become president though everyone under the sun knows he's entangled with dirty money.

The government simply Kanye shrugged at the reports because it was good for the national and global economies.

Honestly this explains more than I ever wanted to know about how soft the UK is on Russia:Ridiculous.

London Tories have always been slow to pull the trigger on Russian and investments. Now we know why.

Hood Critic

The Power Circle

Domingo Halliburton

Handmade in USA

Nobody really gave a shyt about the Panama papers. So i dont know if anything will actually come of this.

ADevilYouKhow

Rhyme Reason

Tired of people not paying their fair share while our country rots

MOGILEVICH

FIRTASH

DERIPASKA

MANAFORT

Global banks defy U.S. crackdowns by serving oligarchs, criminals and terrorists - ICIJ

‘Boss of bosses’

Often, the secret files show, banks handling cross-border transactions have little idea who they’re dealing with — even when they’re shifting hundreds of millions of dollars.

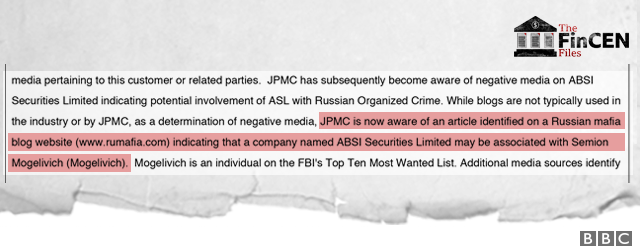

Take the case of a mysterious shell company called ABSI Enterprises. ABSI sent and received more than $1 billion in transactions through JPMorgan between January 2010 and July 2015, the FinCEN Files show.

This amount included transactions through a direct bank account with JPMorgan, which ABSI closed in 2013, and through so-called correspondent banking arrangements, in which a bank with significant U.S. operations, such as JPMorgan, allows foreign banks to process U.S. dollar transactions through its own accounts.

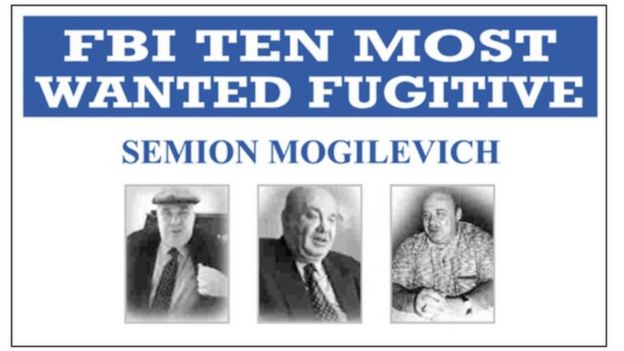

Compliance watchdogs based at the bank’s Columbus, Ohio, operations hub decided to try to figure out ABSI’s actual owner in 2015 after a Russian news site reported that a similarly-named shell company — which JPMorgan’s records indicated was the parent of ABSI — was linked to an underworld figure named Semion Mogilevich.

Mogilevich has been described as the “Boss of Bosses” of Russia mafia groups. When the FBI put him on its Top Ten Most Wanted list in 2009, it said his criminal network was involved in weapons and drug trafficking, extortion and contract murders. The chain-smoking, beefy Ukrainian’s signature method of neutralizing an enemy, The Guardian once reported, is the car bomb.

The records show the compliance officers searched in vain through their files on the shell company, unable to determine who was behind the firm or what its true purpose was.

While those details still remain unclear, JPMorgan had plenty of reasons to examine ABSI years earlier: it operated as a shell company in Cyprus, considered a major money laundering center at the time, and it was directing hundreds of millions of dollars through JPMorgan.

Mogilevich is featured in “World’s Most Wanted,” a Netflix documentary series released in August.

Through a spokesperson, Mogilevich said he had no knowledge of ABSI.

He has previously said: “I am not a leader or an active participant of any criminal group.”

...

Bank of New York Mellon was among the first big banks to pay a large penalty to U.S. authorities for anti-money-laundering failures. In 2005, two years before its merger with Mellon Financial, Bank of New York paid $38 million dollars and signed a non-prosecution agreement after a federal probe concluded that it had allowed $7 billion in illicit Russian money to flow through its accounts.

Media reports said investigators believed that Mogilevich, the alleged Russian mafia “Boss of Bosses,” was behind some of the transactions.

Even as it’s avoided big money laundering enforcement actions in recent years, Bank of New York Mellon has continued doing business with suspect figures, the FinCEN Files show.

The leaked records show, for example, that Bank of New York Mellon moved more than $1.3 billion in transactions between 1997 and 2016 tied to Oleg Deripaska, a Russia billionaire and a longtime ally of Russian President Vladimir Putin.

Since 2008, Deripaska has been the subject of allegations in media reports tying him to organized crime. When U.S. authorities announced sanctions against him in 2018, they said he had been previously been accused of threatening the lives of corporate rivals, bribing a Russian government official and ordering the murder of a businessman.

Deripaska denies laundering funds or committing financial crimes. In 2019 the Trump administration lifted sanctions on three companies linked to him. U.S. sanctions on Deripaska himself remain and he’s suing in an effort to upend them.

“BNY Mellon takes its role in protecting the integrity of the global financial system seriously, including filing Suspicious Activity Reports,” the bank said in a statement. “As a trusted member of the international banking community, we fully comply with all applicable laws and regulations, and assist authorities in the important work they do.”

...

Red flags

One striking pattern revealed by ICIJ’s analysis of the leaked records is the willingness of multiple banks to process transactions for the same risky clients.

Deripaska, the Russian oligarch, didn’t just have Bank of New York Mellon helping him out. The secret records reveal Deutsche Bank shuffled more than $11 billion in transactions between 2003 and 2017 for companies he controlled.

The records also indicate that Deutsche Bank and Standard Chartered helped Odebrecht SA — a Latin American construction firm behind what U.S. prosecutors called the largest foreign bribery case in history — move $677 million from 2010 from 2016. Deutsche Bank played a role in transactions involving more than $560 million of that amount, the records show.

Then there’s Dmytro Firtash, a Ukrainian oligarch who is wanted on criminal charges in the U.S.

In 2014, American prosecutors unsealed an indictment accusing him of bribing officials in India in an effort to secure a mining deal. Since late 2019, U.S. news outlets have reported on claims that Firtash played a role in President Trump’s effort to dig up dirt in Ukraine on his 2020 reelection opponent, Joe Biden.

Firtash, who says he began his climb in business trading Ukrainian powdered milk for Uzbek cotton after the fall of the Soviet Union, lives in exile in a mansion in Vienna, protected so far from efforts to extradite him. His Art Nouveau villa has a home cinema and an infinity pool — a 2017 profile by Bloomberg Businessweek dubbed him “the Oligarch in the Gilded Cage.”

When it comes to banking, he and companies tied to him found open doors among many of the industry’s big institutions.

All five big banks in ICIJ’s analysis — JPMorgan, Deutsche Bank, Standard Chartered, HSBC and Bank of New York Mellon — handled transactions for companies controlled by Firtash, the FinCEN Files show. And the records indicate that all five approved transactions tied to Firtash in the time periods after U.S. authorities had forced the banks to pay fines and pledge to work harder to vet suspect clients.

The files show that among these banks, JPMorgan moved the most money for companies controlled by Firtash by far — shuffling hundreds of transactions totaling nearly $2 billion between 2003 and 2014.

JPMorgan and the other banks should have been aware of Firtash’s questionable history as far back as 2010, when a leaked U.S. diplomatic cable linked Firtash to Mogilevich.

Then in 2011, a lawsuit filed in Manhattan by former Ukrainian Prime Minister Yulia Tymoshenko provided the banks even more of a heads up, even naming specific accounts at four of the banks that the suit alleged were being used by Firtash for money laundering.

The suit accused Firtash, Mogilevich and future Trump campaign manager Manafort of laundering illicit funds from Ukraine through banks and investment deals in the U.S.

The suit claimed accounts at the New York offices of JPMorgan, Deutsche Bank, Standard Chartered and Bank of New York Mellon were being used in money laundering operations shifting money stolen in Ukraine to the U.S. and then — after it had been cleaned — round-tripping it back to Ukraine.

Despite the allegations, these five banks continued to handle transactions involving companies controlled by Firtash, the FinCEN Files show.

The lawsuit was dismissed in 2013, in part because Tymoshenko and her lawyers weren’t able to provide enough specifics of the transactions involved in the alleged scheme.

Firtash has denied wrongdoing, telling Bloomberg Businessweek that he’s the victim of “a special machine of propaganda organized against me.” He told the magazine that Tymoshenko was “wrong in everything. She lies all the time. In order to money launder, you need to have dirty money to start with. I always had clean money.”

In a statement, an attorney for Firtash told ICIJ that Firtash “has never had any partnership or other commercial association with Semion Mogilevich.” The attorney said Firtash would not answer questions from ICIJ because its queries are “reliant on the unlawful and criminal disclosure” of suspicious activity reports.

Often, the secret files show, banks handling cross-border transactions have little idea who they’re dealing with — even when they’re shifting hundreds of millions of dollars.

Take the case of a mysterious shell company called ABSI Enterprises. ABSI sent and received more than $1 billion in transactions through JPMorgan between January 2010 and July 2015, the FinCEN Files show.

This amount included transactions through a direct bank account with JPMorgan, which ABSI closed in 2013, and through so-called correspondent banking arrangements, in which a bank with significant U.S. operations, such as JPMorgan, allows foreign banks to process U.S. dollar transactions through its own accounts.

Compliance watchdogs based at the bank’s Columbus, Ohio, operations hub decided to try to figure out ABSI’s actual owner in 2015 after a Russian news site reported that a similarly-named shell company — which JPMorgan’s records indicated was the parent of ABSI — was linked to an underworld figure named Semion Mogilevich.

Mogilevich has been described as the “Boss of Bosses” of Russia mafia groups. When the FBI put him on its Top Ten Most Wanted list in 2009, it said his criminal network was involved in weapons and drug trafficking, extortion and contract murders. The chain-smoking, beefy Ukrainian’s signature method of neutralizing an enemy, The Guardian once reported, is the car bomb.

The records show the compliance officers searched in vain through their files on the shell company, unable to determine who was behind the firm or what its true purpose was.

While those details still remain unclear, JPMorgan had plenty of reasons to examine ABSI years earlier: it operated as a shell company in Cyprus, considered a major money laundering center at the time, and it was directing hundreds of millions of dollars through JPMorgan.

Mogilevich is featured in “World’s Most Wanted,” a Netflix documentary series released in August.

Through a spokesperson, Mogilevich said he had no knowledge of ABSI.

He has previously said: “I am not a leader or an active participant of any criminal group.”

...

Bank of New York Mellon was among the first big banks to pay a large penalty to U.S. authorities for anti-money-laundering failures. In 2005, two years before its merger with Mellon Financial, Bank of New York paid $38 million dollars and signed a non-prosecution agreement after a federal probe concluded that it had allowed $7 billion in illicit Russian money to flow through its accounts.

Media reports said investigators believed that Mogilevich, the alleged Russian mafia “Boss of Bosses,” was behind some of the transactions.

Even as it’s avoided big money laundering enforcement actions in recent years, Bank of New York Mellon has continued doing business with suspect figures, the FinCEN Files show.

The leaked records show, for example, that Bank of New York Mellon moved more than $1.3 billion in transactions between 1997 and 2016 tied to Oleg Deripaska, a Russia billionaire and a longtime ally of Russian President Vladimir Putin.

Since 2008, Deripaska has been the subject of allegations in media reports tying him to organized crime. When U.S. authorities announced sanctions against him in 2018, they said he had been previously been accused of threatening the lives of corporate rivals, bribing a Russian government official and ordering the murder of a businessman.

Deripaska denies laundering funds or committing financial crimes. In 2019 the Trump administration lifted sanctions on three companies linked to him. U.S. sanctions on Deripaska himself remain and he’s suing in an effort to upend them.

“BNY Mellon takes its role in protecting the integrity of the global financial system seriously, including filing Suspicious Activity Reports,” the bank said in a statement. “As a trusted member of the international banking community, we fully comply with all applicable laws and regulations, and assist authorities in the important work they do.”

...

Red flags

One striking pattern revealed by ICIJ’s analysis of the leaked records is the willingness of multiple banks to process transactions for the same risky clients.

Deripaska, the Russian oligarch, didn’t just have Bank of New York Mellon helping him out. The secret records reveal Deutsche Bank shuffled more than $11 billion in transactions between 2003 and 2017 for companies he controlled.

The records also indicate that Deutsche Bank and Standard Chartered helped Odebrecht SA — a Latin American construction firm behind what U.S. prosecutors called the largest foreign bribery case in history — move $677 million from 2010 from 2016. Deutsche Bank played a role in transactions involving more than $560 million of that amount, the records show.

Then there’s Dmytro Firtash, a Ukrainian oligarch who is wanted on criminal charges in the U.S.

In 2014, American prosecutors unsealed an indictment accusing him of bribing officials in India in an effort to secure a mining deal. Since late 2019, U.S. news outlets have reported on claims that Firtash played a role in President Trump’s effort to dig up dirt in Ukraine on his 2020 reelection opponent, Joe Biden.

Firtash, who says he began his climb in business trading Ukrainian powdered milk for Uzbek cotton after the fall of the Soviet Union, lives in exile in a mansion in Vienna, protected so far from efforts to extradite him. His Art Nouveau villa has a home cinema and an infinity pool — a 2017 profile by Bloomberg Businessweek dubbed him “the Oligarch in the Gilded Cage.”

When it comes to banking, he and companies tied to him found open doors among many of the industry’s big institutions.

All five big banks in ICIJ’s analysis — JPMorgan, Deutsche Bank, Standard Chartered, HSBC and Bank of New York Mellon — handled transactions for companies controlled by Firtash, the FinCEN Files show. And the records indicate that all five approved transactions tied to Firtash in the time periods after U.S. authorities had forced the banks to pay fines and pledge to work harder to vet suspect clients.

The files show that among these banks, JPMorgan moved the most money for companies controlled by Firtash by far — shuffling hundreds of transactions totaling nearly $2 billion between 2003 and 2014.

JPMorgan and the other banks should have been aware of Firtash’s questionable history as far back as 2010, when a leaked U.S. diplomatic cable linked Firtash to Mogilevich.

Then in 2011, a lawsuit filed in Manhattan by former Ukrainian Prime Minister Yulia Tymoshenko provided the banks even more of a heads up, even naming specific accounts at four of the banks that the suit alleged were being used by Firtash for money laundering.

The suit accused Firtash, Mogilevich and future Trump campaign manager Manafort of laundering illicit funds from Ukraine through banks and investment deals in the U.S.

The suit claimed accounts at the New York offices of JPMorgan, Deutsche Bank, Standard Chartered and Bank of New York Mellon were being used in money laundering operations shifting money stolen in Ukraine to the U.S. and then — after it had been cleaned — round-tripping it back to Ukraine.

Despite the allegations, these five banks continued to handle transactions involving companies controlled by Firtash, the FinCEN Files show.

The lawsuit was dismissed in 2013, in part because Tymoshenko and her lawyers weren’t able to provide enough specifics of the transactions involved in the alleged scheme.

Firtash has denied wrongdoing, telling Bloomberg Businessweek that he’s the victim of “a special machine of propaganda organized against me.” He told the magazine that Tymoshenko was “wrong in everything. She lies all the time. In order to money launder, you need to have dirty money to start with. I always had clean money.”

In a statement, an attorney for Firtash told ICIJ that Firtash “has never had any partnership or other commercial association with Semion Mogilevich.” The attorney said Firtash would not answer questions from ICIJ because its queries are “reliant on the unlawful and criminal disclosure” of suspicious activity reports.

HSBC moved scam millions, big banking leak shows

What else did the leak find?

The FinCEN Files also show how multinational bank JP Morgan may have helped a man known as the Russian mafia's boss of bosses to move more than a $1bn through the financial system.

Semion Mogilevich has been accused of crimes including gun running, drug trafficking and murder.

He should not be allowed to use the financial system, but a SAR filed by JP Morgan in 2015 after the account was closed, reveals how the bank's London office may have moved some of the cash.

It details how JP Morgan, provided banking services to a secretive offshore company called ABSI Enterprises between 2002 and 2013, even though the firm's ownership was not clear from the bank's records.

Over one five-year period, JP Morgan sent and received wire transfers totalling $1.02bn, the bank said.

The SAR noted ABSI's parent company "might be associated with Semion Mogilevich - an individual who was on the FBI's top 10 most wanted list".

In a statement, JP Morgan said: "We follow all laws and regulations in support of the government's work to combat financial crimes. We devote thousands of people and hundreds of millions of dollars to this important work."

@88m3 @ADevilYouKhow @wire28 @dtownreppin214

@dza @wire28 @BigMoneyGrip @Dameon Farrow @re'up @Blackfyre @NY's #1 Draft Pick @Skyfall @2Quik4UHoes