I’m tempted to sell some of my SoFi shares that I hold in my SoFi account and just sit on the money and maybe buy back in if it falls. It’s about 460 shares up 18%. I’m up like 43% in the Fidelity and Robinhood accounts. Many of these shares date back to IPOE.Sofi touched $18.

What price did you get in at?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?I’m tempted to sell some of my SoFi shares that I hold in my SoFi account and just sit on the money and maybe buy back in if it falls. It’s about 460 shares up 18%. I’m up like 43% in the Fidelity and Robinhood accounts. Many of these shares date back to IPOE.

18.50s then 20 right behind brother hold the LINEEEEE.. earnings next week atleast wait another week crodie

edit: holding shares 6.40 avg or some shyt

18.50s then 20 right behind brother hold the LINEEEEE.. earnings next week atleast wait another week crodie

edit: holding shares 6.40 avg or some shyt

What price would you sell?

I already trimmed half of my position at 14, riding free at the moment.. letting it ride unless earnings tanks itWhat price would you sell?

President Donald Trump announces AI infrastructure investment — 1/21/2025

President Donald Trump announces a joint venture Tuesday with OpenAI, Oracle and Softbank to invest billions of dollars in AI infrastructure in the United St...

Project Stargate

Last edited:

Pltr up 2.7% AH

President Donald Trump announces AI infrastructure investment — 1/21/2025

President Donald Trump announces a joint venture Tuesday with OpenAI, Oracle and Softbank to invest billions of dollars in AI infrastructure in the United St...www.youtube.com

Project Stargate

who_better_than_me

Time to go!!

Nflx

WTFisWallace?

All Star

I trimmed some of my PLTR 73c Jan 31 calls earlier in the day to secure profit.

I trimmed some of my PLTR 73c Jan 31 calls earlier in the day to secure profit.PLTR shot up to 75 in the after hours. Hopefully it keeps shooting up tomorrow.

Controversy

Superstar

A big year for management

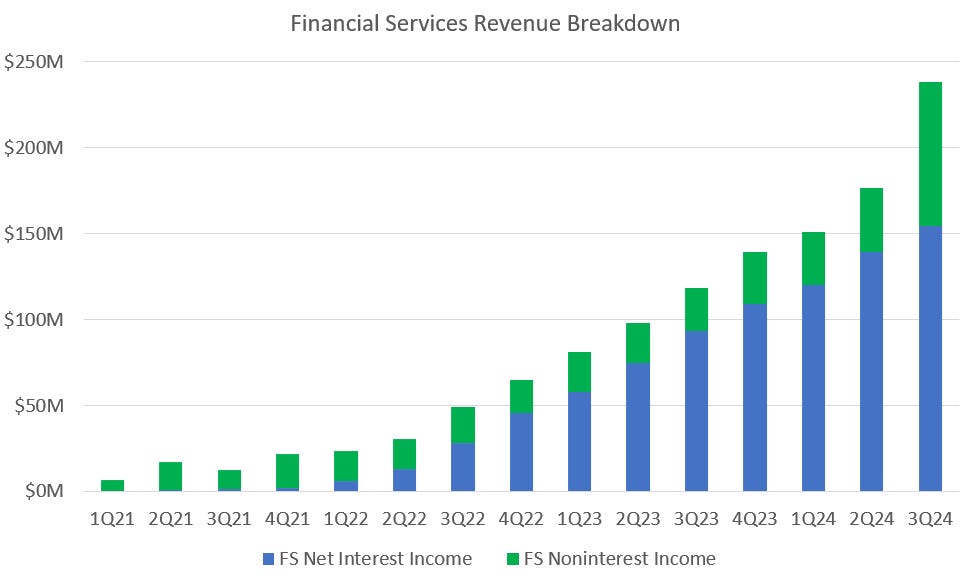

SoFi’s management has a LOT riding on 2025. Yes, it’s the transitional year to see how they get to their 2026 guidance, but it’s also the last full year they have to get push the stock higher before their Performance Stock Units (PSUs) expire.

For those who aren’t aware, senior management like CEO Anthony Noto, CFO Chris Lapointe, and Galileo CEO Derek White have stock that only vests if they hit certain stock price thresholds in the next year and a half.

The PSUs are broken up into three equal buckets that are only awarded if the stock price exceeds a volume-weighted 90 day trading average of $25, $35, and $45 on or before Jun 1, 2026.

So to realistically have a chance at receiving all their PSUs, they need the stock to already be over $35/share by this time next year.

How much is it worth to them? Noto could get a total of 6.43M shares. Lapointe can receive up to 831k shares, and White would earn 750k shares. Here is how much their net worth increases with each individual award, and the growth in their total cumulative net worth if the stock trades at an average price of $45/share before the 2026 target date.

So there are approximately 360 million reasons why they are going to push as hard as possible to deliver the goods in 2025. For those who think this is out of reach, remember that at this time last year, Robinhood was trading in the $10-$11 range and today is at $46. Management has always been in the shareholder’s corner, but their interests are especially aligned over the next 16 months.

SoFi Q4 Earnings Preview: Time to Take the Gloves Off

As I went through these projections, I ended up very enthused about the prospects of Q4 being a true inflection point for the company.www.datadinvesting.com

Fellas, are we locked in?

We loading up now or hoping on one more precipitous dip before we go balls deep (pause)

Or we say fukk all that idle talk and we put racks on racks on that 1/16/26 January options call?

WTFisWallace?

All Star

Looking into long SPY puts.....thought it would be much cheaper than 3k