You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?BlaxOps

Pro

In a strategic move to bolster its electric vehicle (EV) production capabilities, General Motors Company (NYSE:GM) has reportedly acquired Tooling & Equipment International (TEI), a crucial partner in Tesla Inc's (NASDAQ:TSLA) gigacasting technology.

TEI has been instrumental in aiding Tesla to advance gigacasting, a process that involves casting large car body parts in one piece, reported Reuters.

The technique aims to streamline manufacturing while reducing costs. With TEI now under its wing, GM is poised to enhance its own manufacturing efficiencies, especially as Tesla accelerates towards launching a $25,000 EV.

TEI has been instrumental in aiding Tesla to advance gigacasting, a process that involves casting large car body parts in one piece, reported Reuters.

The technique aims to streamline manufacturing while reducing costs. With TEI now under its wing, GM is poised to enhance its own manufacturing efficiencies, especially as Tesla accelerates towards launching a $25,000 EV.

Slim

Superstar

TGT

BlaxOps

Pro

Will this help $LCID?

BlaxOps

Pro

IBM Corp. (IBM) has abruptly pulled ads from X, formerly Twitter , amid a maelstrom of controversial comments from billionaire owner Elon Musk that it said amplify antisemitism. " IBM has zero tolerance for hate speech and discrimination and we have immediately suspended all advertising on X while we investigate this entirely unacceptable situation," the company said in a statement emailed to MarketWatch. On Wednesday, Musk agreed with a post on X that an antisemitic conspiracy theory that Jewish people hold a " dialectical hatred" of white people. "You have said the actual truth," Musk said in response to the post.

Compounding matters, Musk on Thursday said on X it was "super messed up" that white people are not, in the words of one far-right user's tweet, "allowed to be proud of their race."

The cascading conflagration prompted Tesla Inc. (TSLA) bull and investment adviser Ross Gerber to grumble on X: " Getting a flood of messages from clients wanting out of tesla and anything to do with Elon Musk . Many saying they are selling their cars as well. What is he doing to the tesla brand??!!?!?"

Compounding matters, Musk on Thursday said on X it was "super messed up" that white people are not, in the words of one far-right user's tweet, "allowed to be proud of their race."

The cascading conflagration prompted Tesla Inc. (TSLA) bull and investment adviser Ross Gerber to grumble on X: " Getting a flood of messages from clients wanting out of tesla and anything to do with Elon Musk . Many saying they are selling their cars as well. What is he doing to the tesla brand??!!?!?"

BlaxOps

Pro

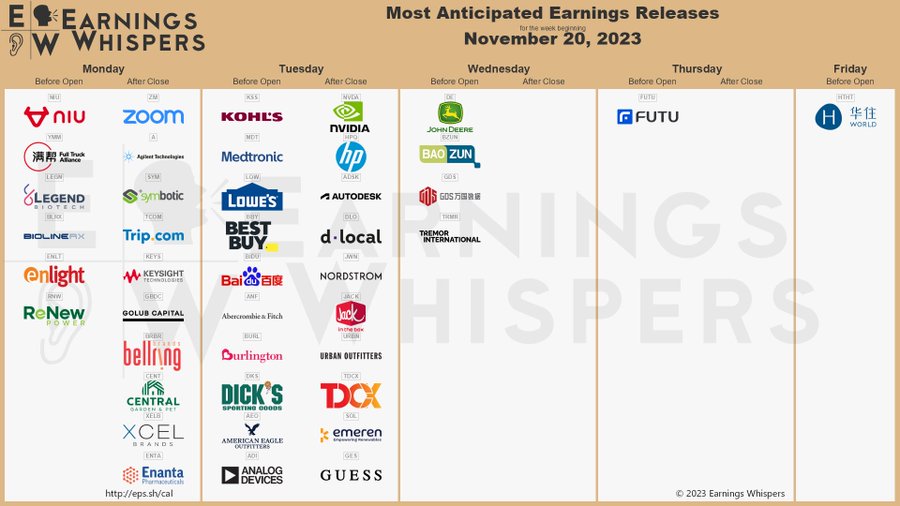

TOP STOCKS TO WATCH FOR THE WEEK OF NOV 20,2023

This video covers earnings this week, Nvida, Lowes, Tesla and Target.

I remember when everyone was like ZOOM ZOOM ZOOM

I remember when everyone was like ZOOM ZOOM ZOOMMy nikka Boosie, he tell it like it is

My rant from discord:

On the eve of Zoom's earnings call, it appears they have stabilized. However, the real lesson lies in navigating a bubble – distinguishing genuine hype and expansion from mere speculation.

This leads me to ponder the evaluation and potential justification of stocks like NVDA, LLY, and NVO, which currently seem isolated. Can their pricing be substantiated?

While I cannot comment on NVDA, regarding LLY, I'd confident that most overweight people would kill to be thinner. The weight loss industry is worth 300 Billion globally.

Although I don't hold NVDA, I do have BOTZ, an AI ETF where NVDA comprises around 10% of the portfolio. If NVDA experiences a surge post-earnings, I may consider derisking.

Looking ahead, my trust lies primarily in SPY and QQQ over the next decade. There's no need for excessive greed, especially given the remarkable movement of QQQ.

Global Weight Loss Products and Services Market Report 2023: Rising Ageing Population Drives Growth

The "Weight Loss Products and Services Global Market Report 2023" report has been added to ResearchAndMarkets.com's offering.

JetFueledThoughts

Superstar

Slim

Superstar

I remember when everyone was like ZOOM ZOOM ZOOM

My nikka Boosie, he tell it like it is

My rant from discord:

Global Weight Loss Products and Services Market Report 2023: Rising Ageing Population Drives Growth

The "Weight Loss Products and Services Global Market Report 2023" report has been added to ResearchAndMarkets.com's offering.finance.yahoo.com

Playing F near the 52-week low has been a consistent lick.

Playing F near the 52-week low has been a consistent lick.