If you’re using your Roth IRA free feel to trade in and out shyt like sqqq, spxs, sdow.Definitely just an investor the simpler the strategy the better for me. Time horizon depends largely on the housing market. At some point I’m going to take a sizeable portion of my investments to use for a down payment. But if interest rates are still high and the overall prices of houses aren’t falling to counteract that I will stay put

Let’s just say going long on half my portfolio

That’s easy money if you’re doing it in a tax delayed/ deferred account. Plus you can take money out penalty free for a house.

However just remember if you’re trading in a regular public account. For all your trades, you’re paying higher percentage on capital gains, plus it’s increasing your overall taxable income. It may not be as lucrative as staying put. However don’t forget this also a great time to take a 3K loss to reduce your tax burden, if you haven’t already.

Can You Deduct a Capital Loss on Your Taxes?

Here’s how to deduct the capital loss when you sell an investment for less than it cost.

If you have speculative stocks or shytty companies I’d “consider “ reducing a position in there, because those are usually what get hit the hardest in a downturn and take a longer duration to recover.

If you’re going longer, like hypothetically your time horizon is mid late 2024 for a house. DCAing isn’t a bad idea.

Because macro wise there’s a few things that’ll “probably” be occurring to push the market up.

I believe student loans coming back online will break something. Also the interest rates still haven’t fully trickled into the economy yet, but by Q1 2024 we should start to see a reduction interest rates, plus the biggest catalyst of next year, the president cycle, its “normally” a bullish time in the market.

:max_bytes(150000):strip_icc()/GettyImages-529793817-def26d9f5b0345c1a8782ebda9191ebf.jpg)

What Is Presidential Election Cycle Theory?

Presidential election cycle theory is a theory of stock market performance that attempts to explain stock market performance using four-year presidential election cycles.

All this us speculative though and I’m not a financial advisor.

You should do your own research, before taking any advice.

My personal plan is to stay hedged. So if we dip, I have a short position in the stocks I mentioned above, but long term everything im currently in, im looking for buying opportunities, so I’ll be DCAing while following my companies closely.

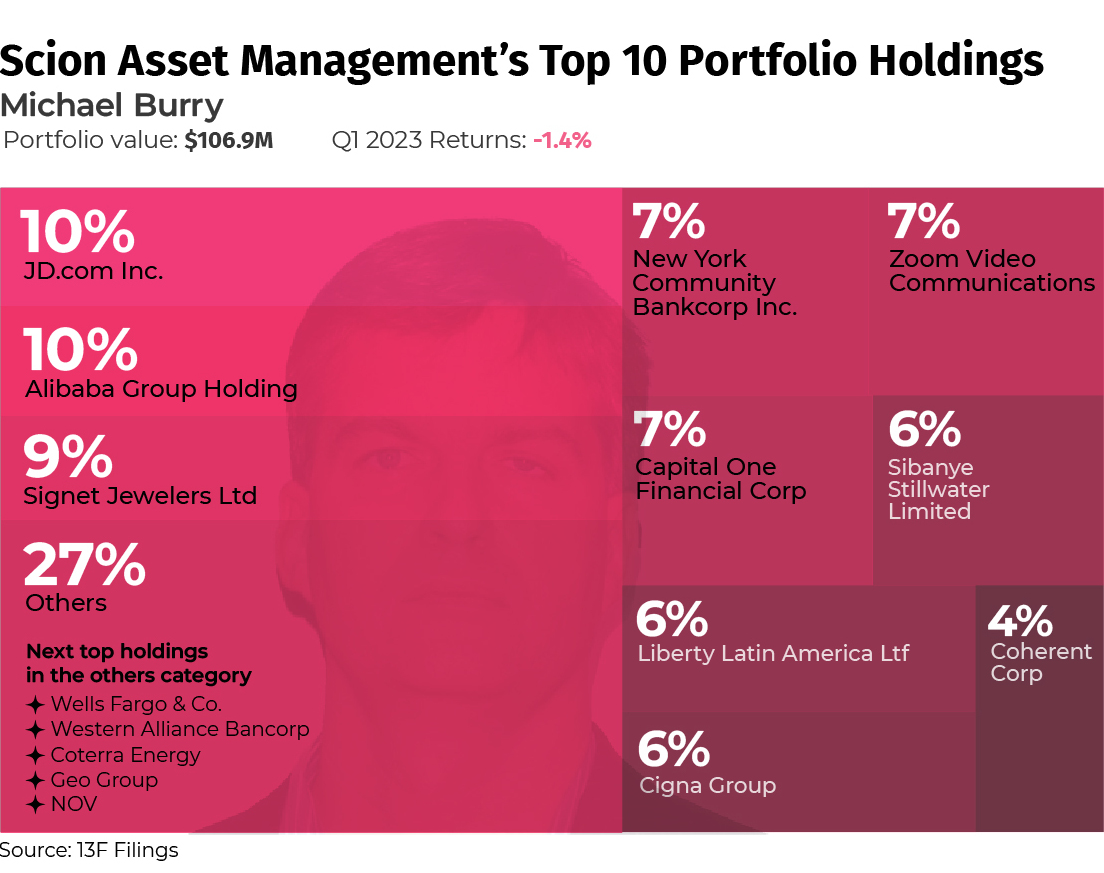

Shid, I ain't the police. Follow the money I say.

Shid, I ain't the police. Follow the money I say.