I'll be opening up a little position in Jumia. Gonna be a very long term play though, but based on what I've been reading, it could be a very big payoff.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?Job numbers are the most lagging aspect of a recession

You can’t have a recession with historic lows in unemployment because that correlates into high demand

A recession wouldn’t have inflation either because the slowdown in the economy would feature less demand

High unemployment= Less spending, business closures, foreclosures… That’s a recession

You missed my point. It’s obvious y’all are just taking buzzwords and phrases you’ve seen someone else say on the internetJob numbers are the most lagging aspect of a recession

Full employment is measured at a 4% unemployment rate

We’re at like 3.6%. Low unemployment means demand is sky high.

We’re not going to go from historic low unemployment at recession levels sharply, without an seismic event

How is demand sky high if for the last 2 quarters there was contracting GDP? It is not adding up at all. The natural rate of unemployment is actually more so 5%.You missed my point. It’s obvious y’all are just taking buzzwords and phrases you’ve seen someone else say on the internet

Full employment is measured at a 4% unemployment rate

We’re at like 3.6%. Low unemployment means demand is sky high.

We’re not going to go from historic low unemployment at recession levels sharply.

A slowdown mid 2023 sounds more reasonable when supply chains are stable

Also, unemployment can be fudged. UE = Those not employed but looking for work / Those in the labour force. UE does not take into account people who are unemployed but couldn't find work and just dropped out of the labour force in total.

Let's keep it a full 1000%. If Trump was in office it'd have been called a recession. Doesn't matter if it was brief, a recession is a recession.

If by Q3 it's 3 quarters of contracting GDP (which is very likely) there won't be anywhere to hide

Why should people not looking for jobs be counted in unemployment?How is demand sky high if for the last 2 quarters there was contracting GDP? It is not adding up at all. The natural rate of unemployment is actually more so 5%.

Also, unemployment can be fudged. UE = Those not employed but looking for work / Those in the labour force. UE does not take into account people who are unemployed but couldn't find work and just dropped out of the labour force in total.

Let's keep it a full 1000%. If Trump was in office it'd have been called a recession. Doesn't matter if it was brief, a recession is a recession.

If by Q3 it's 3 quarters of contracting GDP (which is very likely) there won't be anywhere to hide

What about right now feels like a recession other than y’all using buzzwords and concepts you’ve seen said around the internet?

A recession is a slowdown in the economy. That is felt and it hits certain sectors hard depending on reasons for the recession

1st quarter 2022 GDP: -1.6

2nd Quarter 2022 GDP: -.9

Those GDP numbers say the economy improved from the 1st to the 2nd qtr

US exports and personal incomes both increased in the 2nd Quarter

Read the GDP report and tell how this is a recession

Gross Domestic Product, Second Quarter 2022 (Advance Estimate) | U.S. Bureau of Economic Analysis (BEA)

Real gross domestic product (GDP) decreased at an annual rate of 0.9 percent in the second quarter of 2022 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 1.6 percent. The GDP estimate released today is based on...

Save the conspiracies for TLR

Why should people not looking for jobs be counted in unemployment?

What about right now feels like a recession other than y’all using buzzwords and concepts you’ve seen said around the internet?

A recession is a slowdown in the economy. That is felt and it hits certain sectors hard depending on reasons for the recession

1st quarter 2022 GDP: -1.6

2nd Quarter 2022 GDP: -.9

Those GDP numbers say the economy improved from the 1st to the 2nd qtr

US exports and personal incomes both increased in the 2nd Quarter

Read the GDP report and tell how this is a recession

Gross Domestic Product, Second Quarter 2022 (Advance Estimate) | U.S. Bureau of Economic Analysis (BEA)

Real gross domestic product (GDP) decreased at an annual rate of 0.9 percent in the second quarter of 2022 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 1.6 percent. The GDP estimate released today is based on...www.bea.gov

Save the conspiracies for TLR

hmmmm....idk, 2 contracting quarters of GDP like you've just posted there signals a recession brodi. But let's keep this about stocks. Like I said, end of Q3 there isn't gonna be any hiding.

A lot of the "growth" in preceding quarters was government spending via stimulus checks, PPP and boosted unemployment checks. That money has worked it's way through the system and is now mainly dried up.

If you read the article you posted you'll see that the PCE (which is about 70% of US GDP) is slowing down i.e. inflation forced demand destruction. Give it till Oct/Nov

Rickdogg44

RIP Charmander RIP Kobe

Never want to really bet against tsla stock but...

Regarding recession- I agree it is with 2 negative gdp. Unemployment makes it not as bad (or lagging with the various layoffs we've seen)

Inflation and consumer sentiment makes it spooky

PCE is a measure of inflation and it was at the same rate 1st quarter and 2nd quarter. It decreased if you exclude food and gas cost from the calculationhmmmm....idk, 2 contracting quarters of GDP like you've just posted there signals a recession brodi. But let's keep this about stocks. Like I said, end of Q3 there isn't gonna be any hiding.

A lot of the "growth" in preceding quarters was government spending via stimulus checks, PPP and boosted unemployment checks. That money has worked it's way through the system and is now mainly dried up.

If you read the article you posted you'll see that the PCE (which is about 70% of US GDP) is slowing down i.e. inflation forced demand destruction. Give it till Oct/Nov

Slowdowns are apart of any economic cycle so it’s inevitable.

My only point is that we are not currently in a recession and the data shows that the GDP improved from the 1st qtr to the 2nd

2 negative GDP quarters equals a recession is like saying Westbrook had a good game because he got a triple double

SleezyBigSlim

Banned

Inflation Slows as Economy Cools, Offering a Reprieve: Live Updates

The Consumer Price Index climbed 8.5 percent in July, a bigger slowdown than expected, but inflation may remain uncomfortably high for some time.

Rickdogg44

RIP Charmander RIP Kobe

If it wasn't for stock split hype, I'd probably short tesla

Never want to really bet against tsla stock but...

Regarding recession- I agree it is with 2 negative gdp. Unemployment makes it not as bad (or lagging with the various layoffs we've seen)

Inflation and consumer sentiment makes it spooky

There’s no recession @OfTheCross

OfTheCross

Veteran

Never want to really bet against tsla stock but...

Regarding recession- I agree it is with 2 negative gdp. Unemployment makes it not as bad (or lagging with the various layoffs we've seen)

Inflation and consumer sentiment makes it spooky

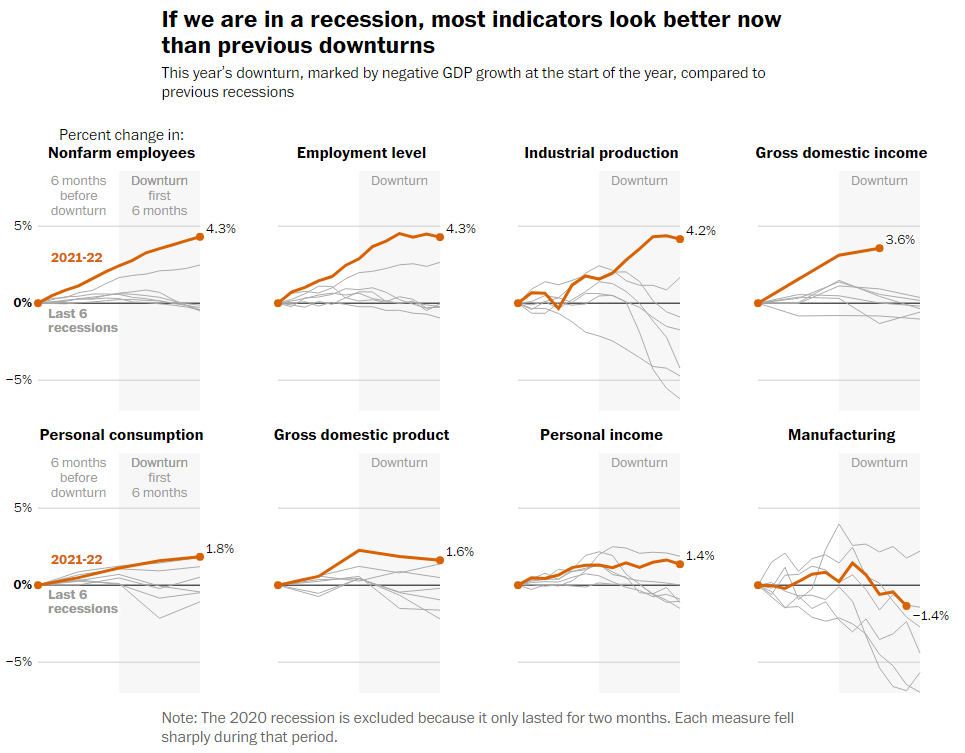

We good, breh.

https://www.washingtonpost.com/business/interactive/2022/are-we-in-recession-data/

BlaxOps

Pro

$TSLA running this morning. Last couple times it got to $940-$950 Elon sold. So lets see if he is done.