You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?Futuristic Eskimo

All Star

Why?i'd short copper and still go long natural gas for the next couple years

Edit: And are you doing it?

only way I short copper is if I can find an inverse ETF to purchase. I aint bout that margin life. Ill let you know when I open my position in UGAZ (down 90% in the last year) so you can take your profits and run. Probably wont be for another month after doing my research but as low as it is, there is simply too much upside in the long term for me to be worried about the downside.Why?

Edit: And are you doing it?

Still an Oil and Gas bull as well

Futuristic Eskimo

All Star

Seems like NG has been in a bear for a long time though. Timing that move wouldn't be easy.only way I short copper is if I can find an inverse ETF to purchase. I aint bout that margin life. Ill let you know when I open my position in UGAZ (down 90% in the last year) so you can take your profits and run. Probably wont be for another month after doing my research but as low as it is, there is simply too much upside in the long term for me to be worried about the downside.

Still an Oil and Gas bull as well

ANGI

already

stocks in focus after hours for me today: CSLT

Tanking after hours

excellentTanking after hours

ANGI

that pos

that posDomingo Halliburton

Handmade in USA

so no one noticed the extra 10 million barrels of oil laying around until 4:30 EST?

88m3

Fast Money & Foreign Objects

so no one noticed the extra 10 million barrels of oil laying around until 4:30 EST?

that wouldn't bode well for the price I would imagine?

Domingo Halliburton

Handmade in USA

only way I short copper is if I can find an inverse ETF to purchase. I aint bout that margin life. Ill let you know when I open my position in UGAZ (down 90% in the last year) so you can take your profits and run. Probably wont be for another month after doing my research but as low as it is, there is simply too much upside in the long term for me to be worried about the downside.

Still an Oil and Gas bull as well

Seems like NG has been in a bear for a long time though. Timing that move wouldn't be easy.

I don't know who J.C. Parets is but he likes nat gas here:

Domingo Halliburton

Handmade in USA

that wouldn't bode well for the price I would imagine?

American Petroleum Institute data: Crude Oil Inventories (Feb 13) W/W 14.3mil prev 4.6mil.

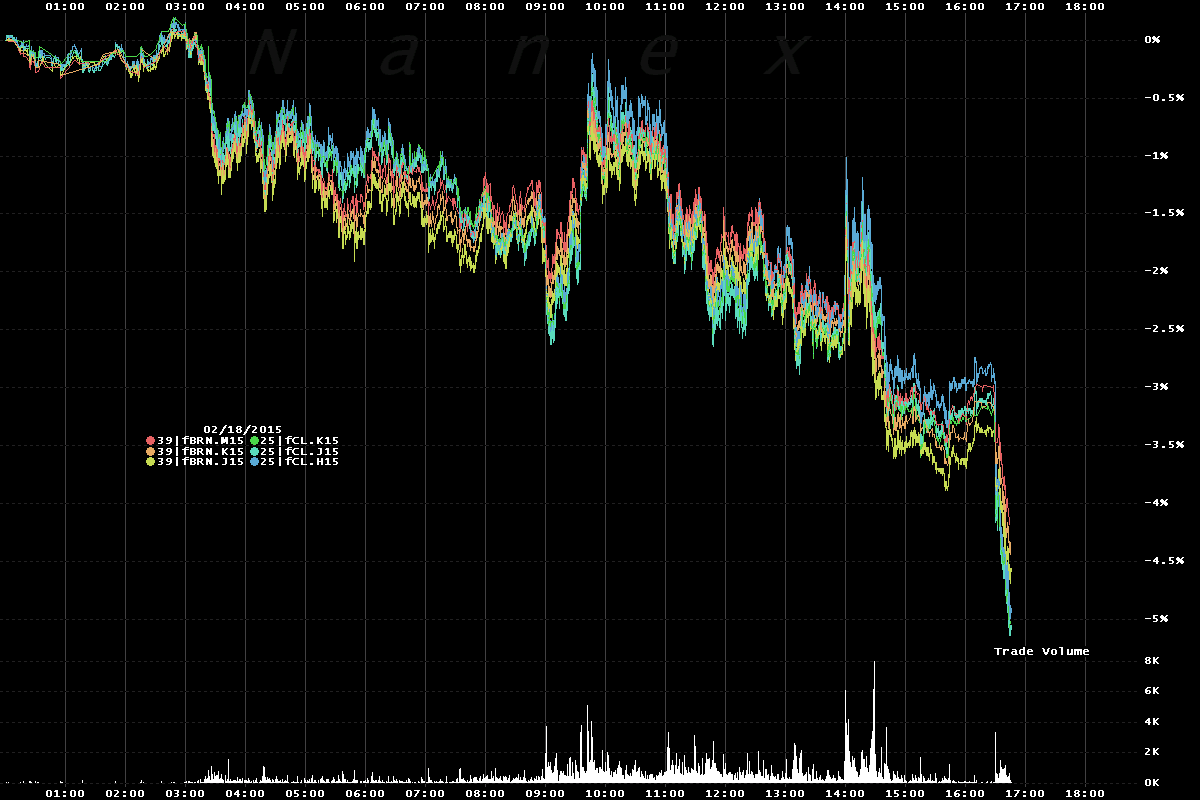

this chart is the three nearest months of brent crude and WTI (you can see the contracts fall in price at 4:30)

this is what I've been looking at. looks like a good time for a trend reversalI don't know who J.C. Parets is but he likes nat gas here:

definitely gonna research some micro and macro factors and analyst opinions though