levitate

I love you, you know.

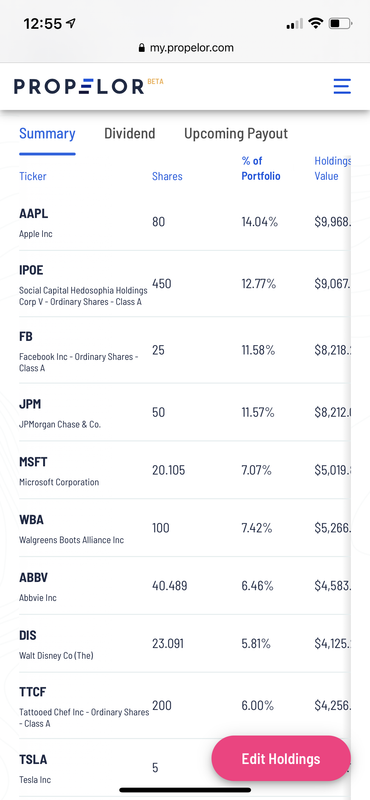

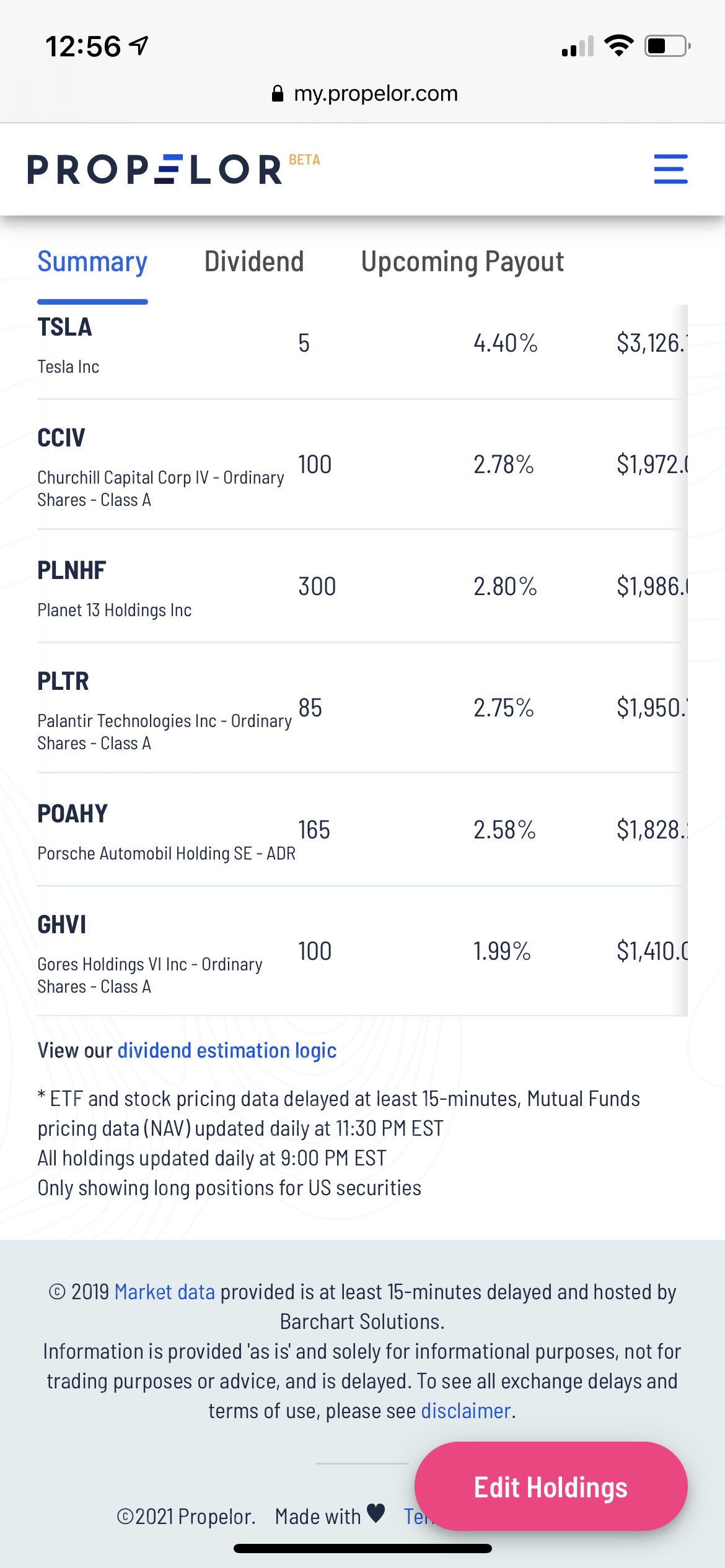

Haven’t check my stocks in a while..

AMC, Target…

AMC, Target…

Ok, so the closer it gets to the strike price prior to the option date the more money you make, and if it exceeds 40 before that date the return is even crazier? Excuse my ignorance, I see posts with this in there and I only vaguely understand wtf I'm reading.

Swapping contracts is the name of the game. However if you're not a wizard at charting buy options 6-24 months out40c (call) means he can buy the stock at anytime between now and 6/18 for $40 a share. For this privilege he agreed to pay an up front cost of $5.55 per share (the premium).

If amc were to get to say $100 before 6/18 he can exercise the contract and make $60 (100-40) at a cost of $5.55.

He can also trade the contract itself.

the premium is now $9.75 for this contract so he can resell the contract and make $4.2 (9.75-5.55)

This is all per share and a single contract is 100 shares.

I bought 10 shares around $12 and sold at $26.dunno when to get out of AMC.

You don't. Hodldunno when to get out of AMC.

Sold amc at $27, regretting that now. Didn’t have many.

blackberry

Not sure what to make of it but... subdivision pool, restaurants near buy... were like ghost towns compared to normal memorial day weekend

Not sure if everything already priced in but...

Airlines

Travel / Hotels / airbnb / etc

Casinos were pretty packed around here.. Slowly but surely it's all comin back

dunno when to get out of AMC.

Some say buy leaps already in the money. Like .7 delta. As long as decent OI and Volume