This guy is usually a crack pot but this article is interesting look at Canada.

................................................................................................................................................................

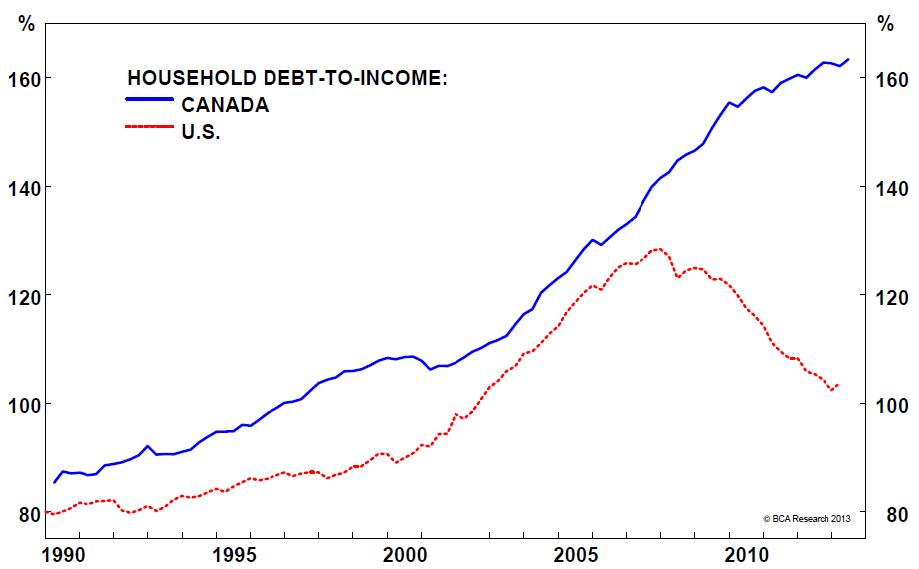

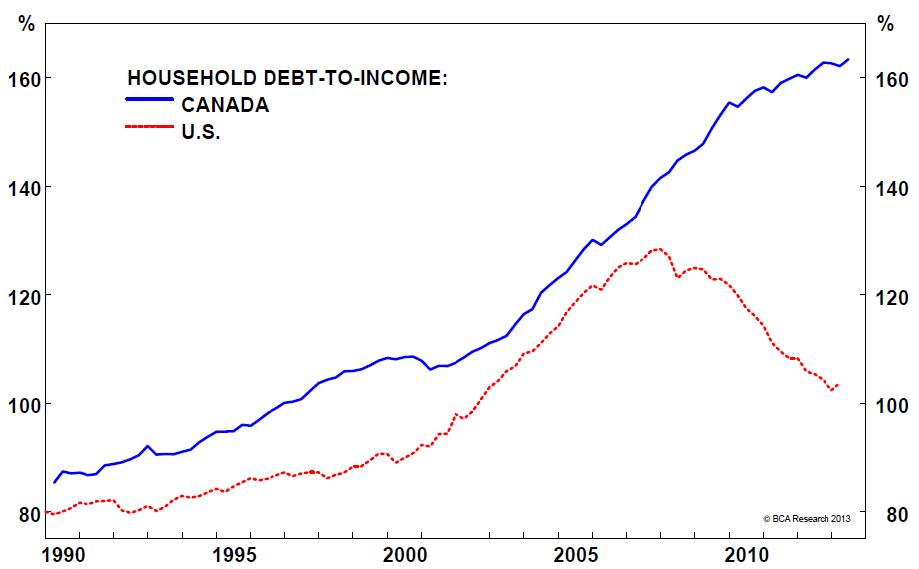

There was an inflection point for US markets when household debt surpassed household income. People kept saying it was a liquidity crisis initially but it was truly a solvency crisis. People took on too much debt and were walking on a financial tightrope. In the US, this peaked above 120 percent. Canada is well on its way above 160 percent:

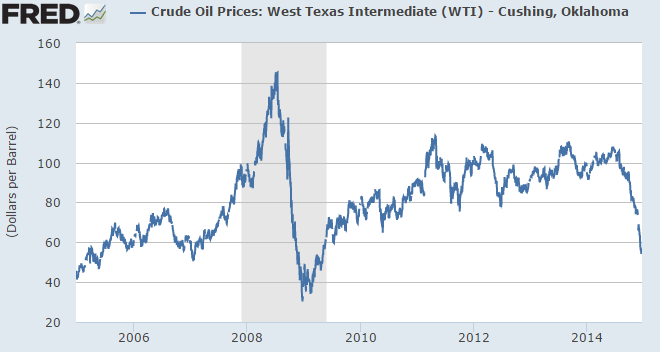

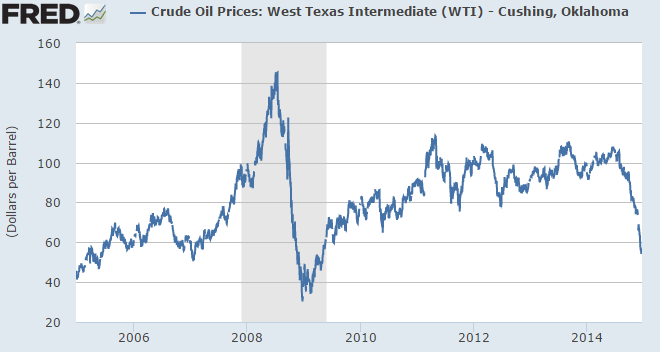

Basically Canadians are deeper in debt relative to their income. And a large part of this debt is housing related. A large part of the economy is also tied to oil and as you may know, oil just took a massive cut:

It was interesting to hear that we would never see oil drop below $100 a barrel. Oil is now trading at $52.84 a barrel. Similar arguments were made about US housing never having one negative year-over-year price drop until we did.

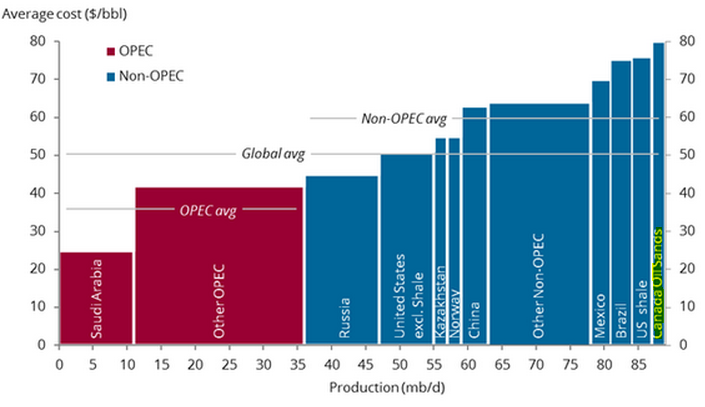

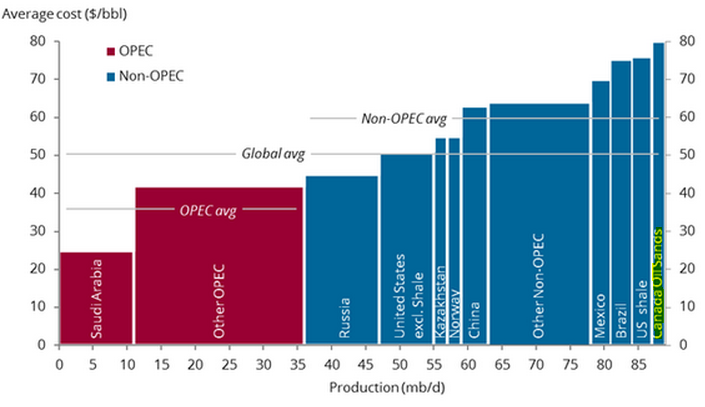

Large part of Canada’s oil is costly to extract

A large portion of Canada’s oil is costly to extract. With oil sands for example oil would need to be at $80 a barrel to make a profit:

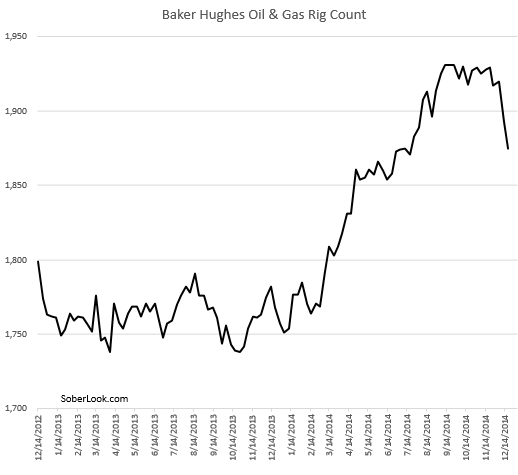

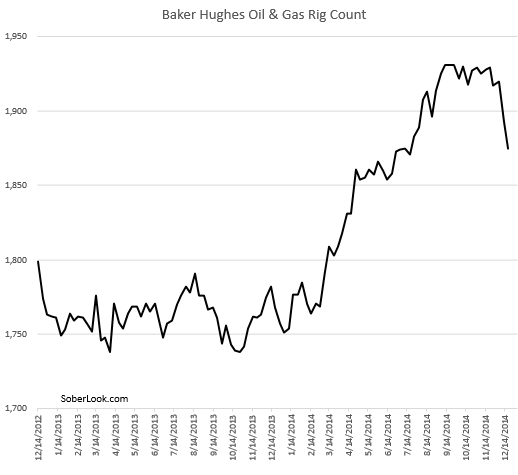

I doubt people want to run money losing operations for a long period of time. So it is no surprise that oil rigs are closing:

Fewer jobs and less money. And for a large part of the Canadian economy, much of this money has been flowing into housing. In Canada, there seems to be a cult belief that housing simply will not correct. They are full on drinking the good old tasting real estate Kool-Aid. In the US, we already lived that correction and understand that yes, housing does go through

booms and busts especially when debt is used to supplement a lack of income growth. As the debt to income chart shows, many US households were forced to deleverage via foreclosures and bankruptcies.

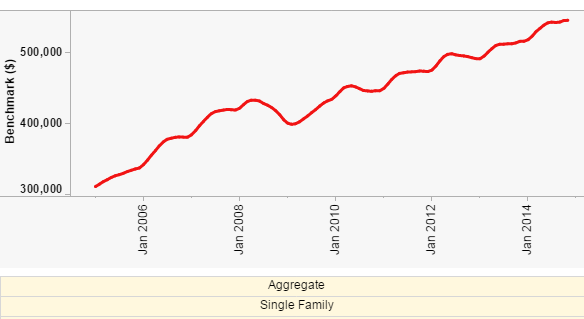

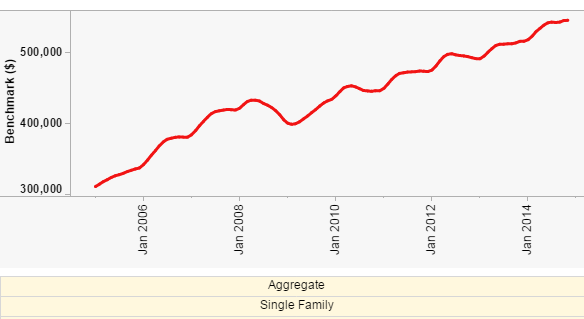

Home prices out of sync

Home prices are fully out of sync with incomes. Take a look at this rise in home values:

Canada has enjoyed many years of the global commodities boom and now finds itself contending with a market full of debt and inflated housing values. Short of oil rising back up to $80 a barrel and higher Canada is likely going to face some short-term pain. The housing market is due for a correction. Those of us in California realize that booms and busts can occur all of a sudden but the events leading up to this are largely foreseeable.

Canada has enjoyed many years of the global commodities boom and now finds itself contending with a market full of debt and inflated housing values. Short of oil rising back up to $80 a barrel and higher Canada is likely going to face some short-term pain. The housing market is due for a correction. Those of us in California realize that booms and busts can occur all of a sudden but the events leading up to this are largely foreseeable.