Saysumthinfunnymike

VOTE!!!

that Plaid Model S is fukking crazy bruh

that Plaid Model S is fukking crazy bruh

) but then there's music videos that 5 billion hits like:

) but then there's music videos that 5 billion hits like:https://www.investors.com/news/goodrx-ipo-price-valuation-soared-trading-debut/The initial public offering of GoodRx (GDRX), whose discounted prescription shopping site serves close to 5 million consumers each month, is set to price late Tuesday ahead of a Wednesday debut.

but amid all the chatter and hide the can come with these high-profile

The GoodRx IPO is expected to price at $24-$28 per share, implying a market cap of about $10 billion. That's up from a valuation of around $2.8 billion in a 2018 financing round, according to CNBC.

The profitable Santa Monica, Calif.-based company is raising about $570 million via the GoodRx IPO. In addition, private equity firm Silver Lake Partners will add to its investment with a roughly $100-million private placement of 3.8 million shares. Silver Lake will have a one-third stake post-GoodRx IPO.

How Does GoodRx Work?

GoodRx, which launched in 2011, gets most of its revenue from prescription benefit managers, or PBMs. When a consumer uses a GoodRx coupon to fill a prescription for less than the drugstore's list price, it receives a fee.

For people with health insurance, the GoodRx price savings might be shared between PBMs and consumers, to the extent they can lower their copay. For those who are uninsured or have a big prescription deductible, the savings may be much greater.

Here's an example of how much it can save: A search for Atorvastatin, the generic from of Pfizer's (PFE) cholesterol-lowering Lipitor, shows that GoodRx can cut the price to as little as $8.25 for 30 tablets. Meanwhile, the list price at Miami drugstores is all over the map: Walmart (WMT) ($15); Costco (COST) ($19); Winn-Dixie ($50); and CVS Health (CVS) ($122).

Its three largest PBM partners, Navitus, MedImpact and Express Scripts, accounted for 48% of total revenue in the first half of 2020, according to the GoodRx IPO filing. GoodRx also has a contract with Optum, the PBM unit of UnitedHealth (UNH).

GoodRx says revenue grew 48% to $257 million in the first half of 2020, while net income rose 75% to $54.7 million.

Having built up its brand, GoodRx is now working to build out its range of services. It acquired telehealth provider HeyDoctor in 2019 and also launched a telehealth marketplace to offer consumers a broader range of options.

Part of the logic behind the expansion into telehealth: about 20% of GoodRx users don't yet have a prescription when they search out prices and may prefer the convenience of a virtual appointment. HeyDoctor averaged more than 1,000 online visits per day in the second quarter.

GoodRx IPO Warning

The GoodRx IPO filing warns that consolidation of PBMs or pharmacy chains could hurt its business prospects. So could major health reform that alters drug pricing.

GoodRx says it's paying close attention to the current constitutional challenge to the Affordable Care Act that comes before the Supreme Court on Nov. 10. The death of Justice Ruth Bader Ginsburg has imperiled that law known as ObamaCare and its $2 trillion in health subsidies.

Underwriters, led by Morgan Stanley, Goldman Sachs, JPMorgan and Barclays, have an option to buy a total of up to 5.2 million shares at the GoodRx IPO price within 30 days. ()

Battery day is huge! Load up on TSLA stock now or regret it latet

TechCrunch is now a part of Verizon MediaPalantir is not a democracy, and it really, really, really wants you to know that.

Palantir’s governance has been under an exacting lens from regulators the past few weeks as it prepares for a public direct listing on September 29th. In revision after revision of its S-1 filing to the SEC — now totaling eight including its draft registration statements — the company has had to continuously explain and re-explain what exactly it is trying to do to prevent retail investors from controlling the company.

Little surprise then that its fifth amended S-1 filing, published this morning, shows even more disclosures about the pitifully small governance control that retail investors will have upon the company’s public market debut.

n a newly added line, the company admits that “holders of our Class A common stock [i.e. the stock that will trade on NYSE starting September 29th] will hold approximately 3.4% of the voting power of our outstanding capital stock.”

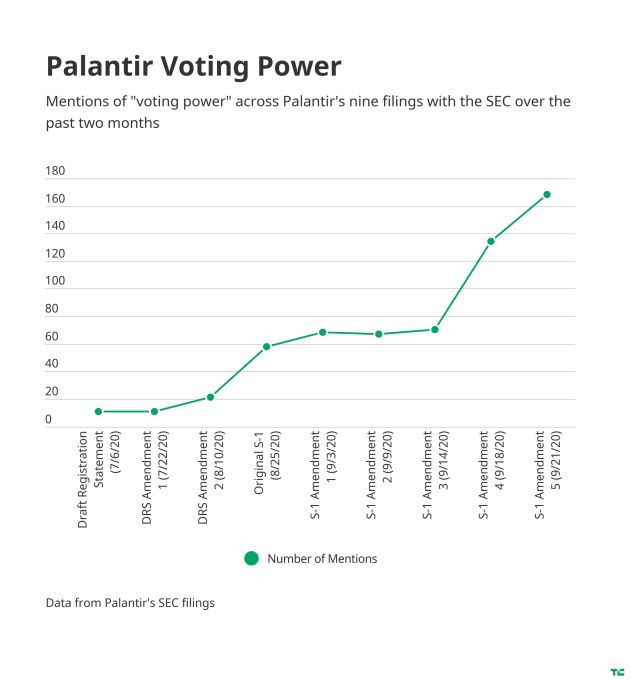

“Voting power” is clearly very important to regulators — the term is now used 168 times in Palantir’s latest amended S-1 filing, up from just 58 in its original filing just a few weeks ago. In fact, take a look at this amazing chart on just how much Palantir has had to explain voting power to regulators over the past few weeks in filing after filing:

Indeed, just to prove how much voting power retail investors are giving up, the company published another column to its infamous founder-ownership table that I discussed at length on Friday. As part of the three-class voting share structure Palantir is using, its founders will retain outsized voting control of the company through what are known as Class F or founders shares, so long as they meet a minimal ownership threshold.

How unbalanced can that voting be? In the most extreme scenario according to Palantir’s newly updated table, its founders could control 68.099999% of the company’s vote while owning just 0.5% of the company’s shares.

In addition, the company has also added a new risk factor reminding owners of the company’s stock that Palantir can issue new stock at any time, and those newly issued shares will dilute retail investors even further in their voting rights relative to founders, who are offered a variable number of votes to ensure they maintain control of the company.

It gets worse though. Palantir has been promulgating this arcane mechanism over the last few amendments to the SEC that would allow its three founders — Alex Karp, Stephen Cohen and Peter Thiel — to designate certain shares to be held outside of their “founder shares” and therefore increase their overall voting power. In its last amendment, the only founder to designate shares in this way was Peter Thiel, who designated a huge bulk of his shares (13.4% of Palantir) as excluded from the founders share calculation.

Now in its latest update, Palantir says that founders will be able to increase their votes essentially willy-nilly by designating any or all of their shares as “Stockholder Party Excluded Shares,” which will be voted separately from their founder shares. And the right to do this will last from the company’s public debut all the way to “in the future.” In short, Palantir’s founders will hold 49.999999% control through their founder shares, plus the votes of any excluded shares, to be determined at any time. As of today, no shares have been designated as excluded, according to the filing.

That leads to one of my new favorite admissions in this whole governance saga: Palantir won’t be able to tell anyone what their actual voting power is, even when they are just about to vote. From its newly amended filing:

In addition, it may be very difficult for our Class A common stockholders to determine from time to time, including in advance of a meeting of stockholders, their individual or aggregate voting power due to the unique features of our multi-class capital structure, such as the variable number of votes per share of our Class F common stock and the ability of our Founders who are then party to the Founder Voting Agreement to unilaterally adjust their total voting power, for example, by designating shares as Stockholder Party Excluded Shares, as described in more detail herein.

The complexity of Palantir’s three-class voting system means that no one basically knows what the hell is going on. “Unilaterally adjust their total voting power” is not a democracy, indeed.

There’s good news though! Palantir might actually add — I kid you not — another class of voting shares just to make all of this even more complicated!

In another new disclosure this morning, the company writes that “In addition, in the future we could create a new class of equity securities with different economic or voting rights than existing classes,” and explains how that could upend the voting for the company further.

I joked last week that “For a company vaunted for its clandestine government work and strong engineering culture, you can’t help but wonder if the government’s bureaucratic norms and paperwork pushing are starting to flood into the Shire.” Well, the complexity is only getting worse and worse, and it doesn’t look good.

Tech companies, even those publicly traded, aren’t democracies. The two-class voting system most tech companies offer their founders and early investors are not democratic — some people get one vote per share while others get 10 votes per share. But it has become a norm whether we like it or not, and it’s directionally helped tech companies avoid the sort of hostile investor scenarios that have plagued other companies in the market.

Now, Palantir is stretching these notions to the extreme, trying to present as a shareholder-centered corporation when it is — let’s just admit it — an oligarchy of three.

It’s a bit like reading the People’s Republic of China constitution and finding this section in Chapter 2: “All citizens of the People’s Republic of China are equal before the law. The State respects and preserves human rights. … Citizens of the People’s Republic of China enjoy freedom of speech, of the press, of assembly, of association, of procession and of demonstration.” And you are like, what?

Words don’t mean anything when the votes and the system aren’t there.

I aint touching this shyt, but I will watch.

I aint touching this shyt, but I will watch.