OfTheCross

Veteran

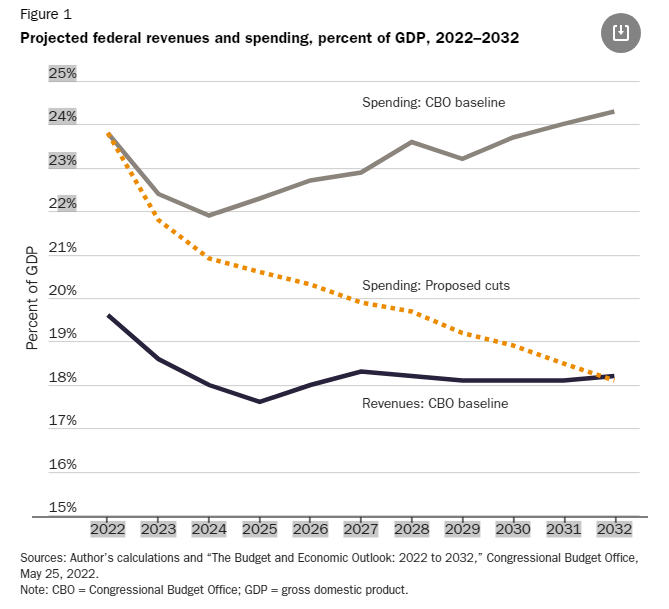

The figure shows projected spending under the reform plan proposed here. Under the plan, spending would decline from 23.8 percent of GDP in 2022 to 18.1 percent by 2032, which would balance the budget that year. Spending reductions would be phased in over 10 years and by 2032 would total $2.3 trillion annually, including reduced interest costs.

The CBO revenue baseline assumes that the individual tax cuts under the 2017 Tax Cuts and Jobs Act expire as scheduled after 2025. If Congress pursues spending reforms, it would create budget room to extend the 2017 tax cuts while still reducing deficits. Extending the tax cuts would also be an opportunity to simplify the tax code by eliminating special breaks and flattening the tax‐rate structure.

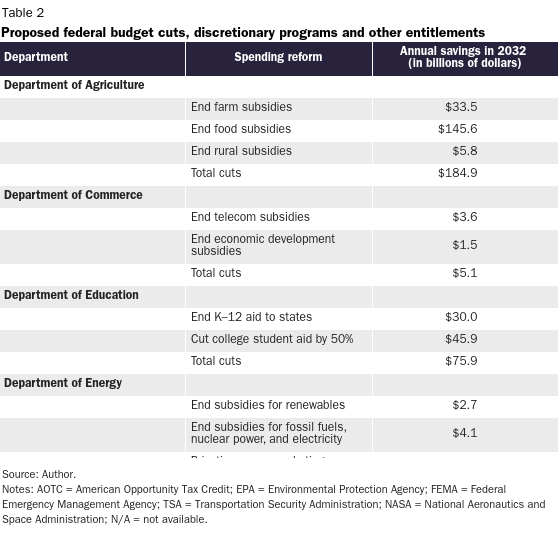

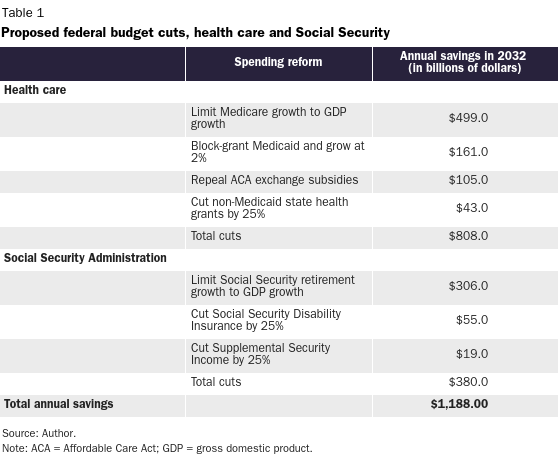

Table 1 shows proposed reforms to Social Security and health care programs, which would generate rising savings over time. The table shows the annual savings compared with the CBO baseline in 2032. Table 2 shows cuts to programs other than Social Security and health care. These cuts would total $611 billion annually, but the plan assumes that one‐tenth of the cuts would be phased in each year over the coming decade. Most values in Table 2 are estimated spending in 2022, but (where applicable) extra pandemic‐related spending was excluded so that the values better reflect typical spending levels.

These reforms are deeper than the savings from “duplication” and “waste” that policymakers often mention. We should cut hundreds of billions of dollars of “meat” from federal departments, not just the obvious “fat.” If the activities that are cut are useful to society, then state governments or private organizations should fund them. The following sections discuss subsidies, aid to the states, entitlement programs, privatization, and defense spending.

Subsidies to Individuals and Businesses

The federal government funds more than 2,300 subsidy programs, more than twice as many programs as in the 1980s. The scope of federal activities has expanded in recent decades along with the size of the federal budget. The federal government subsidizes farming, health care, school lunches, broadband, rural utilities, energy, rental housing, aviation, passenger rail, public broadcasting, job training, foreign aid, urban transit, space exploration, and many other activities.

Each subsidy damages the economy by requiring higher taxes or debt. Each subsidy generates a bureaucracy, spawns lobby groups, and encourages even more groups to demand handouts. Individuals, businesses, and nonprofit groups that become hooked on federal subsidies become tools of the state. They lose their independence, have less incentive to work and innovate, and shy away from criticizing the government.

Table 2 includes cuts to subsidies in agriculture, commerce, energy, foreign aid, housing, and other activities. These cuts would not eliminate all unjustified subsidies in the budget, but they would be a good start. Government subsidies are like an addictive drug, undermining America’s traditions of individual reliance, voluntary charity, and entrepreneurialism.

Aid to the States

Under the Constitution, the federal government was assigned specific limited powers, and most government functions were left to the states. Unfortunately, policymakers and the courts have mainly discarded constitutional federalism in recent decades. With “grants‐in‐aid” programs, Congress has pursued many activities that were traditionally reserved to state and local governments. Grant programs are subsidies that are combined with federal regulatory controls to micromanage state and local activities. Federal aid to the states was $721 billion in 2019 and was distributed through more than 1,300 separate programs. Congress boosted aid by hundreds of billions of dollars during the COVID-19 pandemic in 2020 and 2021.

The theory behind grants‐in‐aid is that the federal government can operate programs in the national interest to solve local problems efficiently. But the aid system does not work that way in practice. Policymakers usually focus on maximizing subsidies for their states, and they tend to ignore efficiency, program failures, and the need for spending tradeoffs in the overall budget.

Furthermore, federal aid stimulates overspending by state governments, and the regulations tied to aid programs raise state and local costs. Aid undermines government accountability because each level of government blames the other levels for program failures. And aid undermines democratic control because it transfers policy decisions from elected state and local officials to unelected officials in faraway Washington.

The grants‐in‐aid system serves no important economic purpose, and it should be phased out. The states should fund their own activities. Tables 1 and 2 include cuts to grants for education, health care, highways, housing, justice, transit, and other activities.

Medicare, Medicaid, and Social Security

The growth in major entitlement programs is the main cause of the government’s looming fiscal crisis. The actuaries of Social Security and Medicare estimate that promised but unfunded future benefits are $60 trillion and $103 trillion, respectively, in present value terms. Those costs dwarf the federal debt of $24 trillion. The only good news is that entitlement programs can be, and should be, cut to reduce future costs. Table 1 lists some proposed reforms.

Congress should limit annual spending growth in Medicare to nominal GDP growth. The table assumes that such a limit begins in 2024, which generates growing savings over time compared with the baseline. Reforms that would limit spending growth include raising the retirement age, increasing program deductibles and copays, increasing premiums for Part B, and cutting the program’s improper payment rate.

Congress should also consider major restructuring of Medicare. Cato scholars have proposed moving to a system based on individual vouchers, personal savings, and consumer choice for elderly health care, as discussed elsewhere in this Handbook. Such reforms would encourage patients to become more discriminating health care consumers and induce providers to improve quality and reduce costs.

Congress should convert Medicaid from an open‐ended matching grant to a block grant while giving the states more flexibility to control costs and tailor the program to local needs. That was the successful approach used for welfare reform in 1996. The plan here would cap the federal contribution to Medicaid at 2 percent annual growth. It would also phase in cuts of 25 percent to non‐Medicaid health grants to the states compared with baseline projections.

Congress should limit annual growth in Social Security retirement spending to nominal GDP growth. The table assumes such a limit begins in 2024, which generates growing savings over time. Some reforms that would limit spending growth include raising the normal retirement age and indexing initial benefits to prices rather than wages. The plan would also phase in cuts of 25 percent to the fraud‐plagued Social Security Disability Insurance and Supplemental Security Income programs.

Over the longer term, Congress should transition Social Security retirement to a system based on private accounts, as discussed elsewhere in this Handbook. Private accounts would increase personal financial security and improve work incentives by converting payroll taxes to account contributions that are personally owned.

Defense Spending

Under the CBO baseline, national defense spending is projected to fall from 3.1 percent of GDP in 2022 to 2.7 percent by 2032. That would be the lowest level of defense spending relative to GDP since before World War II. Elsewhere in this Handbook, Cato’s defense and foreign policy experts describe a general policy of restraint and discuss numerous strategies to reduce defense costs.