Draft budget signals new direction for Trinidad and Tobago

Trinidad & TobagoEconomy

Economic News Update

16 Oct 2015

Presented by the new government of Trinidad and Tobago on October 5, the draft budget signals an early attempt on the part of the administration to tackle the country’s changing fiscal balance.

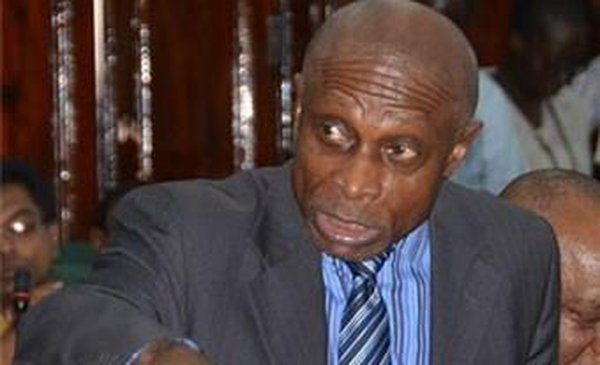

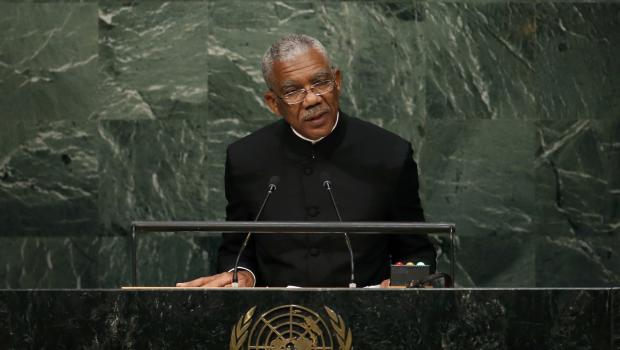

Generating additional tax revenue, reining in public spending and reducing the national deficit were the prevailing themes of the proposed budget, which came just weeks after Prime Minister Keith Rowley and the Peoples’ National Movement (PNM) came to power.

While the proposed budget has been broadly welcomed by the business community, some analysts question whether T&T’s non-oil sector can realistically generate the higher tax revenues demanded by the budget.

Addressing the deficit

With T&T’s 2015/16 fiscal year beginning on October 1, just weeks after the September 7 elections, the government had little time to prepare the preliminary budget, which still requires parliamentary approval.

The draft budget acknowledges the need to curb government outlays in the face of lower oil and gas prices. Spending is set to increase by 2% year-on-year (y-o-y) to TT$63bn ($9.9bn), while capital expenditure in particular will be scaled back.

Despite a forecast 72% drop in hydrocarbons receipts, based on an oil price of $45 per barrel, the government expects total fiscal revenue to rise by 10% to reach TT$60.3bn ($9.5bn), which, along with spending cuts, could help reduce the deficit. The budget anticipates a much lower fiscal deficit, down 60% y-o-y to TT$2.8bn ($441m), which amounts to 1.7% of GDP, compared to 4.2% last year.

Restoring confidence

The draft budget has been widely welcomed as a starting point for rebuilding business confidence in the country, with RBC Caribbean calling the budget “an important step in the right direction” in a recent research note.

Angela Lee Loy, chairman of consultancy Aegis Business Solutions, highlighted the paradigm shift underscored by the new spending approach. “Compared to the budgets of years gone by, this [one] has only a small percentage of revenue attributable to oil,” she said. “This may very well be ushering an era in T&T where oil dependency cannot be taken for granted.”

To help make up the hydrocarbons shortfall, Colm Imbert, minister of finance, announced a range of tax changes aimed at boosting revenue from the non-oil economy.

The measures include the creation of a new Revenue Authority by the end of the fiscal year, which is designed to improve tax collection, as well as a value-added tax cut, from 15% to 12.5%, and the reintroduction of a property tax as of January 1, 2016. Taken together, these are expected generate around TT$13.2bn ($2.1bn) in additional revenue, according to the budget, TT$8bn ($1.3bn) of which will stem from the Revenue Authority.

Importantly, the budget also proposes reducing fuel subsidies. Diesel and super gasoline prices have been increased by 15%, saving an estimated TT$340m ($53.5m), though the government is still expected to pay out around TT$1bn ($158.1m) in fuel subsidies in 2016.

In addition, the government plans to raise TT$13.4bn ($2.1bn) worth of capital revenue through a campaign of initial public offerings, divestment and extraordinary dividends.

Positive reception

The initial private sector response to the draft budget has been favourable, with some measures, such as the reduction in fuel subsidies, previously called for by business lobbies.

Businesses have also lauded the government’s plans to revert to the market-based pre- 2014 system for allocating foreign currency to private companies. The private sector had complained of delays and shortages in meeting their foreign currency needs under the previous administration, despite US dollar reserves being in plentiful supply.

Many believe this change in policy could spark a depreciation of the Trinidad dollar against the greenback, which could provide a welcome boost to both export competitiveness and tourism.

High hopes

However, economists have raised doubts about T&T’s ability to reach the tax revenue targets laid out in the budget.

Speaking at a forum hosted by the American Chamber of Commerce of T&T, Marla Dukharan, group economist for RBC Caribbean, admitted she was “uncomfortable” with the budget’s forecasts for non-oil revenue, as “the non-energy sector is driven mainly by fiscal spending, and fiscal spending comes from partly the energy sector.” According to Dukharan, weak GDP growth further undermines such targets, with the economy contracting by 2% in the first half of the year.

Indera Sagewan-Alli, a fellow economist, expressed similar concern. “If you have a decline in the economy, one where your productive sector is not generating revenue, from where are you going to collect the increase in revenue?” she asked.

Nonetheless, the consensus remained that the budget reaffirms the need for a serious and sustainable economic diversification strategy designed to engage the private sector and boost non-oil activity. The feasibility of the new targets could become clearer after the mid-year review of the budget in March, at which point further fiscal adjustment could be made, according to Imbert.

Oxford Business Group is now on Instagram. Follow us here for news and stunning imagery from the more than 30 markets we cover.

See also: GDP, American Chamber of Commerce

Draft budget signals new direction for Trinidad and Tobago

Trinidad & TobagoEconomy

Economic News Update

16 Oct 2015

Presented by the new government of Trinidad and Tobago on October 5, the draft budget signals an early attempt on the part of the administration to tackle the country’s changing fiscal balance.

Generating additional tax revenue, reining in public spending and reducing the national deficit were the prevailing themes of the proposed budget, which came just weeks after Prime Minister Keith Rowley and the Peoples’ National Movement (PNM) came to power.

While the proposed budget has been broadly welcomed by the business community, some analysts question whether T&T’s non-oil sector can realistically generate the higher tax revenues demanded by the budget.

Addressing the deficit

With T&T’s 2015/16 fiscal year beginning on October 1, just weeks after the September 7 elections, the government had little time to prepare the preliminary budget, which still requires parliamentary approval.

The draft budget acknowledges the need to curb government outlays in the face of lower oil and gas prices. Spending is set to increase by 2% year-on-year (y-o-y) to TT$63bn ($9.9bn), while capital expenditure in particular will be scaled back.

Despite a forecast 72% drop in hydrocarbons receipts, based on an oil price of $45 per barrel, the government expects total fiscal revenue to rise by 10% to reach TT$60.3bn ($9.5bn), which, along with spending cuts, could help reduce the deficit. The budget anticipates a much lower fiscal deficit, down 60% y-o-y to TT$2.8bn ($441m), which amounts to 1.7% of GDP, compared to 4.2% last year.

Restoring confidence

The draft budget has been widely welcomed as a starting point for rebuilding business confidence in the country, with RBC Caribbean calling the budget “an important step in the right direction” in a recent research note.

Angela Lee Loy, chairman of consultancy Aegis Business Solutions, highlighted the paradigm shift underscored by the new spending approach. “Compared to the budgets of years gone by, this [one] has only a small percentage of revenue attributable to oil,” she said. “This may very well be ushering an era in T&T where oil dependency cannot be taken for granted.”

To help make up the hydrocarbons shortfall, Colm Imbert, minister of finance, announced a range of tax changes aimed at boosting revenue from the non-oil economy.

The measures include the creation of a new Revenue Authority by the end of the fiscal year, which is designed to improve tax collection, as well as a value-added tax cut, from 15% to 12.5%, and the reintroduction of a property tax as of January 1, 2016. Taken together, these are expected generate around TT$13.2bn ($2.1bn) in additional revenue, according to the budget, TT$8bn ($1.3bn) of which will stem from the Revenue Authority.

Importantly, the budget also proposes reducing fuel subsidies. Diesel and super gasoline prices have been increased by 15%, saving an estimated TT$340m ($53.5m), though the government is still expected to pay out around TT$1bn ($158.1m) in fuel subsidies in 2016.

In addition, the government plans to raise TT$13.4bn ($2.1bn) worth of capital revenue through a campaign of initial public offerings, divestment and extraordinary dividends.

Positive reception

The initial private sector response to the draft budget has been favourable, with some measures, such as the reduction in fuel subsidies, previously called for by business lobbies.

Businesses have also lauded the government’s plans to revert to the market-based pre- 2014 system for allocating foreign currency to private companies. The private sector had complained of delays and shortages in meeting their foreign currency needs under the previous administration, despite US dollar reserves being in plentiful supply.

Many believe this change in policy could spark a depreciation of the Trinidad dollar against the greenback, which could provide a welcome boost to both export competitiveness and tourism.

High hopes

However, economists have raised doubts about T&T’s ability to reach the tax revenue targets laid out in the budget.

Speaking at a forum hosted by the American Chamber of Commerce of T&T, Marla Dukharan, group economist for RBC Caribbean, admitted she was “uncomfortable” with the budget’s forecasts for non-oil revenue, as “the non-energy sector is driven mainly by fiscal spending, and fiscal spending comes from partly the energy sector.” According to Dukharan, weak GDP growth further undermines such targets, with the economy contracting by 2% in the first half of the year.

Indera Sagewan-Alli, a fellow economist, expressed similar concern. “If you have a decline in the economy, one where your productive sector is not generating revenue, from where are you going to collect the increase in revenue?” she asked.

Nonetheless, the consensus remained that the budget reaffirms the need for a serious and sustainable economic diversification strategy designed to engage the private sector and boost non-oil activity. The feasibility of the new targets could become clearer after the mid-year review of the budget in March, at which point further fiscal adjustment could be made, according to Imbert.

Oxford Business Group is now on Instagram. Follow us here for news and stunning imagery from the more than 30 markets we cover.

See also: GDP, American Chamber of Commerce

Draft budget signals new direction for Trinidad and Tobago