Been staking ada on daedelus. Got a decent return of about 287 ada after a few months. Plan to have at least 10k ada, hopefully when it's like 5$ in the future I can have 100-200$ worth in returns in a monthFor those of you that stake, what have you been doing with your staking rewards? Have you just been keeping them, turning them into BTC, buying other alts, or selling into USD/USDT?

I've mostly held mine, but I think I want to sell portions to go into other projects or have some USDT/USD available for dips. That's the toughest part for me, seeing if I want to continue to hold when so heavily in one coin, or sell here and there.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

1 BTC = $8.2k, it’s up 735% this yr UPDATE 5/19: BTC @ $42k :damn:

- Thread starter JordanWearinThe45

- Start date

More options

Who Replied?so purchases and conversions are taxed? not just sales to dollar?

Yes.

Any conversation, which is stupid, and a main reason I don't trade.

It's how some people in 2017 and 2018 owed more than they made.

-Bought $50,000 BTC.

-Went up to $200,000 worth.

-Sold all for an alt coin.

-Alt coin lost 95% of value.

-Person is required to pay say 20% of the $150,000 gains, but now their alts are say $10,000. You're down $20,000 just in taxes.

This isn't an exact example, but it's pretty much what was happening to some people.

For those of you that stake, what have you been doing with your staking rewards? Have you just been keeping them, turning them into BTC, buying other alts, or selling into USD/USDT?

I've mostly held mine, but I think I want to sell portions to go into other projects or have some USDT/USD available for dips. That's the toughest part for me, seeing if I want to continue to hold when so heavily in one coin, or sell here and there.

I compound any staking and add it to my stack. Then keep staking the gains to add more. Thats mostly with ATOM and my GRT staking I don't really bother looking at the site too often cuz it just works itself.

As far as taxes go, a good idea would be to transfer some of the gains to an IRA or roth or something like that. Think its 6k per year, not sure if thats per person or account like you can have multiple roths. I assume its per person so I'll go with that when the time comes. Thats tax deductible money so putting some into a retirement account can help lower income and taxes.

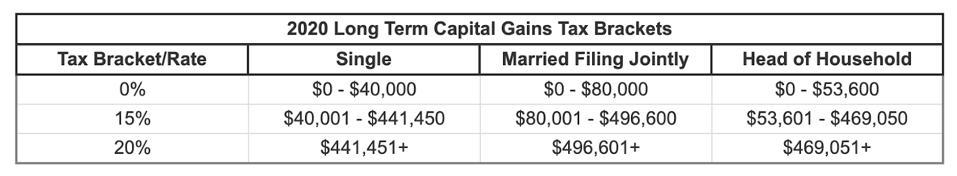

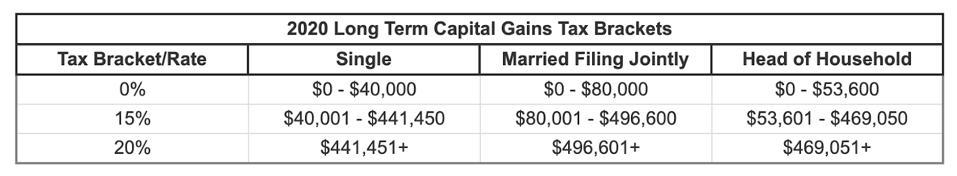

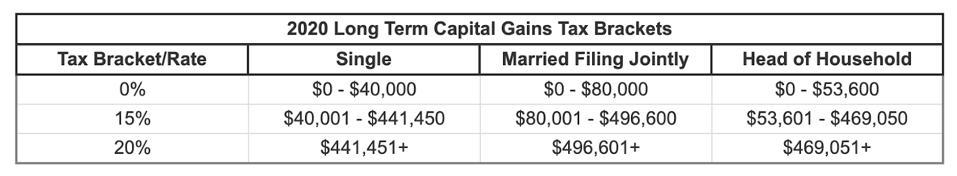

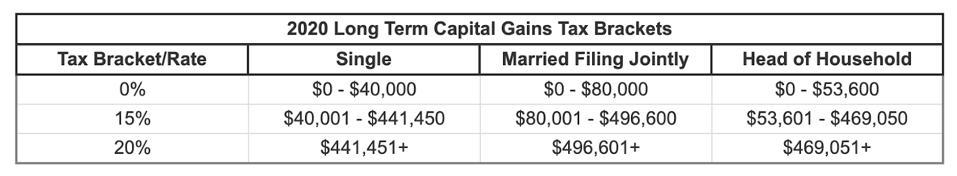

Found this article just now that looks to have great info with these two interesting charts depending on income level. Don't know if things will change year to year but I doubt they will be able to.

What’s Your Tax Rate For Crypto Capital Gains?

Means that if you got paper hands, you gonna pay for it more when the taxman comes around.

Also what I'm thinking is leaving my shyt in stable coins and investments and transferring to fiat as need be. No need to withdraw 100k when you only gonna need 10k. That way it further extends the length of time you withdraw and if you take out lets say 20k in december and then 20k in january you only pay taxes for the december one that year instead of taking out 40k in december. I'm sure there are some tricks to this tax game, will have to research more when the time comes.

I compound any staking and add it to my stack. Then keep staking the gains to add more. Thats mostly with ATOM and my GRT staking I don't really bother looking at the site too often cuz it just works itself.

As far as taxes go, a good idea would be to transfer some of the gains to an IRA or roth or something like that. Think its 6k per year, not sure if thats per person or account like you can have multiple roths. I assume its per person so I'll go with that when the time comes. Thats tax deductible money so putting some into a retirement account can help lower income and taxes.

Found this article just now that looks to have great info with these two interesting charts depending on income level. Don't know if things will change year to year but I doubt they will be able to.

What’s Your Tax Rate For Crypto Capital Gains?

Means that if you got paper hands, you gonna pay for it more when the taxman comes around.

An Ira is 6k per person per year if under 50 and 7k per person per year over 50k.

But the ira is post tax so you get no tax shelter on what you made that year. Its only non taxable when you pull out at 59 (the gains that is).

But good info on the capital gains chart.

Also what I'm thinking is leaving my shyt in stable coins and investments and transferring to fiat as need be. No need to withdraw 100k when you only gonna need 10k. That way it further extends the length of time you withdraw and if you take out lets say 20k in december and then 20k in january you only pay taxes for the december one that year instead of taking out 40k in december. I'm sure there are some tricks to this tax game, will have to research more when the time comes.

Yep this is very true. This is what I do with my brokerage account.

Yes.

Any conversation, which is stupid, and a main reason I don't trade.

It's how some people in 2017 and 2018 owed more than they made.

-Bought $50,000 BTC.

-Went up to $200,000 worth.

-Sold all for an alt coin.

-Alt coin lost 95% of value.

-Person is required to pay say 20% of the $150,000 gains, but now their alts are say $10,000. You're down $20,000 just in taxes.

This isn't an exact example, but it's pretty much what was happening to some people.

uncle sam happy enough assaulting peoples wallets with this setup to not outlaw crypto

uncle sam happy enough assaulting peoples wallets with this setup to not outlaw cryptoI compound any staking and add it to my stack. Then keep staking the gains to add more. Thats mostly with ATOM and my GRT staking I don't really bother looking at the site too often cuz it just works itself.

As far as taxes go, a good idea would be to transfer some of the gains to an IRA or roth or something like that. Think its 6k per year, not sure if thats per person or account like you can have multiple roths. I assume its per person so I'll go with that when the time comes. Thats tax deductible money so putting some into a retirement account can help lower income and taxes.

Found this article just now that looks to have great info with these two interesting charts depending on income level. Don't know if things will change year to year but I doubt they will be able to.

What’s Your Tax Rate For Crypto Capital Gains?

Means that if you got paper hands, you gonna pay for it more when the taxman comes around.

Important info here. Utilize your IRA and if you have one 401k or 403b to reduce your taxable income.HSA as wellAn Ira is 6k per person per year if under 50 and 7k per person per year over 50k.

But the ira is post tax so you get no tax shelter on what you made that year. Its only non taxable when you pull out at 59 (the gains that is).

But good info on the capital gains chart.

funkee

All Star

Yes.

Any conversation, which is stupid, and a main reason I don't trade.

It's how some people in 2017 and 2018 owed more than they made.

-Bought $50,000 BTC.

-Went up to $200,000 worth.

-Sold all for an alt coin.

-Alt coin lost 95% of value.

-Person is required to pay say 20% of the $150,000 gains, but now their alts are say $10,000. You're down $20,000 just in taxes.

This isn't an exact example, but it's pretty much what was happening to some people.

yea they need to fix this shyt b/c it's raping people. w/ traditional stocks, at least you can write off losses and in the example you gave, the person wouldn't owe anything.

funkee

All Star

I compound any staking and add it to my stack. Then keep staking the gains to add more. Thats mostly with ATOM and my GRT staking I don't really bother looking at the site too often cuz it just works itself.

As far as taxes go, a good idea would be to transfer some of the gains to an IRA or roth or something like that. Think its 6k per year, not sure if thats per person or account like you can have multiple roths. I assume its per person so I'll go with that when the time comes. Thats tax deductible money so putting some into a retirement account can help lower income and taxes.

Found this article just now that looks to have great info with these two interesting charts depending on income level. Don't know if things will change year to year but I doubt they will be able to.

What’s Your Tax Rate For Crypto Capital Gains?

Means that if you got paper hands, you gonna pay for it more when the taxman comes around.

these charts are exactly why i'm learning to buy and hold/stack instead of trading in and out of positions. eventually, damn near every stock/coin goes up. find a good one and just constantly add to it. ETH, BTC, LINK, etc. if it's a BS coin/pump then get out and apply it back to your base coins, don't chase other BS pumps often and then risk losing your gains.

Sold all my bitcoin

Buying ETH, XRP, VET and BCH

If you sold into stable coins that’s a taxable transactionAlso what I'm thinking is leaving my shyt in stable coins and investments and transferring to fiat as need be. No need to withdraw 100k when you only gonna need 10k. That way it further extends the length of time you withdraw and if you take out lets say 20k in december and then 20k in january you only pay taxes for the december one that year instead of taking out 40k in december. I'm sure there are some tricks to this tax game, will have to research more when the time comes.

so legally you would have to pay tax on the whole 100k

Sold all my bitcoin

Buying ETH, XRP, VET and BCH

So can most coins be cashed out for cash now? Because years ago you could pretty much only cash with Eth and BTC. Because if you have to trade from an ALT to another coin to cash out then the IRS is double dipping and they really should only tax you once you cash out.