Most people live in Metro Areas...that's where jobs are...

If foreign rich people are buying up shyt...and the real estate market is catering to these people because they got money...that means the average aspiring middle class citizen cannot buy a home and afford to live there.

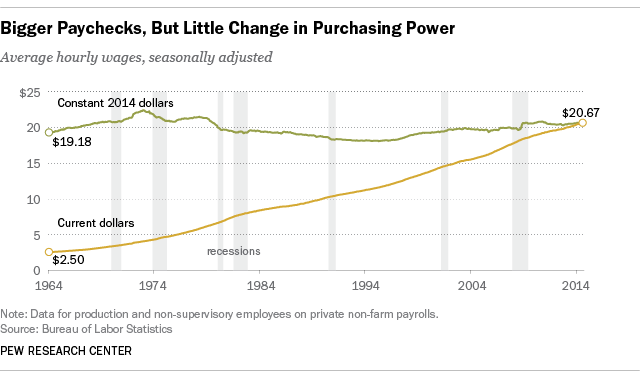

The wage graph is about average wages for employees that are in production and non-supervisor roles...meaning non-executives and factory employees...

It literally says it right here from the same link...

According to the BLS, the average hourly wage for non-management private-sector workers last month was $20.67, unchanged from August and 2.3% above the average wage a year earlier. That’s not much, especially when compared with the pre-Great Recession years of 2006 and 2007, when the average hourly wage often increased by around 4% year-over-year. (During the high-inflation years of the 1970s and early 1980s, average wages commonly jumped 8%, 9% or even more year-over-year.)

But after adjusting for inflation, today’s average hourly wage has just about the same purchasing power as it did in 1979, following a long slide in the 1980s and early 1990s and bumpy, inconsistent growth since then. In fact, in real terms the average wage peaked more than 40 years ago: The $4.03-an-hour rate recorded in January 1973 has the same purchasing power as $22.41 would today.

----

And automation is part of capitalists replacing employees because they don't wanna pay labor...

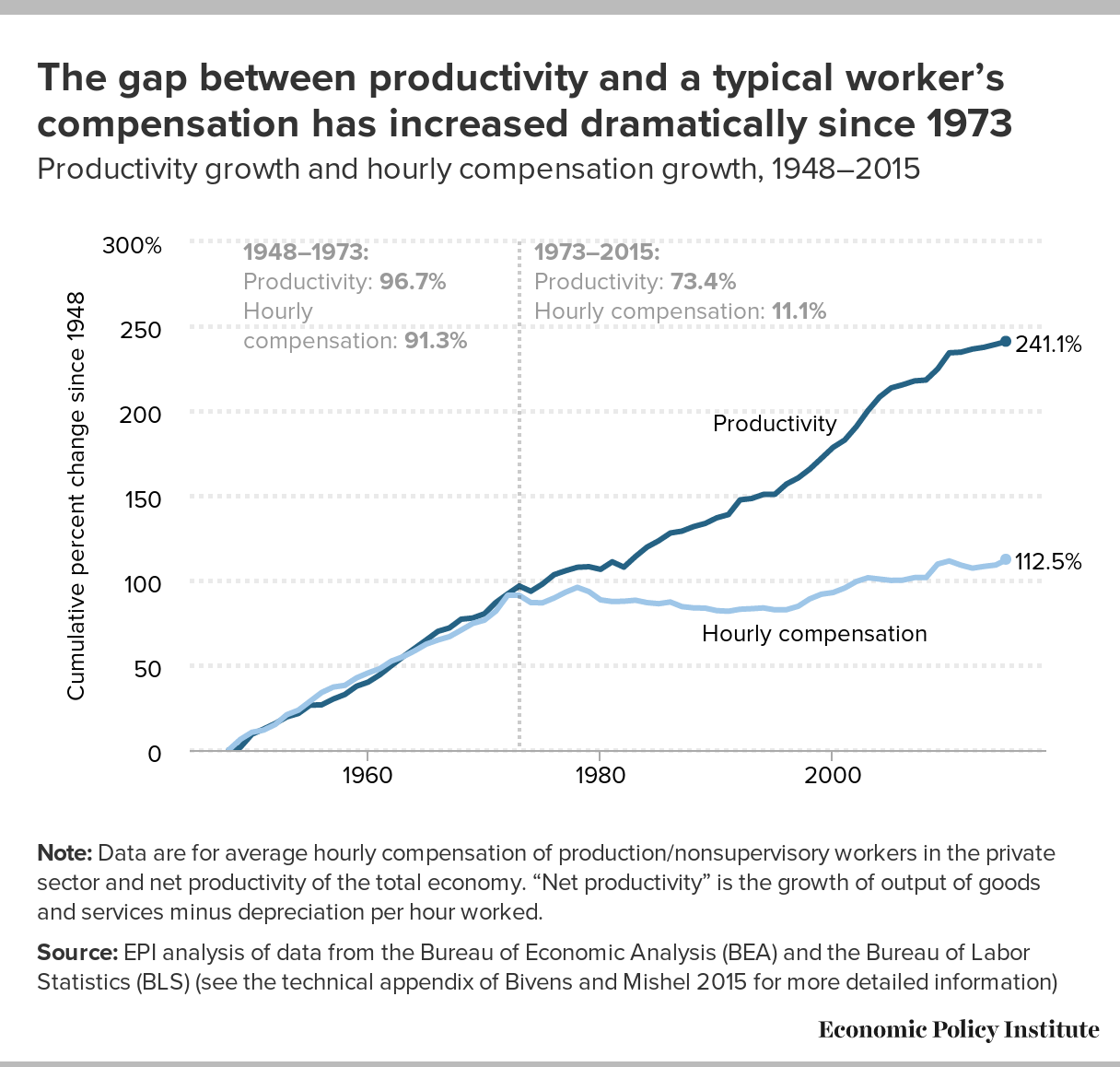

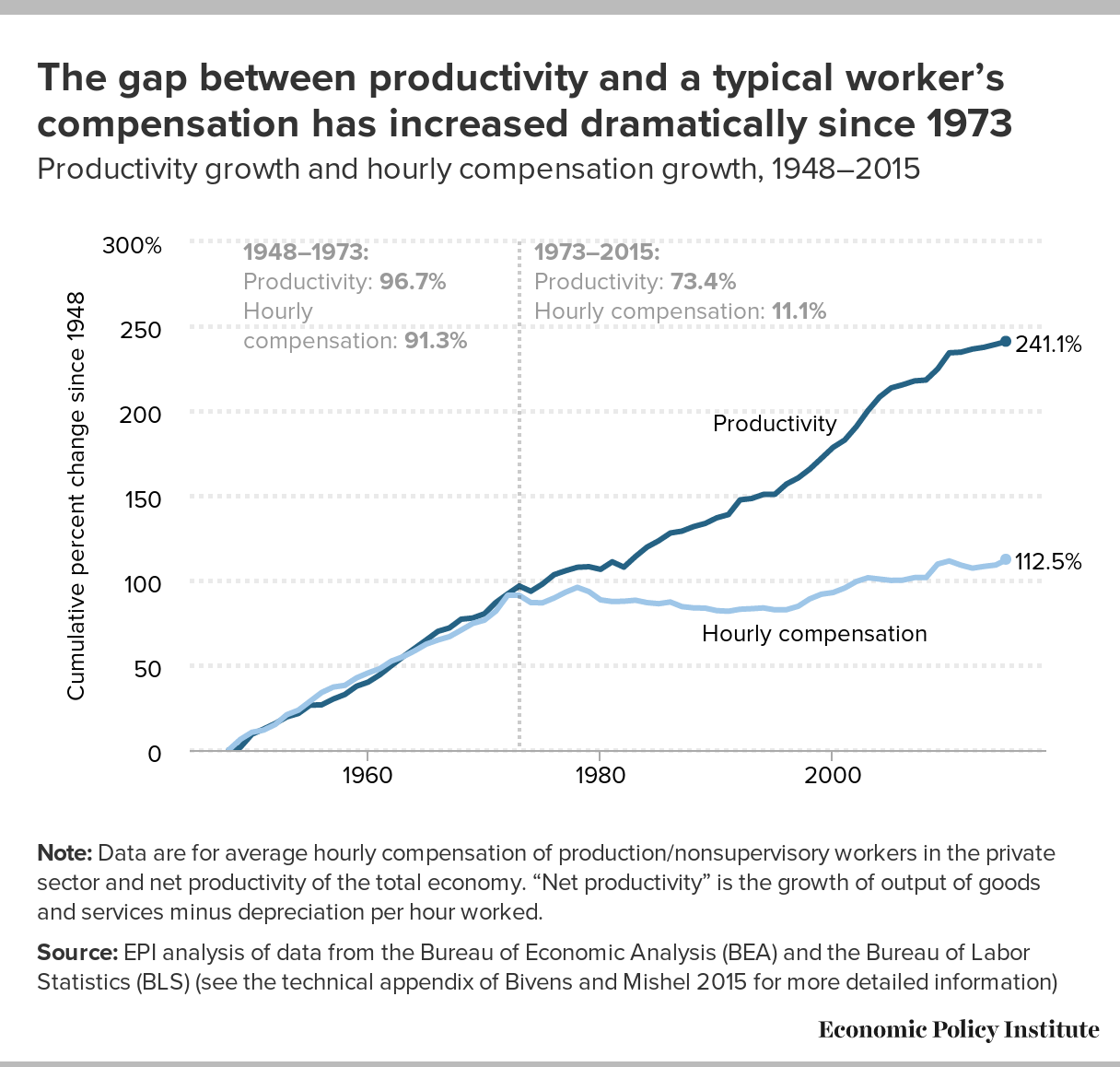

The reason why wealthy inequality has rapidly increased is because capitalists don't pay labor according to productivity

The Productivity–Pay Gap

From 1973 to 2015, net productivity rose 73.4 percent, while the hourly pay of typical workers essentially stagnated—increasing only 11.1 percent over 42 years (after adjusting for inflation). This means that although Americans are working more productively than ever, the fruits of their labors have primarily accrued to those at the top and to corporate profits, especially in recent years.

Rising productivity provides the potential for substantial growth in the pay for the vast majority. However, this potential has been squandered in recent decades. The income, wages, and wealth generated over the last four decades have failed to “trickle down” to the vast majority largely because policy choices made on behalf of those with the most income, wealth, and power have exacerbated inequality. In essence, rising inequality has prevented potential pay growth from translating into actual pay growth for most workers. The result has been wage stagnation.

For future productivity gains to lead to robust wage growth and widely shared prosperity, we need to institute policies that reconnect pay and productivity, such as those in EPI’s Agenda to Raise America’s Pay. Without such policies, efforts to spur economic growth or increase productivity (the largest factor driving growth) will fail to lift typical workers’ wages.

----------

So the wages/salary increases are going to executives...

What gains have been made, have gone to the upper income brackets. Since 2000, usual weekly wages have fallen 3.7% (in real terms) among workers in the lowest tenth of the earnings distribution, and 3% among the lowest quarter. But among people near the top of the distribution, real wages have risen 9.7%.

-------

And how does it automation nothing to do with a recession when people won't have jobs and people with jobs ain't being paid according to how productive they are...and can't afford to live where jobs are because the people that greatly benefited from jobs being shipped overseas are buying up property in the metro areas in the nations where the jobs left...

Bruh...that's a recession/depression...