ReasonableMatic

................................

Hedge funds are facing Lehman-style margin calls as a market crash triggered by President Donald Trump's tariffs raises fears of a looming 'Black Monday.'

The market's sharp downturn has forced hedge funds to sell off assets, with major Wall Street banks demanding collateral after the value of holdings sharply declined, according to sources familiar with the situation.

Many now fear a repeat of the devastating 'Black Monday' from October 19, 1987, when the Dow Jones Industrial Average plummeted by 22.6 percent, the largest one-day percentage drop in history.

It comes as a 10 percent global 'baseline' tariff came into place late last night, hitting all US imports except goods from Mexico and Canada. Come April 9, around 60 trading partners - including the European Union, Japan and China - are set to face even higher rates tailored to each economy.

Following Trump's tariff chaos, several major banks issued the largest margin calls to their clients since the onset of the COVID-19 pandemic in early 2020.

The scale of the calls - across multiple sectors including tech and consumer stocks - has sparked concern that the steep sell-off will continue into Monday.

When margin calls are issued, they can create a vicious feedback loop as selling stocks to meet the call can push prices down more.

Gold fell more than 3 percent Friday, erasing gains from earlier in the week, as investors were forced to shed bullion to cover their losses.

Traders work on the floor of the New York Stock Exchange (NYSE) at the opening bell in New York City, on April 3, 2025

Pictured: President Donald Trump holds up a chart while speaking during a 'Make America Wealthy Again' trade announcement event in the White House on April 2, 2025

'Rates, equities, and oil were all down significantly… it was the broad market movements that caused the scale of the margin calls,' one prime brokerage executive told the Financial Times.

While, another prime brokerage executive noted: 'We are proactively reaching out to clients to assess [risk] across their entire portfolios.'

Prime brokerage teams on Wall Street, which lend money to hedge funds, held 'all hands on deck' meetings on Friday to prepare for the increasing volume of margin calls, sources told the Financial Times.

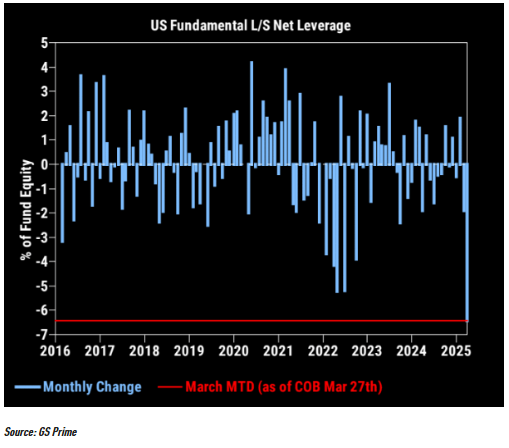

Thursday marked the worst performance for US-based long/short equity funds since tracking began in 2016, with the average fund suffering a 2.6 percent loss, according to a new report from Morgan Stanley's prime brokerage division.

The magnitude of the selling across equities on Thursday was in line with the largest on record.

The report also pointed to equity positions resembling those seen during the US regional bank crisis in 2023 and the COVID-19 market sell-off in 2020.

The broader market downturn, particularly in technology and high-end consumer goods sectors, has worsened the situation.

The heavy selling led US long/short equity fund net leverage - how much hedge funds borrow to magnify their investments - to drop to an 18-month low of about 42 percent, Morgan Stanley reported.

However, experts believe the damage could have been worse if hedge funds hadn't already started scaling back stock positions and cutting leverage in response to the ongoing trade war threats from the Trump administration.

In another indication of stress within the hedge fund sector, gold - the precious metal typically seen as a safe haven for investors - fell 2.9 percent on Friday, despite the pervasive market pessimism.

Now, Trump's 'baseline' tariff which came into place past midnight invoked emergency economic powers to address perceived problems with the country's trade deficits.

The trade gaps, said the White House, were driven by an 'absence of reciprocity' in relationships and other policies like 'exorbitant value-added taxes.'

Come April 9, around 60 trading partners - including the European Union, Japan and China - are set to face even higher rates tailored to each economy.

Hedge funds hit by Lehman-style MARGIN CALLS sparking doom loop fears

President Trump's widest-ranging tariffs to date took effect on Saturday, as hedge funds continue to grapple with massive margin calls.

Just imagine the BLOODBATH on Monday

Last edited: