The US promised to return stolen lands to Native Hawaiians a century ago. Most are still waiting

The Maui wildfires illuminated the ongoing failures of the Hawaiian Homes Commission Act

The US promised to return stolen lands to Native Hawaiians a century ago. Most are still waiting

The Maui wildfires illuminated the ongoing failures of the Hawaiian Homes Commission Act

Claire Wang in Lahaina

Fri 22 Dec 2023 09.00 EST

A sign at the entrance of Lahaina, Maui, on 29 October 2023. Photograph: Akasha Rabut/The Guardian

On a one-acre farm at the foot of Maui’s dormant Haleakalā volcano, Kekoa Enomoto grows dragonfruit, pineapples, yuzu, avocado, kabocha squash and chilli peppers. She tends to a laying chicken, two honeybee hives and an aquaponics system that spawns Mexican oregano, lemongrass and tilapia.

As a beneficiary of the Hawaiian Homes Commission Act, a century-old program to return Native Hawaiians to their ancestral lands, Enomoto, 77, pays just $600 a month in mortgage fees for the farm and three-bedroom house where she’s lived for the past two decades. The average mortgage payment in Hawaii exceeds $2,500, the second-highest among all US states.

“I am an example of what can happen and what should happen,” said Enomoto, who is of Native Hawaiian and Filipino descent.

Yet her experience cultivating, raising a family and growing old on land that is her birthright has been far from the norm for Native Hawaiians, who experience the highest rate of homelessness in one of the most expensive places on the planet. Despite accounting for only 20% of the state’s overall population, Native Hawaiians make up 50% of the unhoused population.

The August wildfires that devastated Lahaina, killing 100 people and displacing more than 10,000, have exposed the island’s escalating housing shortage. For Native Hawaiians – the Kānaka Maoli – who have borne the brunt of this crisis, the tragedy also highlighted failures of the Hawaiian Homes Commission Act, whose promise many say is going unfulfilled.

The department of Hawaiian home lands (DHHL), the state agency charged with distributing homesteads, has awarded lots to 10,000 beneficiaries. But nearly 29,000 people remain on the waitlist, and more than 2,000 have died waiting, according to an investigation by the Honolulu Star-Advertiser and ProPublica.

“The state has failed miserably as a trustee for these Native Hawaiian beneficiaries,” said Carl Varady, a Honolulu-based attorney who represented homesteaders in a landmark case against the state.

Wilted palm trees line a destroyed property on 8 December 2023 in Lahaina. Photograph: Lindsey Wasson/AP

How homesteaders like Enomoto live today is much like how Native Hawaiians did for more than a millennium, before Christian missionaries, traders and whalers arrived on the islands in the 19th century. Like other Indigenous peoples in the US, the Kānaka Maoli lived sustainably and took only what they needed from the land, growing kalo and breadfruit to feed entire villages. In 1893, when American colonists overthrew the Hawaiian monarchy to control the islands’ sugar-based economy, Native Hawaiians disenfranchised from their lands were forced into crowded urban tenements where diseases such as cholera and tuberculosis spread rapidly.

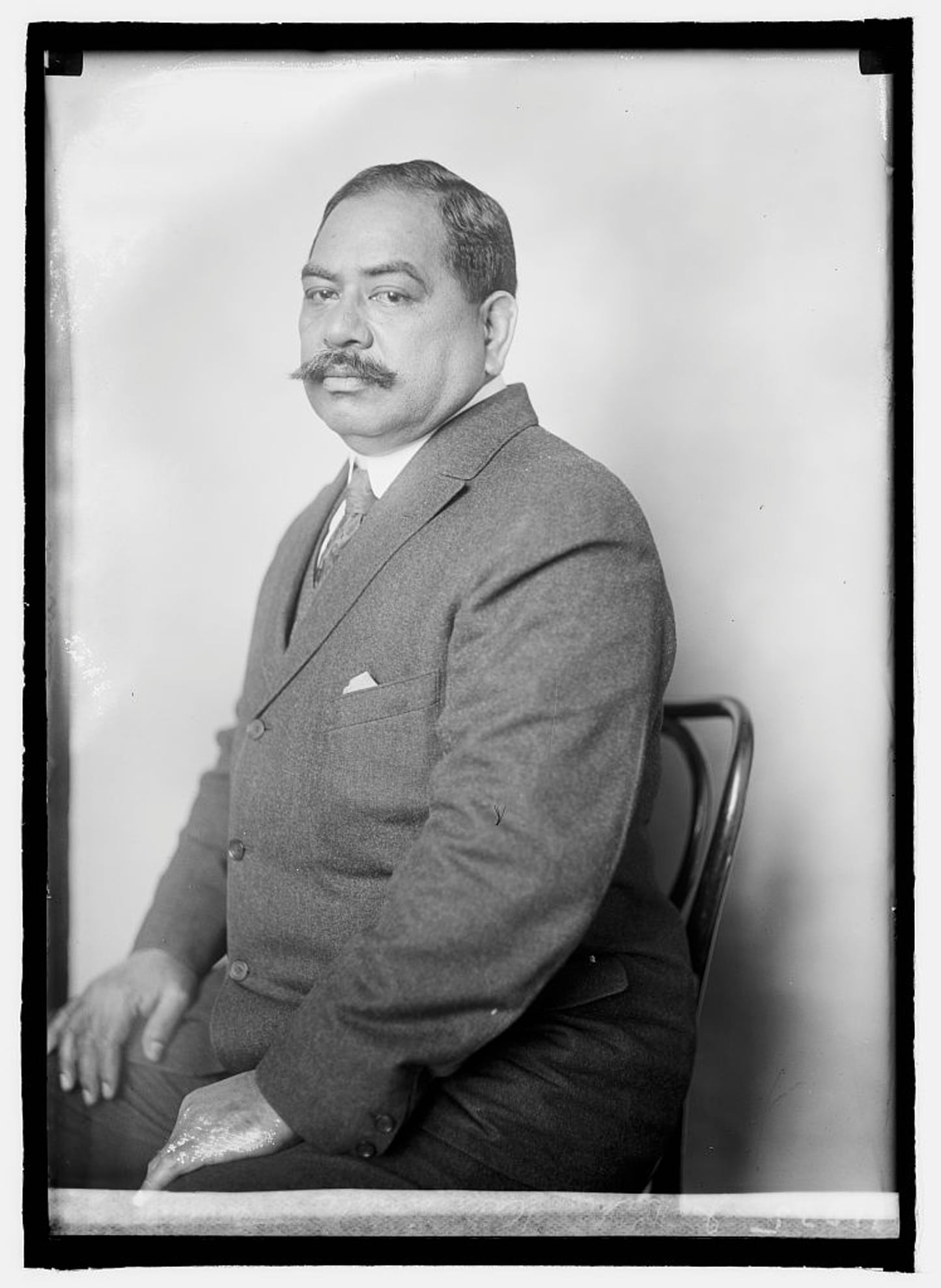

The Native Hawaiian population plunged from hundreds of thousands in the late 18th century, before western contact, to fewer than 24,000 by 1920. Prince Jonah Kūhiō Kalanianaʻole, a territorial delegate to the US Congress, proposed a homesteads program to rehabilitate the Native Hawaiian population through land ownership. In 1921, Congress passed the Hawaiian Homes Commission Act, which placed 200,000 acres of land that belonged to the Hawaiian Kingdom into a trust. Anyone 18 years or older with at least 50% Native Hawaiian lineage would be eligible to obtain a 99-year land lease for $1 a year. (The leases, which are still available, can be extended by another 100 years.)

Prince Jonah Kūhiō Kalanianaʻole. Photograph: Library of Congress

“It’s really important, not just for our generation, but the generations after us so that we don’t lose our culture and our values and what it’s like to be Kānaka,” said Sherry Kupua, who owns a four-bedroom homestead property in central Maui.

Kupua and her husband, both born and raised in Maui, spent most of their adult lives working two jobs each to keep up with rising rent and the costs of raising seven children. In 2017, they bought a homestead for less than $250,000, a fraction of Maui’s median home price, which now exceeds $1.2m.

Since becoming a homeowner, Kupua, 45, has earned a master’s in social work and secured a job as the chief programs director at Family Life Center, a homeless services organization. Her husband is now running his own waste-management business. “That’s the success of having your own home, investing in your dream and being able to make room for other things to come through,” she said.

Her experience also points to the failures of the program. Kupua says she was able to get her property only by bypassing the waitlist after a close friend from church sold it to her directly. Before then, her husband had been on the waitlist for 20 years. “If we waited on the list, we would have been waiting for a very long time,” she said.

Since its inception, the Hawaiian Homes Commission Act has been riddled with problems. The trust lands had been leased to sugar plantations, and only a limited portion were suitable for residential or agricultural use. A quarter of the allotted acres, in fact, were barren lava fields with limited water access that “a goat couldn’t live on”, the territorial representative William Jarrett said in 1921.

Vast portions of homestead lands also have been developed for purposes other than homesteading. For decades, public agencies have leased thousands of acres of trust lands, for little or even no compensation, to develop schools, parks, airports, military bases and other facilities. In 1995, the state legislature passed a reparations bill, Act 14, that authorized land exchanges and $600m to settle public use controversies. But the department has continued to invest in commercial leasing projects with non-Hawaiian entities to make up for revenue shortfalls, including a stalled plan to build a casino resort in Oahu.

In October, the state finalized a $328m settlement agreement with 2,500 waitlisted beneficiaries who had brought a class-action lawsuit against DHHL for mismanaging the public lands trust. The Kalima lawsuit, filed in the late 1990s, alleged that the department leased homestead lands to non-Hawaiian entities and mishandled thousands of homestead applications. More than 1,100 plaintiffs have died in the 23 years the case was fought in court.

Varady, a co-counsel in the Kalima case, said that many of the older plaintiffs he represented lived in derelict conditions as the wait stretched on. Some were unhoused and slept on the beach. Others lived in cramped, multigenerational housing without electricity or running water.

“They were all deprived of the benefits of homesteading because of the state’s breaches of trust,” Varady said.

Another problem, experts say, is that the program has veered away from its goal of affordable home ownership. Residential homestead awards take several forms, including rent-to-own properties and vacant lots on which families can build their own homes. But the most sought-after option among homesteaders is buying prebuilt single-family homes on trust lands. While these turnkey houses cost about half the price of comparable homes elsewhere on the islands, they’re still prohibitively expensive for working-class Kānaka families.

A 2014 DHHL study found that only about a quarter of waitlisted beneficiaries said they could afford the 10% down payment on a mortgage for a $150,000 property. As a result, many beneficiaries who were called off the waitlist ended up turning down home-ownership opportunities.

Turnkey awards have “turned the program on its head because they serve the middle class and not the poorest Native Hawaiians who are most in need of housing”, said Thomas Grande, a co-counsel in the Kalima lawsuit. “A very substantial number of Native Hawaiians can’t possibly afford to pool together several hundred thousand dollars in mortgage.”