88m3

Fast Money & Foreign Objects

Just 6 percent of U.S. land is developed. That matters when we talk about affordability.

Reuters/Andy Clark

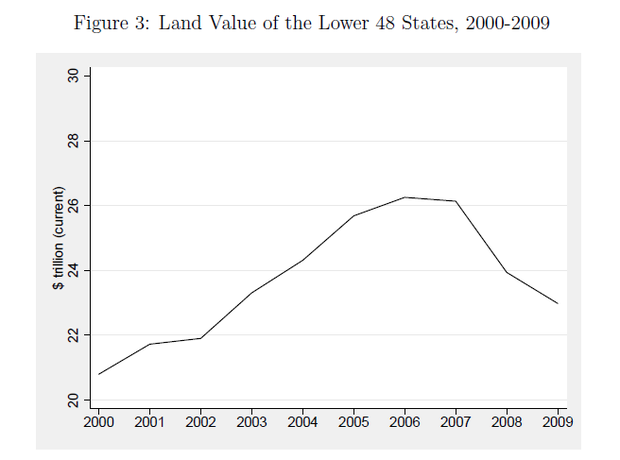

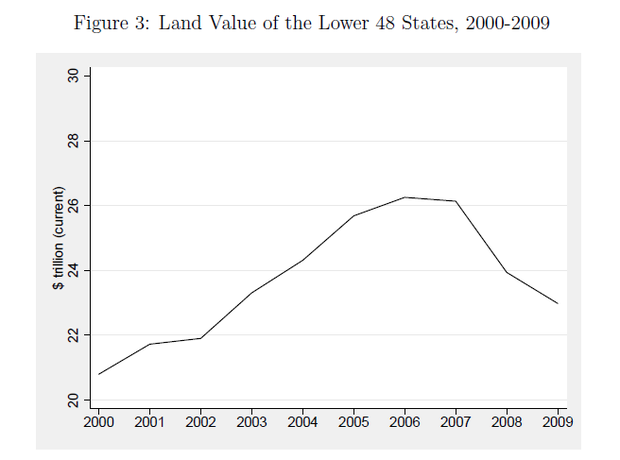

The total value of the land that makes up the contiguous United States was $23 trillion dollars in 2009, according to new data [PDF] released by the United States Bureau of Economic Analysis (BEA). That amounts to roughly 160 percent of U.S. Gross Domestic Product for that year, which stood at $14.5 trillion. According to the BEA’s findings, the value of U.S. land peaked at $26.2 trillion in 2006, before the Great Recession, but then fell back to $23 trillion. The graph below shows the trend.

(Bureau of Economic Analysis)

The study, by William Larson at the Bureau of Economic Analysis, derives these estimates from a wide range of sources—satellite images, GIS maps, USDA figures on farmland, Census data on housing prices and housing price estimates from other researchers, among others—to determine land values in America’s lower 48 states. Larson’s research estimates land values by county for several types of land: developed land, agricultural land, government-owned land and undeveloped land.

Just 6 percent of America’s nearly 2 billion acres of land is developed, Larson finds. But that little bit of land packs a substantial financial punch. It’s worth roughly $11.7 trillion, according to his calculations, comprising slightly more than half of the total value of U.S. land. Compare that to agricultural land, which accounts for nearly half (47 percent) of all land across the contiguous states but is worth just $1.8 trillion. The federal government owns 24 percent of the nation’s land area, which makes up an additional 8 percent of the country’s total land value.

Larson determines that developed land is worth $106,000 per acre, while undeveloped land is worth just $6,500. Agricultural land is also worth much less than non-agricultural land: $2,000 per acre versus $21,000. Federal land is worth $4,100 an acre compare to $14,600 for non-federal land.

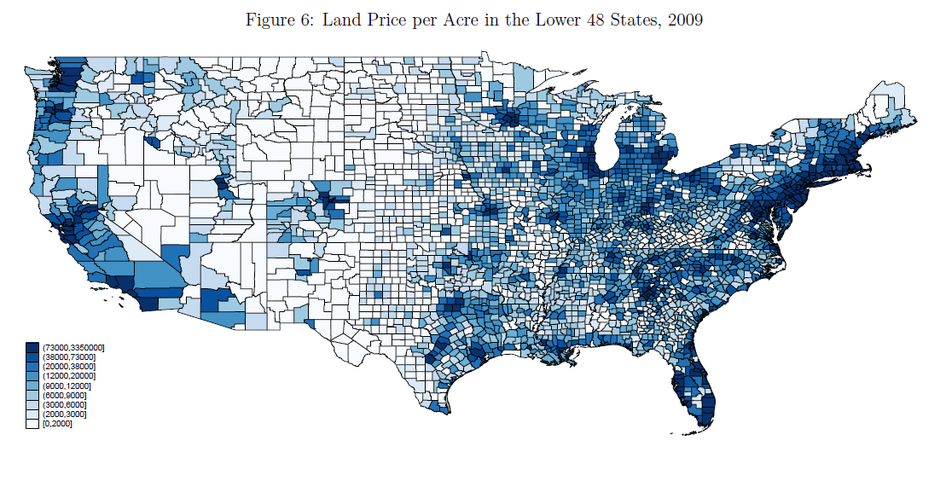

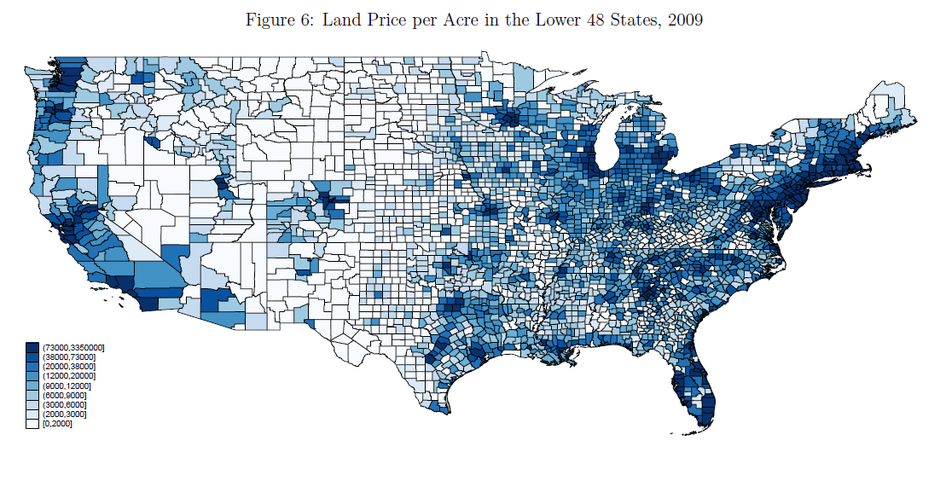

Unsurprisingly, the value of land is quite uneven and spiky across the country, as the map below shows. It charts the land values per acre across U.S. counties, with the darkest blue indicating where land is most expensive. The pattern is largely bi-coastal, with land prices at their highest along the Boston-New York-Washington corridor and parts of Florida on the East Coast, and in northern and southern California and up around Seattle in the West.

(Bureau of Economic Analysis)

Land values track metro size, according to the study. Land averages $64,800 per acre in large metro areas with populations of one million or more, compared to $16,600 per acre in metros with less than a million people and just $6,700 per acre in small cities with populations between 10,000 and 49,000 that are large metro-adjacent.

What’s truly remarkable is how little land is developed even in the most highly urbanized states. Aside from the District of Columbia, Rhode Island and New Jersey have the largest shares of developed land, but this amounts to less than a third (31 percent) of all the land in those states. Just one percent or less of land in Wyoming, New Mexico, Montana and Nevada are developed.

California has, by far, the greatest land value—$3.9 trillion, or about 17 percent of the U.S. total in 2009. And land value exceeds a trillion dollars in New York ($1.2 trillion), Texas ($1.3 trillion) and Florida ($1.0 trillion). In general, the report finds that land is most expensive in the East, West and Midwest, in population centers, and in the forested regions of the Rocky Mountains.

Clearly, land values are a function of what is on that land. Land values are higher in larger, denser places because that land is packed with more infrastructure and people, generating more economic activity. Land near the coast, as economist Jeffrey Sachs has found, also tends to be more valuable. That is of course where ports and trade grew up and where early cities developed and continued to grow over time.

Urban economists note that land values are a product of two basic things: the productivity generated by what goes on that land and the amenities offered by either natural features—coasts or mountains, for example—or by cultural features that develop in denser and more urban locations. Research by economist David Albouy finds San Francisco, Santa Barbara, Honolulu, San Diego, L.A., New York, Seattle and Boston to be among the nation’s leaders on such productivity and amenity values. A 2012 study by Albouy and Gabriel Ehrlich found that, on average, approximately one-third of housing costs are due to land, though that number can hit as high as 48 percent in high-value areas.

Capital in the Twenty-First Century. My own work, as well as that of Michael Porter, Edward Glaeser and many others, has highlighted the close association between clustering and productivity that creates lopsided demand for land in just a few, high-density places.

Land and housing, as MIT graduate student Matthew Rognlie points out, have been major contributors to the growth in net capital income over the past several decades. “Economists combine a lot of different things into ‘capital,’” writes the economics blogger Noah Smith. “Rognlie points out that almost all of the increase in the value of capital over [the last few decades] comes fromland, instead of from other forms of capital.” “The soaring price of land in superstar cites,” The Economist adds, “has brought the once fading relic of pre-industrial times back as a fundamental constraint on growth in the post-industrial age.” Or as Smith bluntly put it: “t’s landlords, not corporate overlords, who are sucking up the wealth in the economy.”

http://www.citylab.com/housing/2015...-states/389862/?utm_source=SFFB#disqus_thread

- RICHARD FLORIDA

- @Richard_Florida

- Apr 10, 2015

- 28 Comments

Reuters/Andy Clark

The total value of the land that makes up the contiguous United States was $23 trillion dollars in 2009, according to new data [PDF] released by the United States Bureau of Economic Analysis (BEA). That amounts to roughly 160 percent of U.S. Gross Domestic Product for that year, which stood at $14.5 trillion. According to the BEA’s findings, the value of U.S. land peaked at $26.2 trillion in 2006, before the Great Recession, but then fell back to $23 trillion. The graph below shows the trend.

(Bureau of Economic Analysis)

The study, by William Larson at the Bureau of Economic Analysis, derives these estimates from a wide range of sources—satellite images, GIS maps, USDA figures on farmland, Census data on housing prices and housing price estimates from other researchers, among others—to determine land values in America’s lower 48 states. Larson’s research estimates land values by county for several types of land: developed land, agricultural land, government-owned land and undeveloped land.

Just 6 percent of America’s nearly 2 billion acres of land is developed, Larson finds. But that little bit of land packs a substantial financial punch. It’s worth roughly $11.7 trillion, according to his calculations, comprising slightly more than half of the total value of U.S. land. Compare that to agricultural land, which accounts for nearly half (47 percent) of all land across the contiguous states but is worth just $1.8 trillion. The federal government owns 24 percent of the nation’s land area, which makes up an additional 8 percent of the country’s total land value.

Larson determines that developed land is worth $106,000 per acre, while undeveloped land is worth just $6,500. Agricultural land is also worth much less than non-agricultural land: $2,000 per acre versus $21,000. Federal land is worth $4,100 an acre compare to $14,600 for non-federal land.

Unsurprisingly, the value of land is quite uneven and spiky across the country, as the map below shows. It charts the land values per acre across U.S. counties, with the darkest blue indicating where land is most expensive. The pattern is largely bi-coastal, with land prices at their highest along the Boston-New York-Washington corridor and parts of Florida on the East Coast, and in northern and southern California and up around Seattle in the West.

(Bureau of Economic Analysis)

Land values track metro size, according to the study. Land averages $64,800 per acre in large metro areas with populations of one million or more, compared to $16,600 per acre in metros with less than a million people and just $6,700 per acre in small cities with populations between 10,000 and 49,000 that are large metro-adjacent.

What’s truly remarkable is how little land is developed even in the most highly urbanized states. Aside from the District of Columbia, Rhode Island and New Jersey have the largest shares of developed land, but this amounts to less than a third (31 percent) of all the land in those states. Just one percent or less of land in Wyoming, New Mexico, Montana and Nevada are developed.

California has, by far, the greatest land value—$3.9 trillion, or about 17 percent of the U.S. total in 2009. And land value exceeds a trillion dollars in New York ($1.2 trillion), Texas ($1.3 trillion) and Florida ($1.0 trillion). In general, the report finds that land is most expensive in the East, West and Midwest, in population centers, and in the forested regions of the Rocky Mountains.

Clearly, land values are a function of what is on that land. Land values are higher in larger, denser places because that land is packed with more infrastructure and people, generating more economic activity. Land near the coast, as economist Jeffrey Sachs has found, also tends to be more valuable. That is of course where ports and trade grew up and where early cities developed and continued to grow over time.

Urban economists note that land values are a product of two basic things: the productivity generated by what goes on that land and the amenities offered by either natural features—coasts or mountains, for example—or by cultural features that develop in denser and more urban locations. Research by economist David Albouy finds San Francisco, Santa Barbara, Honolulu, San Diego, L.A., New York, Seattle and Boston to be among the nation’s leaders on such productivity and amenity values. A 2012 study by Albouy and Gabriel Ehrlich found that, on average, approximately one-third of housing costs are due to land, though that number can hit as high as 48 percent in high-value areas.

Capital in the Twenty-First Century. My own work, as well as that of Michael Porter, Edward Glaeser and many others, has highlighted the close association between clustering and productivity that creates lopsided demand for land in just a few, high-density places.

Land and housing, as MIT graduate student Matthew Rognlie points out, have been major contributors to the growth in net capital income over the past several decades. “Economists combine a lot of different things into ‘capital,’” writes the economics blogger Noah Smith. “Rognlie points out that almost all of the increase in the value of capital over [the last few decades] comes fromland, instead of from other forms of capital.” “The soaring price of land in superstar cites,” The Economist adds, “has brought the once fading relic of pre-industrial times back as a fundamental constraint on growth in the post-industrial age.” Or as Smith bluntly put it: “t’s landlords, not corporate overlords, who are sucking up the wealth in the economy.”

http://www.citylab.com/housing/2015...-states/389862/?utm_source=SFFB#disqus_thread