End of Pandemic-Era Expanded Federal Tax Programs Results in Lower Income, Higher Poverty

The expiration of expansions to federal programs during COVID-19 resulted in lower post-tax household income and higher poverty rates.

End of Pandemic-Era Expanded Federal Tax Programs Results in Lower Income, Higher Poverty

September 12, 2023

Written by:

John Creamer and Matt Unrath

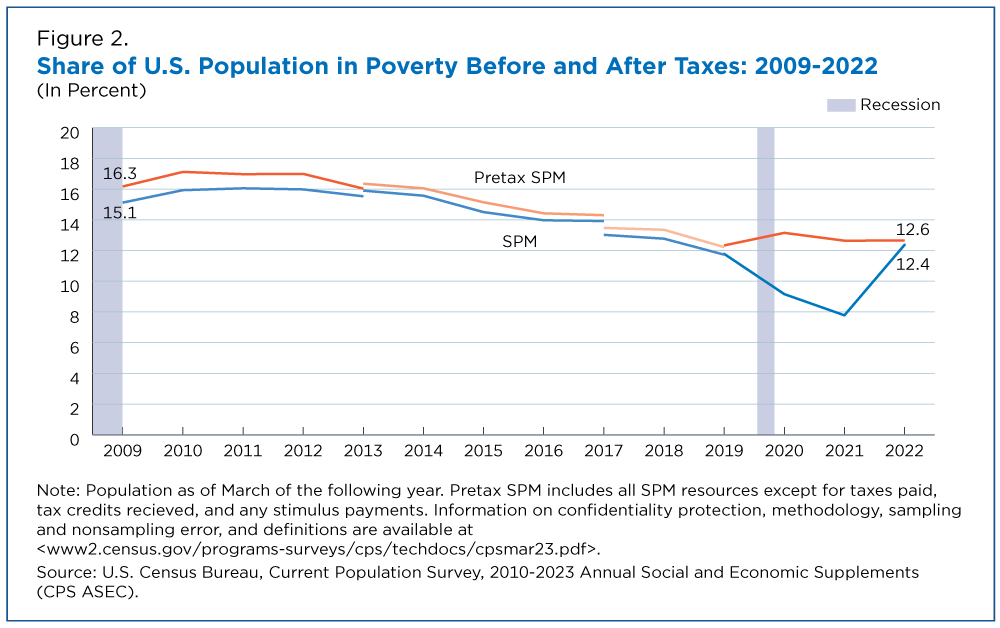

Real median household income after taxes fell 8.8% to $64,240 from 2021 to 2022 and the poverty rate after taxes as measured by the Supplemental Poverty Measure (SPM) increased 59% to 12.4%.

These significant changes in after-tax income and poverty rates of U.S. households were much larger than the annual changes in before-tax income and poverty, according to U.S. Census Bureau data released today.

The Census Bureau reports, Income in the United States: 2022 and Poverty in the United States: 2022, show that before taxes, median household income declined 2.3% to $74,580 and the poverty rate (11.5%), as measured by the official poverty measure, was not statistically different from 2021.

This dramatic difference can be attributed to key changes in federal tax policy.

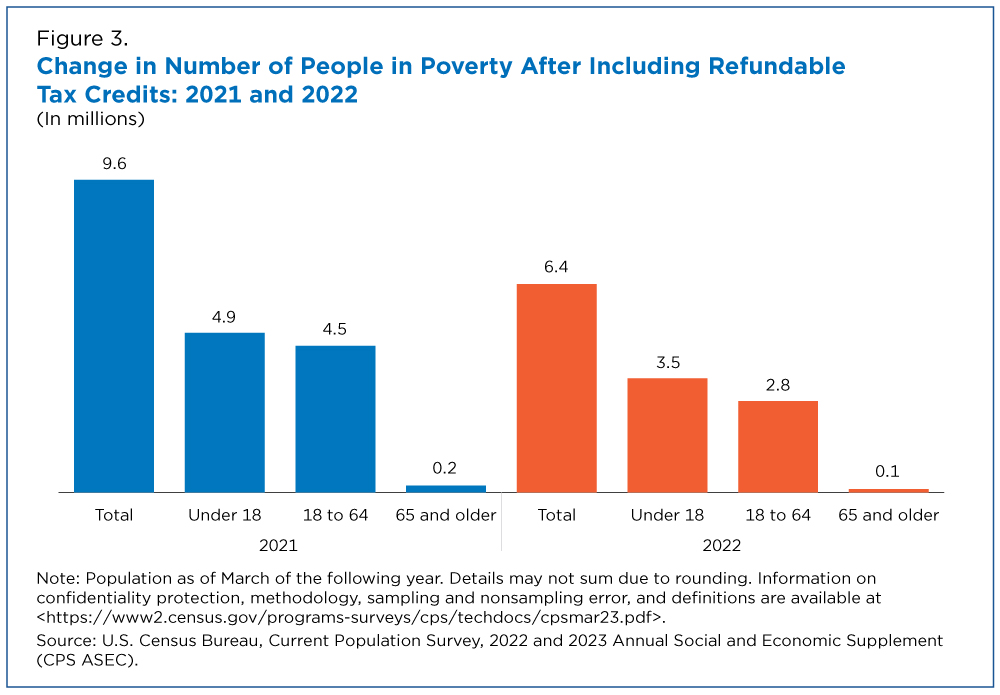

In 2022, several policies enacted by the American Rescue Plan Act (ARPA) expired, including an expansion of the Earned Income Tax Credit (EITC) for filers without children and full refundability of the Child Tax Credit (CTC) and Child and Dependent Care Tax Credit (CDCTC). ARPA also increased the maximum amount of CTC.

In 2020 and 2021, most households also received Economic Impact Payments (EIP) that were no longer issued in 2022.

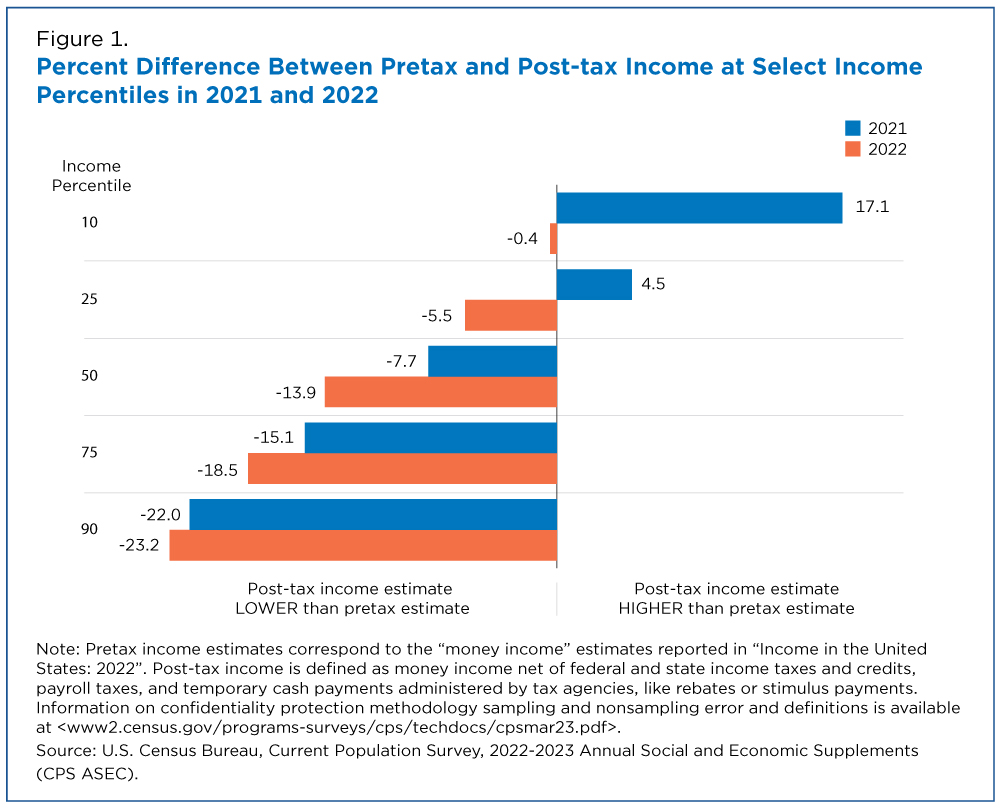

The rollback of these tax policies had the largest effect on post-tax income among the nation’s lowest-income households.

In 2021, for example, post-tax income at the 10th percentile, meaning at the bottom of the income distribution, was 17.1% higher than the corresponding pretax income estimate, reflecting the substantial boost that lower-income households received that year from the EIP and expanded CTC.

In contrast, the 2022 estimates of pretax and post-tax income at the 10th percentile were not significantly different (Figure 1).

Lower post-tax income, particularly at the bottom of the income distribution, also resulted in an increase in income inequality.

The Gini index, a common measure of how spread out or unequal incomes are, for pretax income was 1.2% lower in 2022 than in 2021, reflecting real income declines at the top of the income distribution. However, the post-tax Gini index was 3.2% higher due to substantial declines in post-tax income among lower-income households.