ogc163

Superstar

The Case-Shiller National Home Price Index is up 15% year-over-year through the end of April.

That seems unsustainable.

The same index is up 35% in total since early-2007 when the last housing bubble peaked. That’s a return of just 2.1% per year.

Not nearly as bad.

Since the turn of the century, housing prices are up 150% in total or 4.3% per year.

From the bottom of the housing crash in 2012 (which was a decline of 26%), nationwide housing prices are up 82% or 6.6% per year.

Depending on your vantage point, housing price increases seem either incredibly bubbly, below average, average or strong-to-quite-strong.

But if we’re talking about just the past year or so, it’s undeniable home prices are going bananas. Price gains are actually stronger now than they were during the housing bubble.

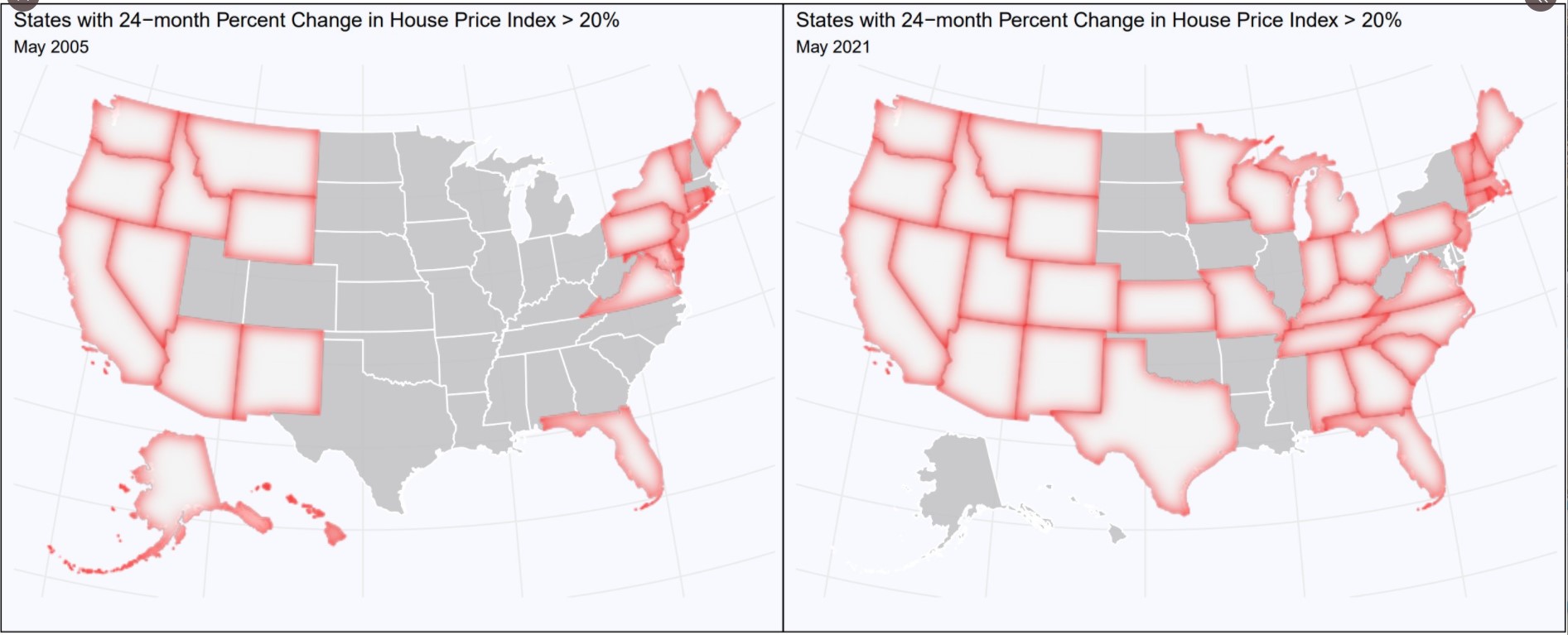

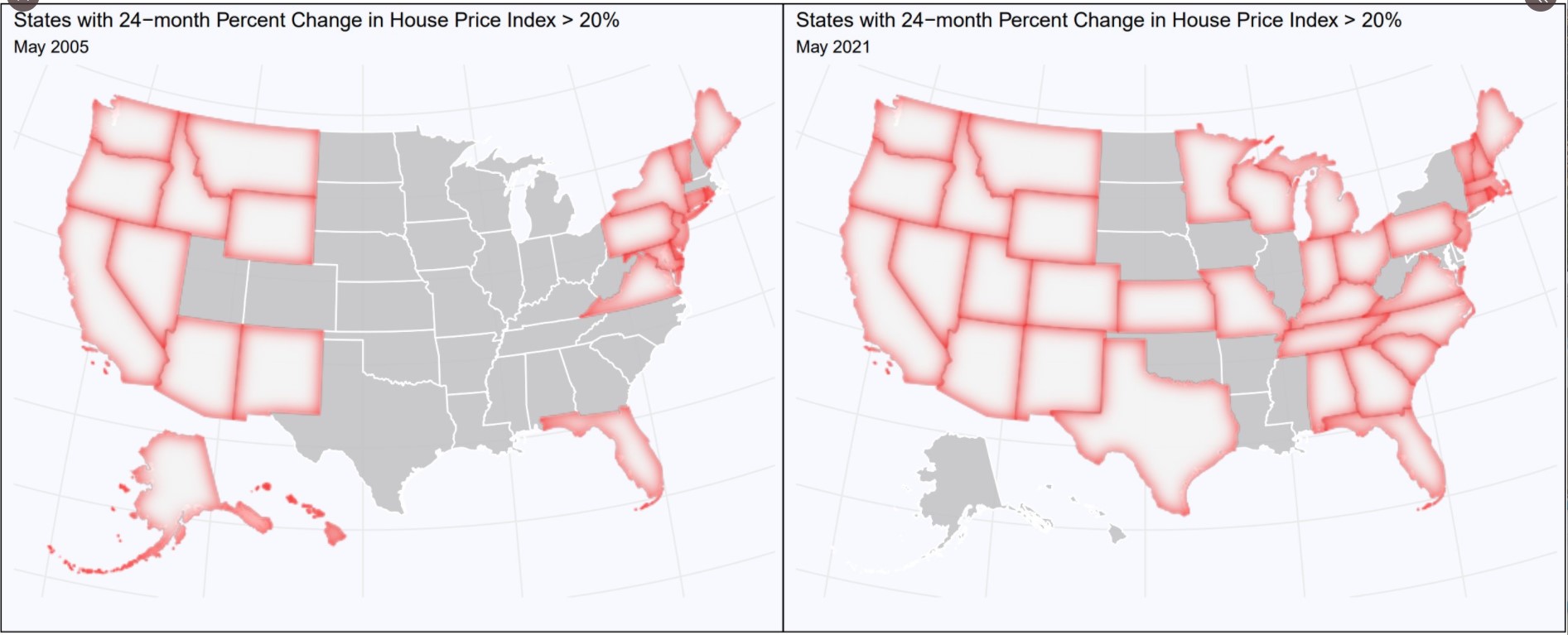

Len Kiefer from Freddie Mac looked at the 24-month price change in housing prices through May 2005 and May 2021 to see how many states showed price gains of 20% or more over a 2-year period:

Back then it was mostly coastal. Now it’s national.

Just eye-balling this chart1 it looks like 40% or so of all states back in 2005 had a 2-year price gain of greater than 20% versus more like 70% of states today.

You might look at these numbers and assume the speculation must be even crazier than the housing bubble of the aughts. Is it time for Michael Lewis to get started on The Big Short 2: The Housing Shortage?

The infamous story from The Big Short everyone cites was a strawberry picker in Bakersfield, California who had an income of $14,000 yet managed to secure a loan for $724,000.

Lewis would have a harder time finding as many crazy stories this time around.

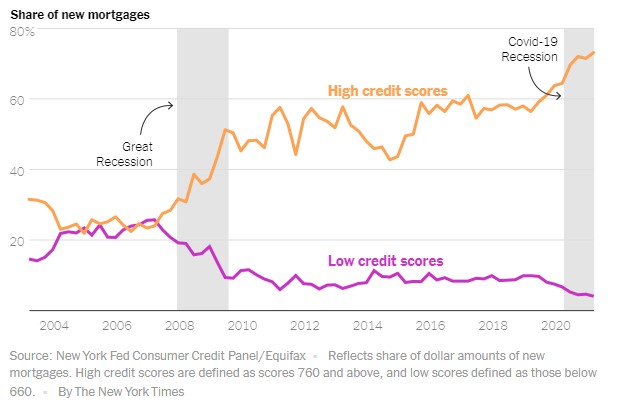

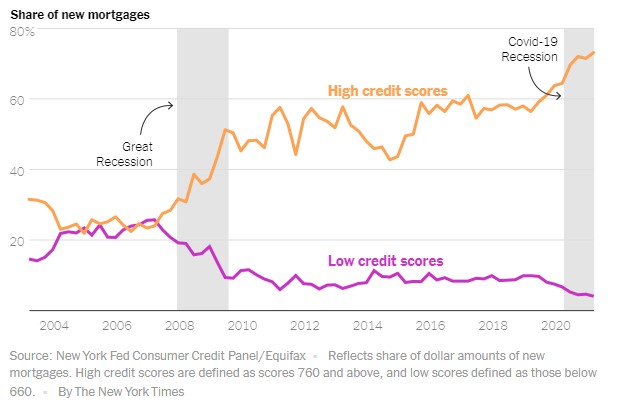

This week Ali Wolf wrote how homebuyers are far more financially sound, with 73% of mortgages in the first quarter of this year secured by people with credit scores of 760 or above. Look at how this number has been trending higher ever since the last housing bubble:

By 2007, people with low credit scores were taking out more new mortgages than people with high credit scores. That was obviously unsustainable.

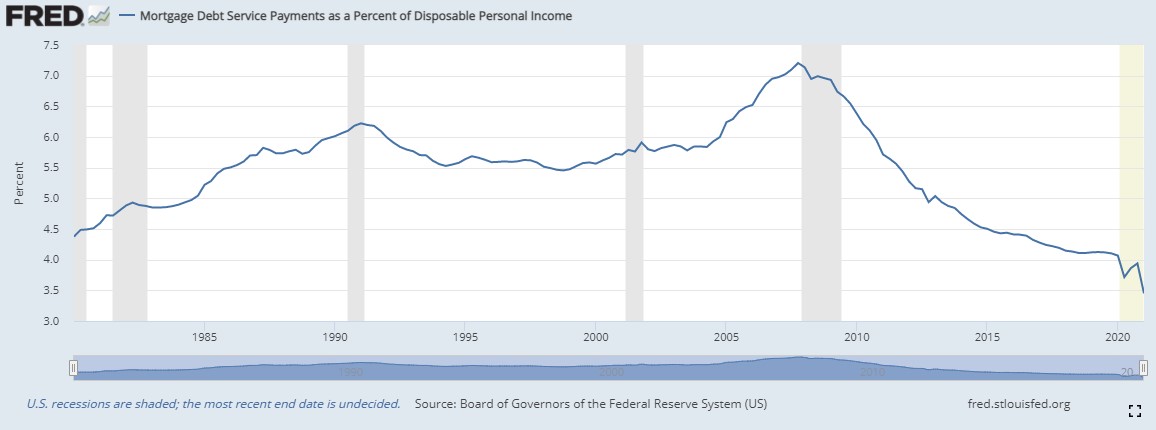

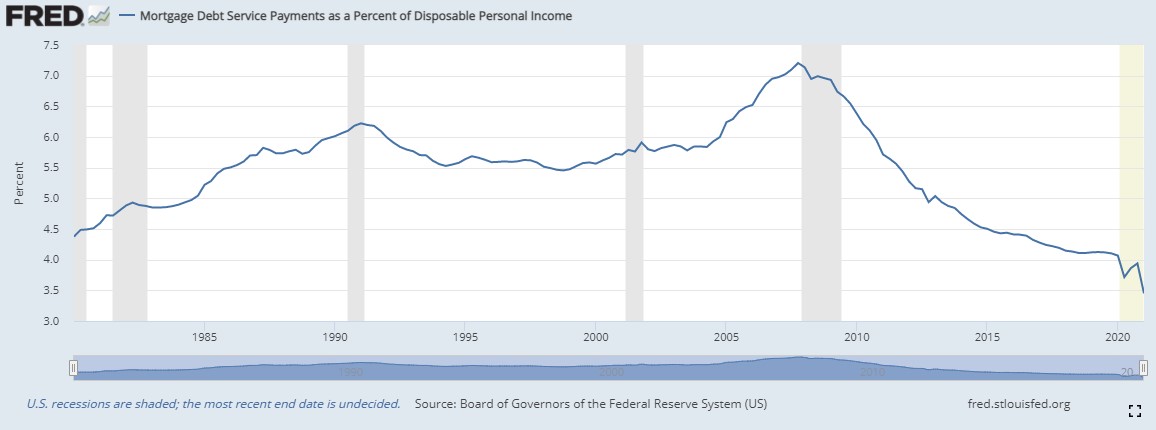

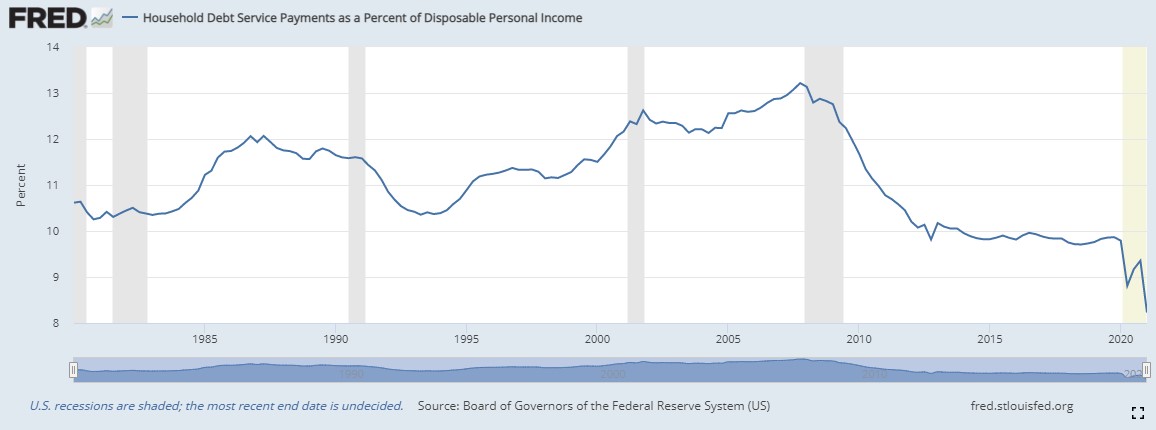

Now look at how much better shape households are in terms of being able to service their mortgage debt:

This data goes back to 1980 and it’s now at its lowest point ever. This number peaked in the fourth quarter of 2007 right before the financial crisis and is now 50% lower.

Freddie Mac recently shared some numbers to show how low rates have helped save people money through refinancing:

On average, borrowers who refinanced their 30-year fixed rate mortgage to another 30-year fixed rate mortgage to lower their mortgage rate (non cash-out refinancers) saved over $2,800 in mortgage payments (principal and interest) annually by refinancing in 2020. The typical refinance loan in 2020 was a loan for about $300,000 and the borrower lowered their rate from 4.3% to 3.1%.

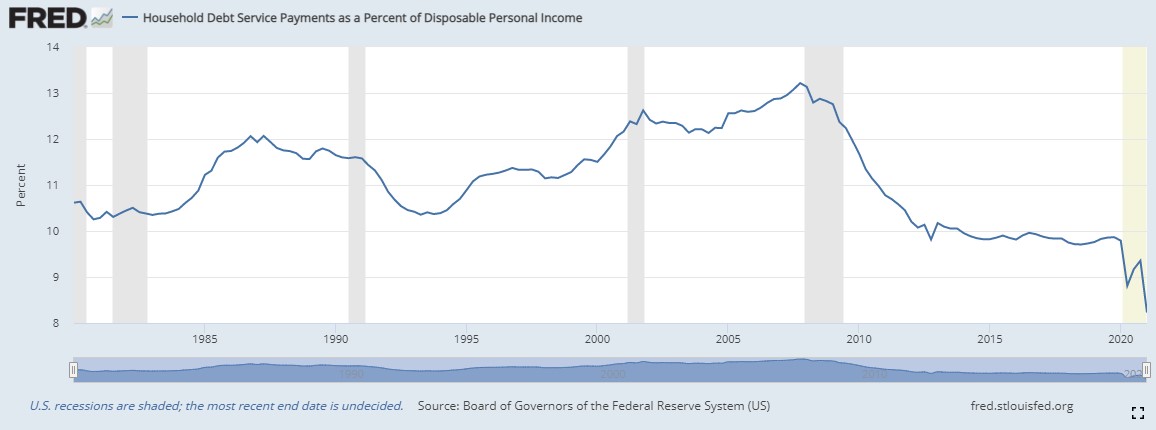

Mortgage debt makes up around 70% of total U.S. household debt in the United States so it makes sense that overall debt service as a percentage of disposable income is also as low as it’s ever been:

This number is roughly one-third lower than it was following the onset of the housing crash. U.S. households have spent the past 12 years shoring up their balance sheets and are arguably are in better shape financially than they’ve ever been.

Housing prices have never been higher but households have never been better able to handle those prices.

There are other differences between now and the housing bubble.

From 2000-2007, the 30 year fixed rate mortgage averaged 6.5%. The average from 2012 until now is just 3.8%. Even if rates were to scream higher from here, the majority of the country has spent the past few years refinancing or buying at or near record low mortgage rates.

It’s hard to overstate the impact this can have on a household’s budget.

Back then many people were taking out interest-only loans that would reset when rates went higher. Today, the majority of people buying a new home are locking in low rates through fixed rate mortgages or paying cash.

Back then people with low credit scores were buying houses to flip. Now people with high credit scores are buying houses to live in for the long-term.

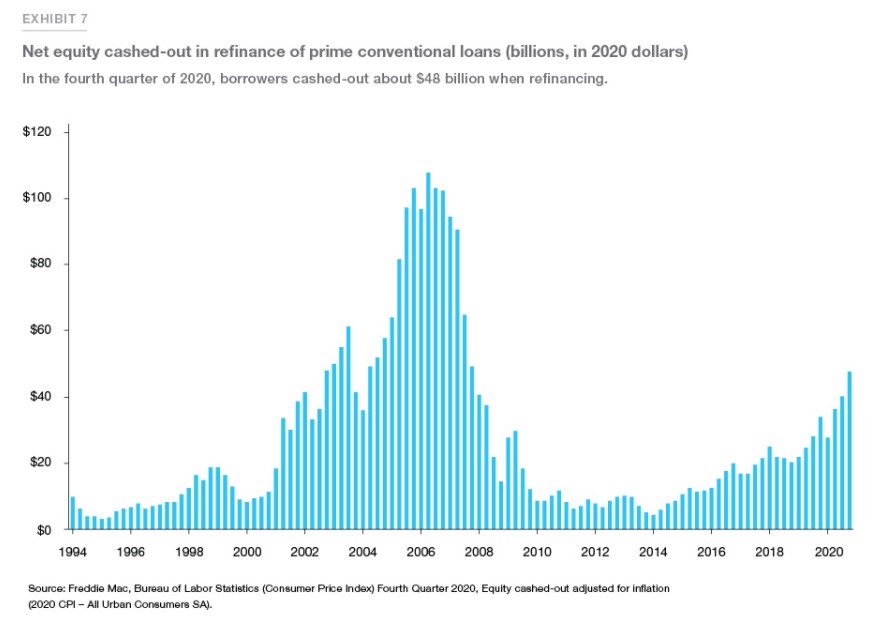

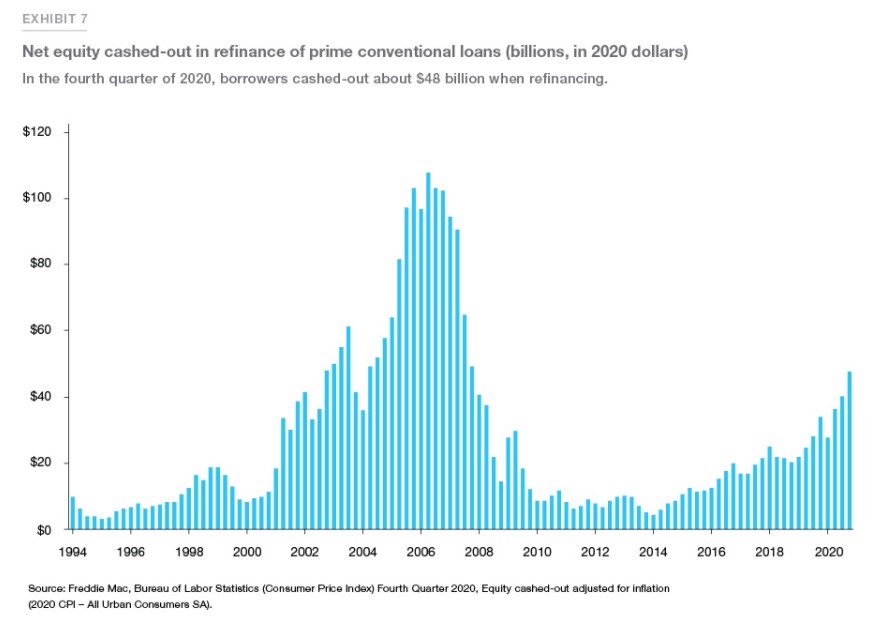

There aren’t nearly as many people pulling cash out of their homes this time around either:

This doesn’t look like a bubble to me. It looks like a housing shortage, a demographic wave and a pandemic-induced buying frenzy but not speculative excess.

Having said all of this, it’s still reasonable to worry about home prices. How could you not be worried?

Low rates are winning the fight against rising prices but it would not be healthy for housing to continue rising at its current clip. It would be nice to see more inventory come online to the housing market, more houses built and fewer bidding wars for the houses that are available.

This will all come with time but it would be a mistake to assume housing prices are going to crash just like they did last time.2 For once, Americans are richer coming out of a recession than they were going into it.

It’s important to remember you can’t look at a single variable — price — to make your housing decision.

Yes housing prices are a factor but so are interest rates, taxes, how long you plan to stay in the home, the ancillary costs of homeownership, your budget, your income and so on.

Don’t avoid buying a house because you think prices are too high. Avoid buying a house if you think your financial circumstances don’t warrant buying a house right now.

The housing market plays a large role in shaping the macroeconomy.

But your personal decision to buy a home or not should be based on your own personal finances, not some macro forecast about housing prices.

Further Reading:

What If Housing Prices Aren’t as High as They Appear?

1Some of those east coast states are so tiny. Maybe they should just merge some of them.

2And potentially higher mortgage rates if that ever happens.

The Biggest Differences Between Now & The Housing Bubble

That seems unsustainable.

The same index is up 35% in total since early-2007 when the last housing bubble peaked. That’s a return of just 2.1% per year.

Not nearly as bad.

Since the turn of the century, housing prices are up 150% in total or 4.3% per year.

From the bottom of the housing crash in 2012 (which was a decline of 26%), nationwide housing prices are up 82% or 6.6% per year.

Depending on your vantage point, housing price increases seem either incredibly bubbly, below average, average or strong-to-quite-strong.

But if we’re talking about just the past year or so, it’s undeniable home prices are going bananas. Price gains are actually stronger now than they were during the housing bubble.

Len Kiefer from Freddie Mac looked at the 24-month price change in housing prices through May 2005 and May 2021 to see how many states showed price gains of 20% or more over a 2-year period:

Back then it was mostly coastal. Now it’s national.

Just eye-balling this chart1 it looks like 40% or so of all states back in 2005 had a 2-year price gain of greater than 20% versus more like 70% of states today.

You might look at these numbers and assume the speculation must be even crazier than the housing bubble of the aughts. Is it time for Michael Lewis to get started on The Big Short 2: The Housing Shortage?

The infamous story from The Big Short everyone cites was a strawberry picker in Bakersfield, California who had an income of $14,000 yet managed to secure a loan for $724,000.

Lewis would have a harder time finding as many crazy stories this time around.

This week Ali Wolf wrote how homebuyers are far more financially sound, with 73% of mortgages in the first quarter of this year secured by people with credit scores of 760 or above. Look at how this number has been trending higher ever since the last housing bubble:

By 2007, people with low credit scores were taking out more new mortgages than people with high credit scores. That was obviously unsustainable.

Now look at how much better shape households are in terms of being able to service their mortgage debt:

This data goes back to 1980 and it’s now at its lowest point ever. This number peaked in the fourth quarter of 2007 right before the financial crisis and is now 50% lower.

Freddie Mac recently shared some numbers to show how low rates have helped save people money through refinancing:

On average, borrowers who refinanced their 30-year fixed rate mortgage to another 30-year fixed rate mortgage to lower their mortgage rate (non cash-out refinancers) saved over $2,800 in mortgage payments (principal and interest) annually by refinancing in 2020. The typical refinance loan in 2020 was a loan for about $300,000 and the borrower lowered their rate from 4.3% to 3.1%.

Mortgage debt makes up around 70% of total U.S. household debt in the United States so it makes sense that overall debt service as a percentage of disposable income is also as low as it’s ever been:

This number is roughly one-third lower than it was following the onset of the housing crash. U.S. households have spent the past 12 years shoring up their balance sheets and are arguably are in better shape financially than they’ve ever been.

Housing prices have never been higher but households have never been better able to handle those prices.

There are other differences between now and the housing bubble.

From 2000-2007, the 30 year fixed rate mortgage averaged 6.5%. The average from 2012 until now is just 3.8%. Even if rates were to scream higher from here, the majority of the country has spent the past few years refinancing or buying at or near record low mortgage rates.

It’s hard to overstate the impact this can have on a household’s budget.

Back then many people were taking out interest-only loans that would reset when rates went higher. Today, the majority of people buying a new home are locking in low rates through fixed rate mortgages or paying cash.

Back then people with low credit scores were buying houses to flip. Now people with high credit scores are buying houses to live in for the long-term.

There aren’t nearly as many people pulling cash out of their homes this time around either:

This doesn’t look like a bubble to me. It looks like a housing shortage, a demographic wave and a pandemic-induced buying frenzy but not speculative excess.

Having said all of this, it’s still reasonable to worry about home prices. How could you not be worried?

Low rates are winning the fight against rising prices but it would not be healthy for housing to continue rising at its current clip. It would be nice to see more inventory come online to the housing market, more houses built and fewer bidding wars for the houses that are available.

This will all come with time but it would be a mistake to assume housing prices are going to crash just like they did last time.2 For once, Americans are richer coming out of a recession than they were going into it.

It’s important to remember you can’t look at a single variable — price — to make your housing decision.

Yes housing prices are a factor but so are interest rates, taxes, how long you plan to stay in the home, the ancillary costs of homeownership, your budget, your income and so on.

Don’t avoid buying a house because you think prices are too high. Avoid buying a house if you think your financial circumstances don’t warrant buying a house right now.

The housing market plays a large role in shaping the macroeconomy.

But your personal decision to buy a home or not should be based on your own personal finances, not some macro forecast about housing prices.

Further Reading:

What If Housing Prices Aren’t as High as They Appear?

1Some of those east coast states are so tiny. Maybe they should just merge some of them.

2And potentially higher mortgage rates if that ever happens.

The Biggest Differences Between Now & The Housing Bubble