Tenants and Economists Are Pushing to Regulate Rent for a Vast Amount of U.S. Housing

A growing movement is pressuring the government to regulate rents on buildings where developers received federal loans.

Tenants and Economists Are Pushing to Regulate Rent for a Vast Amount of U.S. Housing

A growing movement is pressuring the government to regulate rents on buildings where developers received federal loans.By Roshan Abraham

November 20, 2023, 12:50pm

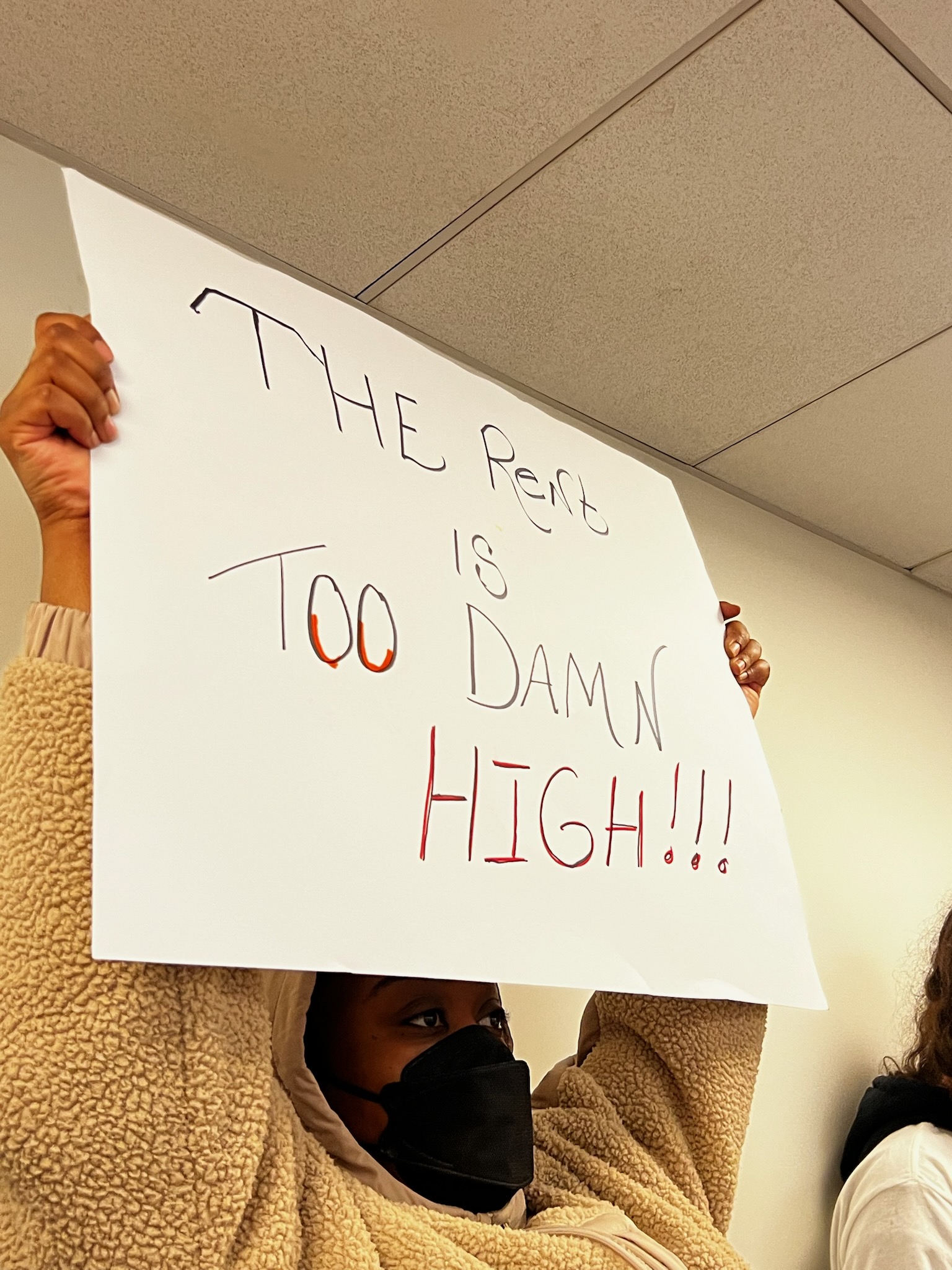

IMAGE VIA X/@PPLSACTION

About a hundred tenants from across the country, all living in units with federally-backed mortgages,occupied the headquarters of Starwood Capital Groupin Washington, D.C. on Friday, wearing shirts that said “THE RENT IS TOO DAMN HIGH.” They unfurled a large banner that said, “Tenants are capable and willing to pay rent increases,” which is a paraphrased quotefrom the company’s CEO. Tenants filed up the stairs and through a narrow corridor before knocking on a glass lobby entrance.

Starwood is a private equity firm that is heavily invested in housing, one of the country’s largest landlords and a recipient of federal government loans. Tenants spoke about their rent challenges, including Elyse Redden, who said she moved to Merced, California after getting sick and losing her home. Her rent was recently hiked by $268. “That might not sound like much to anybody else, but to me, on a fixed income, it is devastating,” she said.

Redden said she lives in fear that her son and her four year old grandson will become homeless. “Starwood Capital receives billions of dollars in federal financing and uses our money to displace us,” she said.

The action was the culmination of a week of activism, as tenants with the People’s Action Homes Guarantee Campaign advocated for stronger federal regulations on rental housing, including protections for tenants with federal housing vouchers—who face rampant discrimination from landlords—and a cap on rent increases in apartments with federally-backed mortgages.

The government has the ability to regulate rents on buildings where it provides loans for purchase, construction or rehabilitation, and a demand for rent control is a key pillar of Homes Guarantee’s advocacy. Close to half of all multifamily mortgage debt is federally-backed. The week of advocacy included a Wednesday morning Congressional briefing in which tenants and economists spoke about the shortage of affordable rental housing and a press conference later in the day.

Starwood Capital Group, which labels itself a private investment firm“with a focus on real estate” is one of the largest residential landlords in the U.S., owning 115,000 apartment units. It also boasts that it is one of the largest owners of single family rental housing, owns one of the largest portfolios of hotels, and owns two of the largest commercial mortgage finance companies in the country.

Starwood’s CEO Barry Sternlicht drew fire in the past for comments made on earnings calls. In 2021, Sternlicht referred to the company’s Woodstar affordable housing portfolio in Orlando and Tampa—where renters faced 20 percent year over year increases—as “the gift that keeps on giving,” Sternlicht said on the earnings call that because affordable housing is based on wage increases and inflation increases, that revenue increases at the apartments were “pretty much locked in” and that “tenants seem capable and willing to pay these rent increases.” In a separate interview with Bloomberg, he said that remote workers would return to the office as they have in Europe if the U.S. had a “nice little recession.” Starwood did not respond to a request for comment.

Homes Guarantee said that they also targeted Starwood because it is a key member of the National Multifamily Housing Council, a lobbying group that often opposes tenant-centered rent reforms.

One person who attended the action at Starwood’s offices, Demetrius Mosley, is a tenant at Pioneer Mobile Home Park in Louisville, Kentucky, who advocated for rent regulations at a press conference near the Capitol building on Wednesday. At the press conference, Mosley said he works on trucks, fixing brakes on 18-wheelers. He said his rent was $885 a month, but the owner of the lot added fines, fees, and hiked the rent to $1,200 a month. “I couldn’t afford to feed my kids,” Mosley said. He sent his three children to live with family members for fear that he wouldn’t be able to provide for them. “I feel angry, defeated, frustrated, as a father, I feel like I failed my family,” he said.

Mosley said that when he asked his employer for time off to attend the action in D.C., he was fired. Now, he doesn’t know how he’s going to pay his rent next month. The mobile home park where Mosley lives was purchased with a federally-backed mortgage, he said.

“The government is in business with my landlord,” Mosley said. “They turned around and squeezed me for everything I had.”

At the Wednesday press conference after the Congressional briefing, tenants were joined by Representative Pramila Jayapal, chair of the Congressional progressive caucus.

“When I go back to my district, this is what I hear from my constituents every single minute of every single day: the rent is too damn high. And the housing crisis is out of control wherever you live in the country,” Jayapal said. She railed against laws that “destroy encampments that make basic life activities like sleeping in public illegal.”

During Wednesday morning’s hearing before Congress, tenants and economists advocated for stronger rent regulations on rental units with federally-backed mortgages. They included Lilly Durtka, 19, a social worker and tenant activist with Bozeman Tenants United in Montana. Durtka said her family moved to Bozeman in 2015. She said they lived in a camper, moved apartments and couchsurfed for seven years. Since this summer she’s been living in Mountain View Apartments with her brother, where they pay a combined $2475 a month. She said after paying for groceries, healthcare and utilities, “there isn’t much left.” and she can’t afford another rent hike. The apartment complex received a $2.6 million loan from Fannie Mae, which means the federal government could put conditions on its lending. “They are profiting off our rent while our conditions are not improving.”

Economists at Wednesday’s hearing spoke about the relationship between housing supply and regulations on rents. (A group of economists signed a letteradvocating for rent regulation as part of the Homes Guarantee campaign this Summer.)

Alexei Alexandrov, a former chief economist at the Federal Housing Finance Agency who works at the Urban Institute , characterized housing affordability mainly in terms of supply.

“If we had enough housing everything would be affordable,” he said. Alexandrov cited the commonly cited number of a shortage of 4 million homes. (Numbers vary, with Fannie Mae estimatingabout 4 million units need to be built and the National Low-Income Housing Coalitionestimating about 7.3 million affordable rental units are needed.)

Alexandrov said since the homes were not going to be built immediately, that anti-price gouging laws could “stem the bleeding.” He suggested a rent increase cap of 30-50 percent, far above the 3 percent rent cap that Homes Guarantee is asking for.

But another economist, Kitty Richards with Groundwork Collaborative, said that while landlords’ pricing power was “super charged” by the supply problems, there were other factors giving landlords market power that demand regulation.

Richards disputed the idea that all housing would be affordable even if supply issues were addressed, saying this would only happen in an idealized world in which every person can freely move from their homes, where every unit is owned by a different landlord, and where landlords are unable to combine their pricing power. She cited the example of insulin, where the government had to set price caps to end rampant price-gouging. And she brought up the lawsuits against RealPage, one of several firms accused of operating cartels through algorithmic pricing software.

“In this world houses are easily substituted for each other, people have lots of freedom and it’s cheap or even free to move,” she said.

“Do we actually think this is the world that we live in? When you make it that stark, does anyone think that’s the world that we live in? Most economists don’t,” Richards said.

Richards urged government agencies to use their power to regulate rents. “Unlike in Econ 101, where any regulation of what people can charge for their product is going to have the unintended consequence of reducing supply and driving up rents in the long-run, you have power to decide whether they are allowed to exercise it at the expense of tenants,” she said, pointing to members of Congress. “It is a policy choice.”