So Pelosi stalled for months and said she was against the Congressional stock ban, then did a fake about-face and said she would support it, then refused to support either of the already-proposed bills which both have plenty of bipartisan support, then put a Congresswoman who is against the whole thing in charge of drafting the bill, then claimed the negotiations were going well and the bill would come up for a vote, and now is saying there's just not enough time....which is entirely a product of her ensuring there would not be enough time.

news.yahoo.com

news.yahoo.com

www.businessinsider.in

www.businessinsider.in

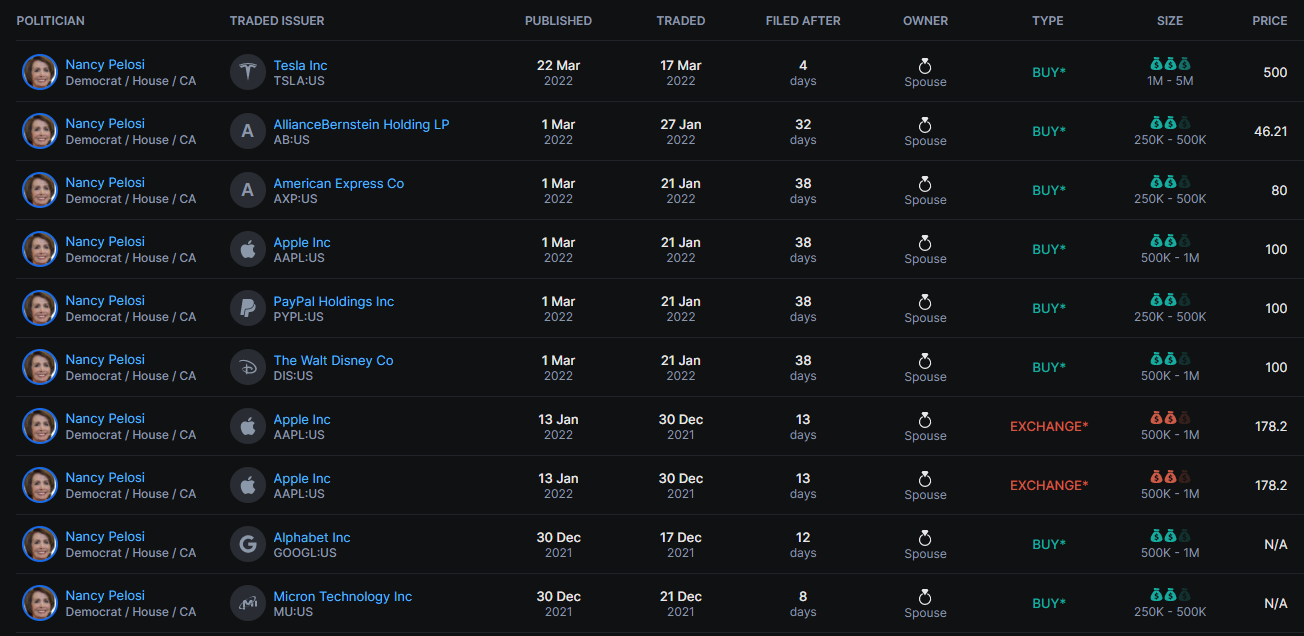

And what's wild is even the bill that Pelosi isn't going to put to vote was weak as fukk. Look at the list here:

time.com

time.com

1. Would replace the government's strict rules for what constitutes a blind trust with weak-ass rules that would allow fake blind trusts like the one Trump had when he was president.

2. Would allow each branch of government to set their own rules for blind trusts, including the ability to refuse to disclose the contents.

3. Would allow ethics offices to waive penalties for violations due to "extraordinary circumstances."

4. Allows investment in "diversified" assets, without defining diversified (so, for example, officials with secret information or policy power over Covid would likely still be able to dump money into targeted medical or tech funds just so long as they didn't buy individual stocks).

5. Would allow government officials to hold banned assets if they receive them via gift.

6. Automatically defers capital gains taxes.

This is why Democrats have such weak support compared to their demographic numbers. No one believes they're the party of the working class/poor anymore. Too many of the corporate dems in power are just rich a$$holes who are grateful the other rich party is even bigger a$$holes.

The effort to ban members of Congress from trading stocks is mostly dead — at least for now

Both top lawmakers and the most dogged advocates of stock ban legislation seem to agree — Congress has run out of time to strengthen ethics.

The effort to ban members of Congress from trading stocks is mostly dead — at least for now | Business Insider India

Politics Insider Article and News

And what's wild is even the bill that Pelosi isn't going to put to vote was weak as fukk. Look at the list here:

Pelosi’s Stock Ban Bill Isn’t Just Weak, It’s Dangerous

House Democrats made a point of criticizing Trump’s assault on government ethics, so it’s maddening to see their leadership adopting his most notorious ethics dodge just a few years later.

1. Would replace the government's strict rules for what constitutes a blind trust with weak-ass rules that would allow fake blind trusts like the one Trump had when he was president.

2. Would allow each branch of government to set their own rules for blind trusts, including the ability to refuse to disclose the contents.

3. Would allow ethics offices to waive penalties for violations due to "extraordinary circumstances."

4. Allows investment in "diversified" assets, without defining diversified (so, for example, officials with secret information or policy power over Covid would likely still be able to dump money into targeted medical or tech funds just so long as they didn't buy individual stocks).

5. Would allow government officials to hold banned assets if they receive them via gift.

6. Automatically defers capital gains taxes.

This is why Democrats have such weak support compared to their demographic numbers. No one believes they're the party of the working class/poor anymore. Too many of the corporate dems in power are just rich a$$holes who are grateful the other rich party is even bigger a$$holes.