Computer Simulations Reveal Benefits of Random Investment Strategies Over Traditional Ones | MIT Technology Review

Back in 2001, a British psychologist carried out an unusual experiment in which he asked three people to invest a virtual £5000 in the UK stock market. The three people were a professional trader, an astrologer and a 4 year old girl called Tia.

The results were something of an eye-opener. At the end of the year, the trader had lost 46.2 per cent of the original investment and the astrologer 6.2 per cent. Tia, on the other hand, had made 5.8 per cent. Others have carried out similar experiments with similar results in which investments were chosen by a chimpanzee or by throwing darts.

The implication in these experiments is that random investment strategies are as good as, or even better than, traditional ways of making investments.

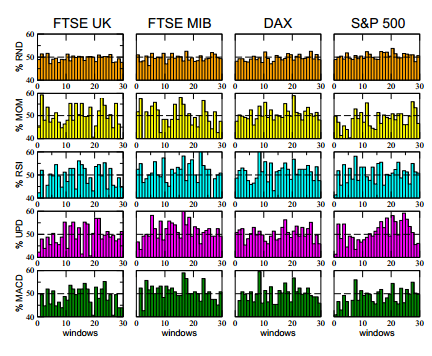

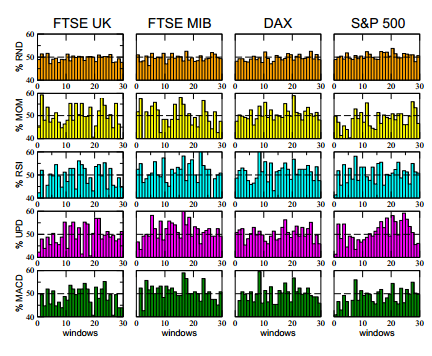

Today, Alessio Biondo from the University of Catania in italy and a few pals test this idea for themselves. These guys have simulated the performance of four traditional strategies using 10 years of historical data from the UK, German and US stock markets. They then compare the results with those from an entirely random strategy.

The traditional approaches are all based on the past performance of the market and include, for example, the momentum strategy which measures how fast the price of something has changed in the recent past and then uses this to predict how much it will change in the near future. Another approach is called the up down strategy in which the prediction for tomorrows market behaviour is exactly the opposite of todays.

The results of this comparison are straightforward and the same for all the markets these guys studied. They say that standard trading strategies can occasionally be successful over small time windows. But on large timescales, they perform no better than a purely random strategy.

Whats more, the results from a random strategy are much less volatile than those from traditional trading strategies and so less risky.

Thats an interesting result that needs to be studied in more detail. In some ways, its no surprise that randomness works so well, given that the actual movement of the market is influenced by numerous random, forces.

But Biondo and co go further and suggest that random trading strategies could eventually become a powerful force in markets because of their lower volatility. One might expect that a widespread adoption of a random approach for financial transactions would result in a more stable market with lower volatility, they say.

For example, this kind of approach would help to reduce herding behaviour and cause bubbles to burst while they were still small. The entire financial system would be less prone to the speculative behaviour of credible guru traders, say Biondo and co.

They even suggest that Central Banks should step in to stabilise markets by using a large-scale random buying and selling strategy.

Biondo and co say this is the first time that these kinds of strategies have been simulated on computer on this kind of scale. Theres an obvious next step which is to try them for real.

Whether the Central Banks could ever be persuaded to act in this fashion is another question but it certainly looks worth exploring in more detail.

As if we needed more proof that long-term financial consultants, or really, the entire field of financial prediction is a cesspool of charlatans who have no idea what they're actually doing.

Back in 2001, a British psychologist carried out an unusual experiment in which he asked three people to invest a virtual £5000 in the UK stock market. The three people were a professional trader, an astrologer and a 4 year old girl called Tia.

The results were something of an eye-opener. At the end of the year, the trader had lost 46.2 per cent of the original investment and the astrologer 6.2 per cent. Tia, on the other hand, had made 5.8 per cent. Others have carried out similar experiments with similar results in which investments were chosen by a chimpanzee or by throwing darts.

The implication in these experiments is that random investment strategies are as good as, or even better than, traditional ways of making investments.

Today, Alessio Biondo from the University of Catania in italy and a few pals test this idea for themselves. These guys have simulated the performance of four traditional strategies using 10 years of historical data from the UK, German and US stock markets. They then compare the results with those from an entirely random strategy.

The traditional approaches are all based on the past performance of the market and include, for example, the momentum strategy which measures how fast the price of something has changed in the recent past and then uses this to predict how much it will change in the near future. Another approach is called the up down strategy in which the prediction for tomorrows market behaviour is exactly the opposite of todays.

The results of this comparison are straightforward and the same for all the markets these guys studied. They say that standard trading strategies can occasionally be successful over small time windows. But on large timescales, they perform no better than a purely random strategy.

Whats more, the results from a random strategy are much less volatile than those from traditional trading strategies and so less risky.

Thats an interesting result that needs to be studied in more detail. In some ways, its no surprise that randomness works so well, given that the actual movement of the market is influenced by numerous random, forces.

But Biondo and co go further and suggest that random trading strategies could eventually become a powerful force in markets because of their lower volatility. One might expect that a widespread adoption of a random approach for financial transactions would result in a more stable market with lower volatility, they say.

For example, this kind of approach would help to reduce herding behaviour and cause bubbles to burst while they were still small. The entire financial system would be less prone to the speculative behaviour of credible guru traders, say Biondo and co.

They even suggest that Central Banks should step in to stabilise markets by using a large-scale random buying and selling strategy.

Biondo and co say this is the first time that these kinds of strategies have been simulated on computer on this kind of scale. Theres an obvious next step which is to try them for real.

Whether the Central Banks could ever be persuaded to act in this fashion is another question but it certainly looks worth exploring in more detail.

As if we needed more proof that long-term financial consultants, or really, the entire field of financial prediction is a cesspool of charlatans who have no idea what they're actually doing.