John Roberts Begs the Liberal Justices to Stop Criticizing the Court

The chief justice doesn’t like his conservative Supreme Court colleagues getting called out for judicial overreach.

Matt Ford/

June 30, 2023

SUPREME SQUABBLE

John Roberts Begs the Liberal Justices to Stop Criticizing the Court

The chief justice doesn’t like his conservative Supreme Court colleagues getting called out for judicial overreach.

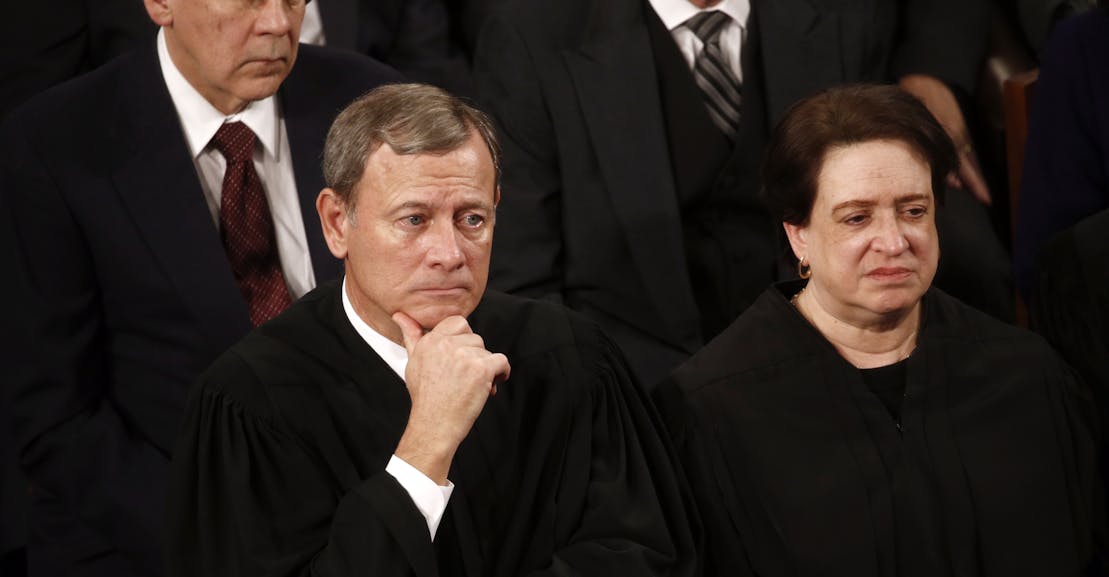

STEFANI REYNOLDS/BLOOMBERG/GETTY IMAGES

The most striking portion of the Supreme Court’s student loan relief decision isn’t the decision itself, as significant as it is. The justices on Friday blocked President Joe Biden’s order to forgive billions of dollars of student loan debt in Biden v. Nebraska, ruling that he had violated federal law by trying to wipe away up to $20,000 in debt for each of millions of borrowers last year. As many as 40 million Americans will lose out on student debt relief as a result.

Nor is it the majority’s questionable analysis of standing that let it hand down the ruling in the first place. The lawsuit, filed by a coalition of Republican-led states, hinged on whether they could act on behalf of MOHELA, a federal student loan servicer created by the Missouri legislature. MOHELA has an independent legal personality and chose to not challenge the executive order on its own. That’s OK, the court said—Missouri and other states can just do it on their behalf.

What really stands out is the final paragraph of Chief Justice John Roberts’s majority opinion. Ever the institutionalist, he takes issue with criticism of the court by some of its own members who fault it for overstepping its powers. “It has become a disturbing feature of some recent opinions to criticize the decisions with which they disagree as going beyond the proper role of the judiciary,” Roberts laments. He argues that they reached Friday’s ruling based on normal judicial methods of statutory interpretation.

“Reasonable minds may disagree with our analysis—in fact, at least three do,” the chief justice concludes, referring to the court’s three liberal members who dissented from Friday’s ruling. “We do not mistake this plainly heartfelt disagreement for disparagement. It is important that the public not be misled either. Any such misperception would be harmful to this institution and our country.”

Nobody likes to be criticized. As someone who also has to write things that the public reads—albeit to a much smaller audience and with much lower stakes—I can sympathize with that sentiment. At the same time, it is hard to square Roberts’s plea to not claim the court is exceeding its authority at the conclusion of an opinion in which it does just that.

Roberts, writing for the court, rules that the federal law which the Biden administration invoked to forgive large amounts of student debt did not authorize it. “The Secretary asserts that the HEROES Act grants him the authority to cancel $430 billion of student loan principal,” he writes. “It does not. We hold today that the Act allows the Secretary to ‘waive or modify’ existing statutory or regulatory provisions applicable to financial assistance programs under the Education Act, not to rewrite that statute from the ground up.”

The 6–3 ruling fell along the court’s usual ideological divide. In dissent, Justice Elena Kagan writes that “in every respect, the court today exceeds its proper, limited role in our Nation’s governance.” She castigates the majority for concluding that Missouri and a coalition of other Republican-led states had the legal standing necessary to challenge the order.

“[The court] declines to respect Congress’s decision to give broad emergency powers to the secretary,” Kagan wrote. “It strikes down his lawful use of that authority to provide student-loan assistance. It does not let the political system, with its mechanisms of accountability, operate as normal. It makes itself the decision-maker on, of all things, federal student-loan policy. And then, perchance, it wonders why it has only compounded the ‘sharp debates’ in the country?”

Biden’s order sought to erase up to $10,000 of student loan debt for borrowers who made less than $125,000 a year. Borrowers who also obtained Pell grants could receive up to $20,000 in relief. The Biden administration estimated that the order would erase as much as $400 billion in student loan debt and that it would affect as many as 40 million Americans.

For legal authority, the White House cited the Heroes Act of 2003, a law drafted by Congress during the early stages of the Iraq War that replaced a temporary version enacted after the September 11 attacks. It allows the Department of Education to “waive or modify any statutory or regulatory provision” involving federal student loan programs. While the law was originally meant to help Iraq War veterans avoid student loan repayment issues during the war, Congress phrased it to apply to national emergencies in general.

To that end, when the Covid-19 pandemic first struck the United States in 2020, then–Secretary of Education Betsy DeVos invoked the Heroes Act to suspend student debt payments and the accrual of interest. The move was part of a raft of policy maneuvers that Congress and the Trump administration engaged in after the American economy partially collapsed that spring. The Biden administration continued the debt-repayment pause and, last year, added on additional forms of relief by wiping away a certain amount of debt for each borrower.

Republicans strongly opposed that level of relief when it was announced. At the time, however, even they acknowledged that it would be extremely difficult to challenge in court. To bring a lawsuit, a would-be plaintiff would have to show that they were injured in some way by the executive order. Without an injury, there’s nothing for the court to fix, and if there’s nothing for the court to fix, there’s no reason for it to hear the case. The Constitution only allows the courts to hear “cases and controversies,” not issue freewheeling advisory opinions.

Who is possibly injured by having $10,000 in debt removed from your student loans? Certainly not the individual borrowers who received that relief, despite some tortured attempts to claim otherwise. In a separate ruling on Friday, the justices unanimously rejected a too-clever-by-half lawsuit by two individual borrowers who were recruited by right-wing legal activists. The borrowers claimed that the order was invalid for procedural reasons and that, if it were redone properly, they might receive even more debt relief. Justice Samuel Alito, writing for all nine justices in Dept. of Education v. Brown, rejected that argument out of hand.

In Biden v. Nebraska, a coalition of Republican-led state attorneys general sought to overturn the order. How could states possibly have standing, you might ask? They do not go to college, after all. The residents of a state may go to college, but the state couldn’t sue on their behalf because they don’t have standing either. And while every state operates its own colleges and universities, those schools get the tuition payments no matter what happens to the student debt that follows, so there’s no injury—and thus no standing—to be found there.

The Republican attorneys general clung to MOHELA as their vehicle to stop the Biden administration. Missouri’s legislature created the Missouri Higher Education Loan Authority in the 1980s to act as a servicer for federal student loans. MOHELA has its own independent legal personality, meaning it can file lawsuits and defend itself from litigation on its own. MOHELA has filed no such lawsuit to challenge the debt-relief order, nor does it appear interested in filing one, even though it purportedly stood to lose out on an estimated $44 million in fees if the order went into effect.

Not to worry, the Supreme Court said on Friday. Since the order would affect MOHELA’s revenues, and thus potentially make it harder to “help” Missouri students “access student loans,” as Roberts puts it, Missouri naturally has a legal interest in the welfare of one of its “instrumentalities.” Kagan sharply disagrees with how the court misread its own precedents on the matter, as well as its ultimate conclusion.

For starters, Kagan notes, not even Missouri has claimed that anything affecting MOHELA will necessarily hurt Missouri borrowers, and it probably couldn’t claim that because MOHELA doesn’t actually issue student loans. “MOHELA is not a lender; it services loans others have made,” she points out. And even if that weren’t true, she notes, it is a canonical rule of standing that states can never sue the federal government based on alleged harms to the state’s residents.

“Missouri needs to show that the harm to MOHELA produces harm to the State itself,” Kagan explained. “And because, as explained above, MOHELA was set up (as corporations typically are) to insulate its creator from such derivative harm, Missouri is incapable of making that showing. The separateness, both financial and legal, between MOHELA and Missouri makes MOHELA alone the proper party.” She also pointedly noted that Roberts himself had previously opposed broad versions of state standing.

“If MOHELA had brought this suit, we would have had to resolve it, however hot or divisive. But Missouri?” Kagan concludes. “In adjudicating Missouri’s claim, the majority reaches out to decide a matter it has no business deciding. It blows through a constitutional guardrail intended to keep courts acting like courts.”

On the merits, Roberts and Kagan also duel over how to read language that the secretary could “waive or modify” student loan provisions. Roberts, writing for the court, rules that the Biden administration could not “rewrite that statute from the ground up.” His view that it was a radical shift from the text suffuses the opinion. “What the Secretary has actually done is draft a new section of the Education Act from scratch by ‘waiving’ provisions root and branch and then filling the empty space with radically new text,” Roberts wrote, referring to the requirement that the administration report on any changes to Congress.

the corruption, the activism. this court is a disgrace

the corruption, the activism. this court is a disgrace very lucky america not in a third world he would be more than CHASTISED for his decisions...

very lucky america not in a third world he would be more than CHASTISED for his decisions...