OfTheCross

Veteran

Inflation Is Back With a Vengeance in Latin America | naked capitalism

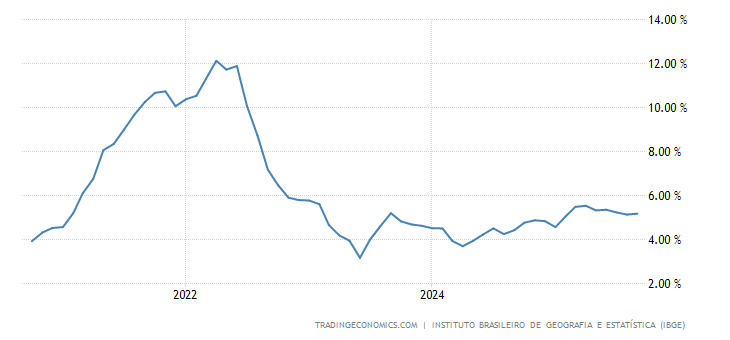

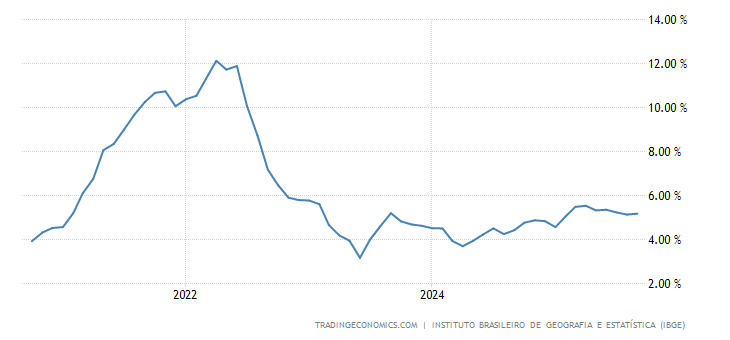

In Brazil today inflation rates have tripled over the past year, from 3.1% in August 2020 to an anualized 9.7% in August 2021, its highest level since 2016. In September, the IPCA-15 consumer-price index — a mid-month predictor of the official inflation rate — surged by 1.14% over the month. If the indicator rings true, Brazil will soon report its highest reading for the month of September since 1994. That was when the country had just launched a new currency, the Brazilian Real, after being ravaged by its second bout of hyperinflation in seven years.

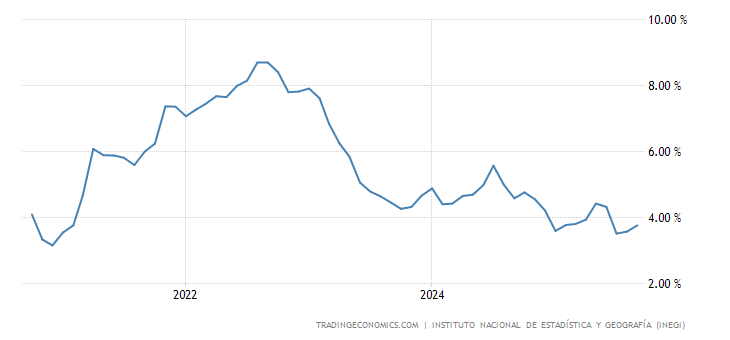

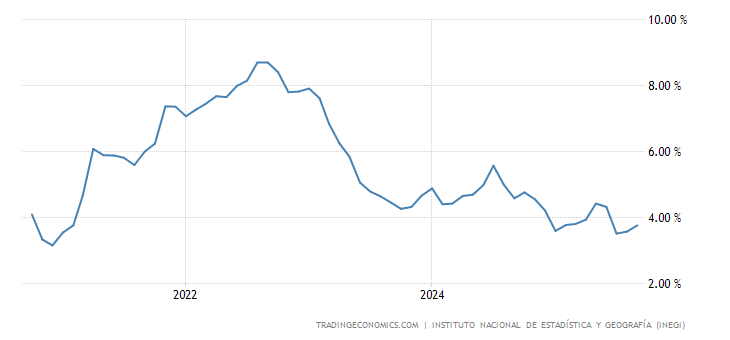

In Mexico, inflation is not quite as high as in Brazil, partly because Mexico’s central bank, Banco de Mexico (Banxico for short), didn’t cut rates as aggressively as most of its peers last year. AMLO’s leftist government also didn’t unleash nearly as much fiscal stimulus as its right-wing Brazilian counterpart. Nonetheless, the consumer price index (CPI) in Mexico still weighed in at 5.59% in August, almost double the central bank’s target rate of 3%.

Banxico raised its benchmark policy rate by 25 bps to 4.75% last week, saying that while it expects the shocks fuelling inflation to be transitory, they may still pose risks to the price formation process and to inflation expectations, due to their variety, magnitude and potential duration of their effects.

Prices are also rising fast along the Andes. In August, Colombia’s consumer price index (CPI) clocked in at 4.44%, its highest level since 2017. Chile’s CPI reached 4.8% in August, its highest reading since late 2016. In September, Peru recorded its fifth consecutive month of rises, as its CPI surged to 5.23%. The last time it was that high was February 2009. All three countries have begun hiking rates in the last month.

In Brazil today inflation rates have tripled over the past year, from 3.1% in August 2020 to an anualized 9.7% in August 2021, its highest level since 2016. In September, the IPCA-15 consumer-price index — a mid-month predictor of the official inflation rate — surged by 1.14% over the month. If the indicator rings true, Brazil will soon report its highest reading for the month of September since 1994. That was when the country had just launched a new currency, the Brazilian Real, after being ravaged by its second bout of hyperinflation in seven years.

In Mexico, inflation is not quite as high as in Brazil, partly because Mexico’s central bank, Banco de Mexico (Banxico for short), didn’t cut rates as aggressively as most of its peers last year. AMLO’s leftist government also didn’t unleash nearly as much fiscal stimulus as its right-wing Brazilian counterpart. Nonetheless, the consumer price index (CPI) in Mexico still weighed in at 5.59% in August, almost double the central bank’s target rate of 3%.

Banxico raised its benchmark policy rate by 25 bps to 4.75% last week, saying that while it expects the shocks fuelling inflation to be transitory, they may still pose risks to the price formation process and to inflation expectations, due to their variety, magnitude and potential duration of their effects.

Prices are also rising fast along the Andes. In August, Colombia’s consumer price index (CPI) clocked in at 4.44%, its highest level since 2017. Chile’s CPI reached 4.8% in August, its highest reading since late 2016. In September, Peru recorded its fifth consecutive month of rises, as its CPI surged to 5.23%. The last time it was that high was February 2009. All three countries have begun hiking rates in the last month.