Elaborately detailed piece by Jacobin. It's adapted from “Foreclosed: Destruction of Black Wealth During the Obama Presidency,” a report out from People’s Policy Project.

Crucial snippets:

A Program Designed to Fail

*For homeowners, the largest source of potential relief was, ironically, that same bank bailout, which contained an unspecified appropriation to “prevent avoidable foreclosures.” The Obama administration designed and implemented the foreclosure relief effort, calling it the Home Affordable Mortgage Program (HAMP), and set aside $75 billion for the effort.

But HAMP proved to be an abject failure. The basic problem was that the government paid mortgage servicers (who process the payments and paperwork for the mortgage owner) to conduct mortgage modifications. Servicers have an incentive to keep people paying on a high principal, since they receive a percentage of the outstanding debt. They even have an incentive to foreclose, because they are paid from the proceeds of a foreclosure sale before the actual owners.

As a result, in many cases HAMP actively enabled foreclosure. Its re-default rate — the fraction of people who got a modification and later defaulted out of the program — was 22 percent as of 2013. Only about $15 billion of the original $75 billion appropriation was spent by mid-2016.

Letting Off Crooks

*During the bubble years, originators and banks had routinely mangled the paperwork while issuing loans and packaging them into securities. When they went to foreclose, they often found they did not have the correct documentation. But rather than acknowledging their indiscretions, financial institutions paid large teams of entry-level employees to commit document fraud on an industrial scale — forging signatures, falsely notarizing documents, or falsely attesting to “personal knowledge” of large mortgage files, hundreds of times per day. This was the so-called “robosigning” scandal.

These document problems eventually came to the attention of law enforcement. Forty-nine state attorneys general, the District of Columbia, and the Department of Justice banded together in a lawsuit, which resulted in a $26 billion joint settlement between them and the five largest servicers.

However, largely due to foot-dragging at the Department of Justice, the settlement ended up being toothless. Much of the cash went to “short sales” (simply selling an underwater home) instead of principal reductions, or to other weak relief. Servicers even received roughly $12 billion in credit for waiving outstanding debts from short sales in states where such a waiver is already legally mandatory. JPMorgan Chase allegedly claimed credit for forgiving loans that it had already sold.

Black Wealth Destroyed

*Former Wells Fargo employees later testified that the bank deliberately tricked middle-class black families (who they called “mud people”) into subprime “ghetto loans.” Overall, a Center for Responsible Lending study found that from 2004 to 2008, 6.2 percent of white borrowers with a credit score of 660 and up got subprime mortgages, while 19.3 percent of such Latino borrowers and 21.4 percent of black borrowers did.

The effects of the foreclosure disaster are starkly apparent in Survey of Consumer Finances data. To start, the homeownership national rate shows a marked decline over almost the whole Obama presidency, reaching the lowest rate since 1965 (before slightly rebounding).

Broken down by race, the overall story for homeownership is similar for all groups, but black homeowners started lower and stayed lower than white ones, with no rebound at all from 2013 to 2016.

However, the total homeownership rate can be misleading in that it includes people with negative equity, which is worse than owning no home at all — it is merely “a rental with debt.” After the crisis, the percentage of black homeowners with negative equity exploded by twenty-fold, from 0.7 percent to 14.2 percent — and unlike white families, did not reach its peak until 2013.

Next we examined home equity by race. Here is average white, black, and Latino home equity by year:

The sharp decline from 2007 to 2013 is readily seen, as well as partial recovery through 2016, and the large racial wealth gap. Average white home equity in 2016 is 3.5 times greater than the same black figure, and it has regained 84 percent of its 2007 value, compared to a black figure of 73 percent.

Then there are the distributional effects. Home ownership makes up a much larger percentage of black and Latino wealth than it does white wealth, and a much larger percentage of middle-class wealth than top wealth in all racial groups. On the eve of the recession, middle-class families tended to hold 50 percent to 70 percent of their wealth in home equity, while the wealthiest 10 percent of families held 15 percent to 30 percent of their wealth in home equity.

Given these differences in wealth portfolios, bailing out financial assets after 2008 while allowing homeowners to drown directly concentrated the national wealth into the hands of the richest white families.

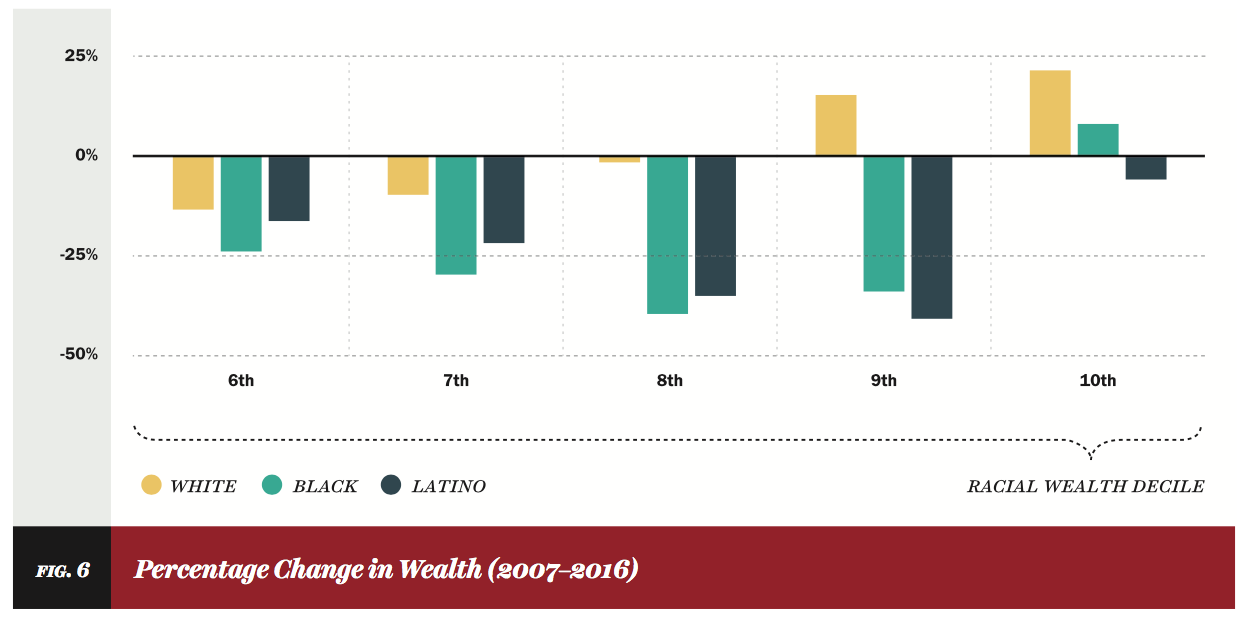

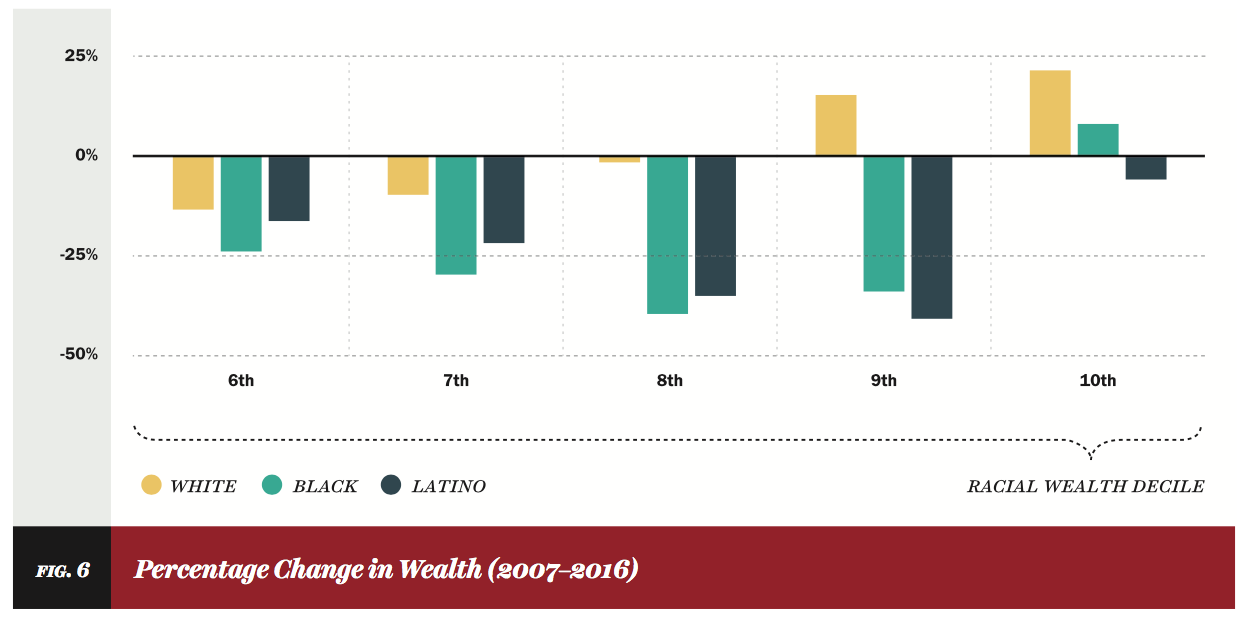

Between 2007 and 2016, the wealthiest 10 percent of white families saw their wealth expand by an average of $1.2 million (21.6 percent), the next wealthiest 10 percent of white families increased their net worth by an average of $141,000 (15.5 percent), and the top 10 percent of black families grew their wealth by $78,000 (8 percent). Everyone else experienced wealth declines as high as 40 percent.

Mass foreclosures have severe ripple effects. People who lose their homes are at greater risk of job loss and falling into poverty, and are more likely to commit suicide. Nearby homes lose value, as foreclosed properties are often blighted. A 2013 Center for Responsible Lending study estimated that properties in proximity to a foreclosure shed $2.2 trillion in value — and that half that loss was in communities of color.

The decision to hang homeowners — especially black homeowners — out to dry was a catastrophe.

What Obama Wrought

It is impossible to say with any certainty what the precise effects of a sensible housing policy would have been. But it unquestionably would have prevented a huge fraction of the wealth destruction detailed above. The overall housing crash would have passed much sooner — even in 2016 the rate of foreclosure was higher than it was in 2005.

No political obstacle stood between President Obama and a better housing policy. On the contrary, his heavily bank-slanted policy cost the Democrats dearly: mass foreclosure, and the associated economic wreckage, is a large part of why his party was crushed in the 2010 midterms.

Because African Americans were disproportionately victimized at all levels of the housing and foreclosure crises, they stood to gain the most from better policy. But because Obama’s approach failed cataclysmically, the first black president in American history turned out to be a disaster for black wealth.

Link to essay: https://jacobinmag.com/2017/12/obama-foreclosure-crisis-wealth-inequality

Crucial snippets:

A Program Designed to Fail

*For homeowners, the largest source of potential relief was, ironically, that same bank bailout, which contained an unspecified appropriation to “prevent avoidable foreclosures.” The Obama administration designed and implemented the foreclosure relief effort, calling it the Home Affordable Mortgage Program (HAMP), and set aside $75 billion for the effort.

But HAMP proved to be an abject failure. The basic problem was that the government paid mortgage servicers (who process the payments and paperwork for the mortgage owner) to conduct mortgage modifications. Servicers have an incentive to keep people paying on a high principal, since they receive a percentage of the outstanding debt. They even have an incentive to foreclose, because they are paid from the proceeds of a foreclosure sale before the actual owners.

As a result, in many cases HAMP actively enabled foreclosure. Its re-default rate — the fraction of people who got a modification and later defaulted out of the program — was 22 percent as of 2013. Only about $15 billion of the original $75 billion appropriation was spent by mid-2016.

Letting Off Crooks

*During the bubble years, originators and banks had routinely mangled the paperwork while issuing loans and packaging them into securities. When they went to foreclose, they often found they did not have the correct documentation. But rather than acknowledging their indiscretions, financial institutions paid large teams of entry-level employees to commit document fraud on an industrial scale — forging signatures, falsely notarizing documents, or falsely attesting to “personal knowledge” of large mortgage files, hundreds of times per day. This was the so-called “robosigning” scandal.

These document problems eventually came to the attention of law enforcement. Forty-nine state attorneys general, the District of Columbia, and the Department of Justice banded together in a lawsuit, which resulted in a $26 billion joint settlement between them and the five largest servicers.

However, largely due to foot-dragging at the Department of Justice, the settlement ended up being toothless. Much of the cash went to “short sales” (simply selling an underwater home) instead of principal reductions, or to other weak relief. Servicers even received roughly $12 billion in credit for waiving outstanding debts from short sales in states where such a waiver is already legally mandatory. JPMorgan Chase allegedly claimed credit for forgiving loans that it had already sold.

Black Wealth Destroyed

*Former Wells Fargo employees later testified that the bank deliberately tricked middle-class black families (who they called “mud people”) into subprime “ghetto loans.” Overall, a Center for Responsible Lending study found that from 2004 to 2008, 6.2 percent of white borrowers with a credit score of 660 and up got subprime mortgages, while 19.3 percent of such Latino borrowers and 21.4 percent of black borrowers did.

The effects of the foreclosure disaster are starkly apparent in Survey of Consumer Finances data. To start, the homeownership national rate shows a marked decline over almost the whole Obama presidency, reaching the lowest rate since 1965 (before slightly rebounding).

Broken down by race, the overall story for homeownership is similar for all groups, but black homeowners started lower and stayed lower than white ones, with no rebound at all from 2013 to 2016.

However, the total homeownership rate can be misleading in that it includes people with negative equity, which is worse than owning no home at all — it is merely “a rental with debt.” After the crisis, the percentage of black homeowners with negative equity exploded by twenty-fold, from 0.7 percent to 14.2 percent — and unlike white families, did not reach its peak until 2013.

Next we examined home equity by race. Here is average white, black, and Latino home equity by year:

The sharp decline from 2007 to 2013 is readily seen, as well as partial recovery through 2016, and the large racial wealth gap. Average white home equity in 2016 is 3.5 times greater than the same black figure, and it has regained 84 percent of its 2007 value, compared to a black figure of 73 percent.

Then there are the distributional effects. Home ownership makes up a much larger percentage of black and Latino wealth than it does white wealth, and a much larger percentage of middle-class wealth than top wealth in all racial groups. On the eve of the recession, middle-class families tended to hold 50 percent to 70 percent of their wealth in home equity, while the wealthiest 10 percent of families held 15 percent to 30 percent of their wealth in home equity.

Given these differences in wealth portfolios, bailing out financial assets after 2008 while allowing homeowners to drown directly concentrated the national wealth into the hands of the richest white families.

Between 2007 and 2016, the wealthiest 10 percent of white families saw their wealth expand by an average of $1.2 million (21.6 percent), the next wealthiest 10 percent of white families increased their net worth by an average of $141,000 (15.5 percent), and the top 10 percent of black families grew their wealth by $78,000 (8 percent). Everyone else experienced wealth declines as high as 40 percent.

Mass foreclosures have severe ripple effects. People who lose their homes are at greater risk of job loss and falling into poverty, and are more likely to commit suicide. Nearby homes lose value, as foreclosed properties are often blighted. A 2013 Center for Responsible Lending study estimated that properties in proximity to a foreclosure shed $2.2 trillion in value — and that half that loss was in communities of color.

The decision to hang homeowners — especially black homeowners — out to dry was a catastrophe.

What Obama Wrought

It is impossible to say with any certainty what the precise effects of a sensible housing policy would have been. But it unquestionably would have prevented a huge fraction of the wealth destruction detailed above. The overall housing crash would have passed much sooner — even in 2016 the rate of foreclosure was higher than it was in 2005.

No political obstacle stood between President Obama and a better housing policy. On the contrary, his heavily bank-slanted policy cost the Democrats dearly: mass foreclosure, and the associated economic wreckage, is a large part of why his party was crushed in the 2010 midterms.

Because African Americans were disproportionately victimized at all levels of the housing and foreclosure crises, they stood to gain the most from better policy. But because Obama’s approach failed cataclysmically, the first black president in American history turned out to be a disaster for black wealth.

Link to essay: https://jacobinmag.com/2017/12/obama-foreclosure-crisis-wealth-inequality