88m3

Fast Money & Foreign Objects

By Harry Stein & Anna Chu | Wednesday, March 18, 2015

Talking points from congressional Republican leaders are now filled with concern about inequality, the struggling middle class, and stagnant wages, but their budget plans do not match this rhetoric.

The new talking points are at least an improvement over the old rhetoric that attempted to downplay rising inequality and portrayed many struggling Americans as lazy takers. For example, in 2012, Rep. Paul Ryan (R-WI), then chairman of the House Budget Committee, toldthe conservative MacIver Institute, “We risk hitting a tipping point in our society, where we have more takers than makers in society. Where we will have turned our safety net into a hammock.” The year before, Rep. Ryan released a report on economic inequality, and while he acknowledged the “painful fact that millions of Americans are materially impoverished,” he attempted to diminish and undermine this fact by arguing, “In many important respects, the difference between ultra-elites and average Americans is less pronounced today.” This claim was based on the increased affordability of consumer goods such as televisions, cell phones, and cars, but the availability of inexpensive electronics and vehicles does not make it acceptable for a working family to struggle to afford even basic housing, nutritious food, and utilities.

What a difference a few years can make. Rep. Ryan now says he “was wrong to talk about ‘makers and takers.’” And other congressional leaders are tripping over themselves to express their newfound interest in addressing stagnant wages, rising inequality, and the detrimental effects of poverty. House Speaker John Boehner (R-OH) says inequality is a problem that his caucus wants to address. Rep. Ryan spent a significant amount of time on an anti-poverty tourin 2014. Indeed, the House budget itself talks about how “wages have stagnated, median income is down.” So have these congressional leaders become the new champions for working and middle class families?

Hardly.

Rising income inequality and wage stagnation are the greatest economic challenges of our generation. But there is a big difference between congressional leaders’ rhetoric and the reality of their proposals and policies. In reality, little has changed. On the issues that matter to everyday American families—from combating income inequality to providing economic security for families, from boosting economic growth overall to boosting wages for workers specifically—the congressional budgets fail. Instead of offering new solutions to address these challenges, the congressional budgets resort to the same trickle-down policies that have increased inequality and hurt economic growth.

The congressional budgets increase income inequality

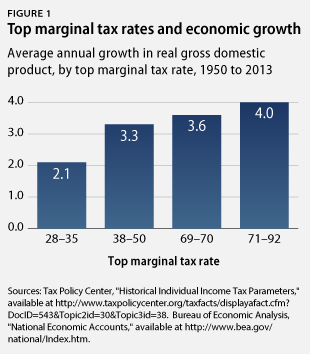

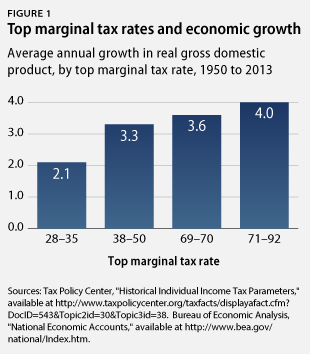

Congressional leaders are using a new sales pitch, but they are selling the same old thing. While these politicians are correct about the problems of rising income inequality and stagnant wages, the solution they propose—cutting taxes for the wealthiest Americans—would only exacerbate inequality and hurt working- and middle-class families. This is the same tired policy that trickle-down believers have pushed for decades as being good for the economy, but a growing body of economic research demonstrates that tax cuts for the rich do not generate economic growth. And while correlation does not prove causation, trickle-down adherents still need to explain how these tax cuts can possibly be such a powerful growth engine when low top tax rates are actually associated with periods of relatively low economic growth.

Both the Senate and House budgets propose massive spending cuts without seeking to raise even a nickel of new tax revenue. While struggling families lose the programs that offer a foothold to climb into the middle class, these budgets give a free pass to millionaires, billionaires, and big corporations. Both budgets cut taxes on wages and investment income for high-income taxpayers by repealing the tax changes in the Affordable Care Act. The House budget also repeals the Alternative Minimum Tax—a tax cut that would almost exclusivelybenefit taxpayers making more than $200,000 per year. The White House estimates that these tax changes would cut taxes by at least $50,000 per year for the average millionaire.

The House budget calls for lower tax rates for large corporations and individuals with business income, which would be a windfall for those at the top. Corporate taxes are mostly paid by the wealthy, with the nonpartisan Congressional Budget Office estimating that the top 1 percent of households paid 48.7 percent of corporate income taxes in 2011. If a corporate tax reform package ended enough tax breaks, it would be possible to lower the corporate tax rate and reduce deficits at the same time, but the congressional budgets do not identify even a single tax loophole to close. A special low rate for business income not taxed at the corporate level would also disproportionately benefit the wealthy. While business income only accounted for 7 percent of the total market income for all American households in 2011, the top 1 percent received 22 percent of their income from this source.

While this year’s congressional budgets do not specify how much to lower tax rates, their tax reform parameters are consistent with more specific tax cuts from earlier House budgets, which would have cost approximately $5.7 trillion over 10 years. The lack of details is troubling for low- and middle-income taxpayers, since any tax reform that cuts taxes so steeply for the rich will have to raise taxes on others to make the numbers add up. Cutting the top tax rate might not be correlated with economic growth, but it is correlated with making the rich even richer and increasing inequality.

The congressional budgets make middle-class economic security even more unaffordable

Congressional leaders have also recently expressed concern about the rising costs of living for the middle class. Rep. Ryan remarked that it is becoming “a serious problem for many Americans,” while Sen. Marco Rubio (R-FL) spoke about how the American dream is “increasingly difficult to achieve for far too many” in part because “everyday costs have risen.” Both are right about the challenges families face with rising costs. An analysis by the Center for American Progress shows that from 2000 to 2012, a median-income married couple with two kids saw their income rise by a mere $600, while the cost of the pillars of middle-class security—such as health care, child care, housing, retirement, and higher education—rose by more than $10,000.

https://www.americanprogress.org/is...-their-budgets-only-work-for-the-wealthy-few/

Shame on them

further reading in link

Talking points from congressional Republican leaders are now filled with concern about inequality, the struggling middle class, and stagnant wages, but their budget plans do not match this rhetoric.

The new talking points are at least an improvement over the old rhetoric that attempted to downplay rising inequality and portrayed many struggling Americans as lazy takers. For example, in 2012, Rep. Paul Ryan (R-WI), then chairman of the House Budget Committee, toldthe conservative MacIver Institute, “We risk hitting a tipping point in our society, where we have more takers than makers in society. Where we will have turned our safety net into a hammock.” The year before, Rep. Ryan released a report on economic inequality, and while he acknowledged the “painful fact that millions of Americans are materially impoverished,” he attempted to diminish and undermine this fact by arguing, “In many important respects, the difference between ultra-elites and average Americans is less pronounced today.” This claim was based on the increased affordability of consumer goods such as televisions, cell phones, and cars, but the availability of inexpensive electronics and vehicles does not make it acceptable for a working family to struggle to afford even basic housing, nutritious food, and utilities.

What a difference a few years can make. Rep. Ryan now says he “was wrong to talk about ‘makers and takers.’” And other congressional leaders are tripping over themselves to express their newfound interest in addressing stagnant wages, rising inequality, and the detrimental effects of poverty. House Speaker John Boehner (R-OH) says inequality is a problem that his caucus wants to address. Rep. Ryan spent a significant amount of time on an anti-poverty tourin 2014. Indeed, the House budget itself talks about how “wages have stagnated, median income is down.” So have these congressional leaders become the new champions for working and middle class families?

Hardly.

Rising income inequality and wage stagnation are the greatest economic challenges of our generation. But there is a big difference between congressional leaders’ rhetoric and the reality of their proposals and policies. In reality, little has changed. On the issues that matter to everyday American families—from combating income inequality to providing economic security for families, from boosting economic growth overall to boosting wages for workers specifically—the congressional budgets fail. Instead of offering new solutions to address these challenges, the congressional budgets resort to the same trickle-down policies that have increased inequality and hurt economic growth.

The congressional budgets increase income inequality

Congressional leaders are using a new sales pitch, but they are selling the same old thing. While these politicians are correct about the problems of rising income inequality and stagnant wages, the solution they propose—cutting taxes for the wealthiest Americans—would only exacerbate inequality and hurt working- and middle-class families. This is the same tired policy that trickle-down believers have pushed for decades as being good for the economy, but a growing body of economic research demonstrates that tax cuts for the rich do not generate economic growth. And while correlation does not prove causation, trickle-down adherents still need to explain how these tax cuts can possibly be such a powerful growth engine when low top tax rates are actually associated with periods of relatively low economic growth.

Both the Senate and House budgets propose massive spending cuts without seeking to raise even a nickel of new tax revenue. While struggling families lose the programs that offer a foothold to climb into the middle class, these budgets give a free pass to millionaires, billionaires, and big corporations. Both budgets cut taxes on wages and investment income for high-income taxpayers by repealing the tax changes in the Affordable Care Act. The House budget also repeals the Alternative Minimum Tax—a tax cut that would almost exclusivelybenefit taxpayers making more than $200,000 per year. The White House estimates that these tax changes would cut taxes by at least $50,000 per year for the average millionaire.

The House budget calls for lower tax rates for large corporations and individuals with business income, which would be a windfall for those at the top. Corporate taxes are mostly paid by the wealthy, with the nonpartisan Congressional Budget Office estimating that the top 1 percent of households paid 48.7 percent of corporate income taxes in 2011. If a corporate tax reform package ended enough tax breaks, it would be possible to lower the corporate tax rate and reduce deficits at the same time, but the congressional budgets do not identify even a single tax loophole to close. A special low rate for business income not taxed at the corporate level would also disproportionately benefit the wealthy. While business income only accounted for 7 percent of the total market income for all American households in 2011, the top 1 percent received 22 percent of their income from this source.

While this year’s congressional budgets do not specify how much to lower tax rates, their tax reform parameters are consistent with more specific tax cuts from earlier House budgets, which would have cost approximately $5.7 trillion over 10 years. The lack of details is troubling for low- and middle-income taxpayers, since any tax reform that cuts taxes so steeply for the rich will have to raise taxes on others to make the numbers add up. Cutting the top tax rate might not be correlated with economic growth, but it is correlated with making the rich even richer and increasing inequality.

The congressional budgets make middle-class economic security even more unaffordable

Congressional leaders have also recently expressed concern about the rising costs of living for the middle class. Rep. Ryan remarked that it is becoming “a serious problem for many Americans,” while Sen. Marco Rubio (R-FL) spoke about how the American dream is “increasingly difficult to achieve for far too many” in part because “everyday costs have risen.” Both are right about the challenges families face with rising costs. An analysis by the Center for American Progress shows that from 2000 to 2012, a median-income married couple with two kids saw their income rise by a mere $600, while the cost of the pillars of middle-class security—such as health care, child care, housing, retirement, and higher education—rose by more than $10,000.

https://www.americanprogress.org/is...-their-budgets-only-work-for-the-wealthy-few/

Shame on them

further reading in link