88m3

Fast Money & Foreign Objects

China Makes Debt Burden Heavier for Others

14 AUG 16, 2015 6:00 PM EDT

By Mark Whitehouse

China's surprise move to weaken the yuan will have repercussions far beyond last week's market turmoil. For one: Governments and companies in emerging markets will have a harder time paying the dollar-denominated debt they have amassed.

The People's Currency

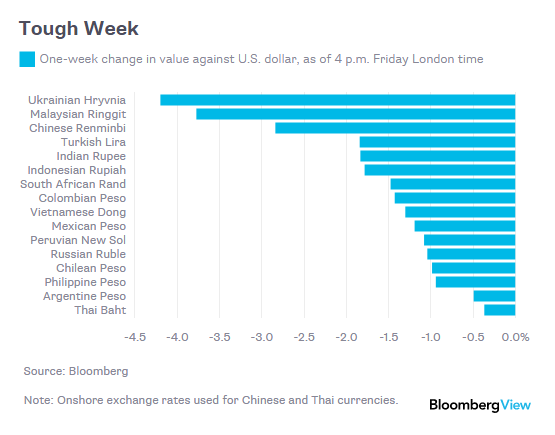

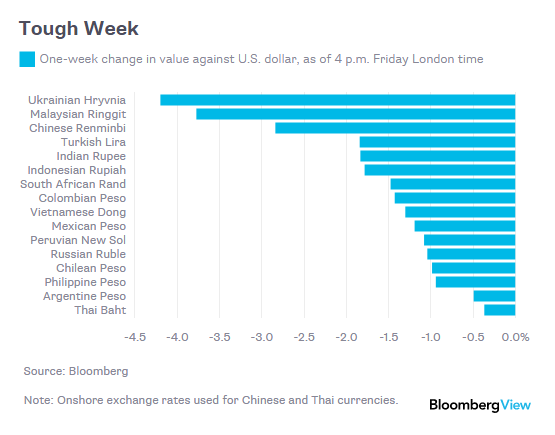

The yuan's depreciation -- by almost 3 percent against the U.S. dollar -- triggered instability and exchange-rate declines across emerging markets. As of Friday evening in Asia, the Malaysian ringgit was down 3.8 percent from a week earlier. The Turkish lira, Mexican peso and Russian ruble also fell sharply. Here's a ranking:

The depreciations might help the countries' exports remain competitive. But they also expose a vulnerability: Over the past several years, borrowers in emerging markets have built up more than $2 trillion in dollar-denominated debt. When the U.S. currency was cheap and the Federal Reserve was holding interest rates close to zero, that debt seemed like a great deal. Now, with the dollar getting stronger and the Fed set to start raising rates, it's becoming more of a burden.

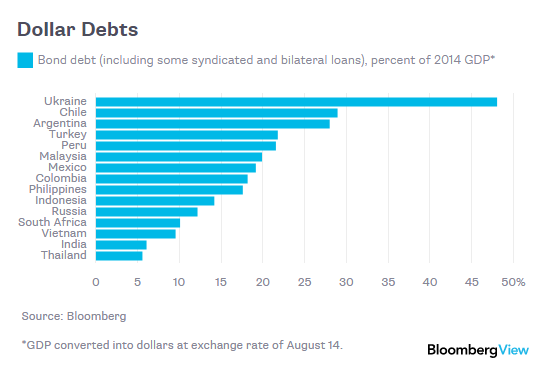

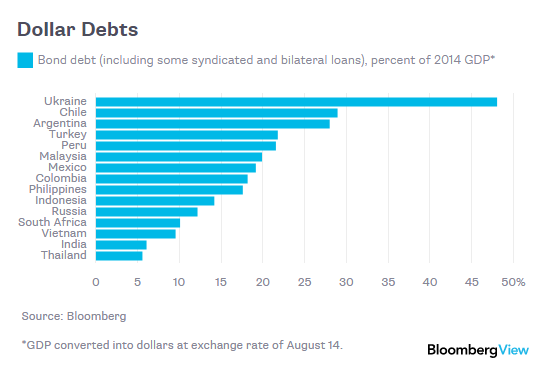

Here's a breakdown of the dollar-denominated government and corporate bond debt of selected emerging-market countries, as a share of gross domestic product (it excludes most loans, which can be significant):

If investors decide the debts aren’t sustainable, they could pull out en masse, starting a dangerous spiral of declining exchange rates and financial stress that could render otherwise viable companies and governments insolvent. One can only hope that regulators are trying to understand where the resulting losses would be concentrated, and how to mitigate the potential fallout.

China Makes Emerging Market Debt Heavier

Thanks, China!

14 AUG 16, 2015 6:00 PM EDT

By Mark Whitehouse

China's surprise move to weaken the yuan will have repercussions far beyond last week's market turmoil. For one: Governments and companies in emerging markets will have a harder time paying the dollar-denominated debt they have amassed.

The People's Currency

The yuan's depreciation -- by almost 3 percent against the U.S. dollar -- triggered instability and exchange-rate declines across emerging markets. As of Friday evening in Asia, the Malaysian ringgit was down 3.8 percent from a week earlier. The Turkish lira, Mexican peso and Russian ruble also fell sharply. Here's a ranking:

The depreciations might help the countries' exports remain competitive. But they also expose a vulnerability: Over the past several years, borrowers in emerging markets have built up more than $2 trillion in dollar-denominated debt. When the U.S. currency was cheap and the Federal Reserve was holding interest rates close to zero, that debt seemed like a great deal. Now, with the dollar getting stronger and the Fed set to start raising rates, it's becoming more of a burden.

Here's a breakdown of the dollar-denominated government and corporate bond debt of selected emerging-market countries, as a share of gross domestic product (it excludes most loans, which can be significant):

If investors decide the debts aren’t sustainable, they could pull out en masse, starting a dangerous spiral of declining exchange rates and financial stress that could render otherwise viable companies and governments insolvent. One can only hope that regulators are trying to understand where the resulting losses would be concentrated, and how to mitigate the potential fallout.

China Makes Emerging Market Debt Heavier

Thanks, China!