Big batteries are solving a longstanding problem with solar power in California. Can they do the same for Australia?

When you graph electricity demand in power grids with lots of solar panels, it looks a bit like a duck, with high points in the morning and evening (when people are relying on the grid) and a big dip in the middle of the day (when many people use their own solar instead and need less from the...

JUNE 18, 2024

Editors' notes

Big batteries are solving a longstanding problem with solar power in California. Can they do the same for Australia?

by Asma Aziz, The Conversation

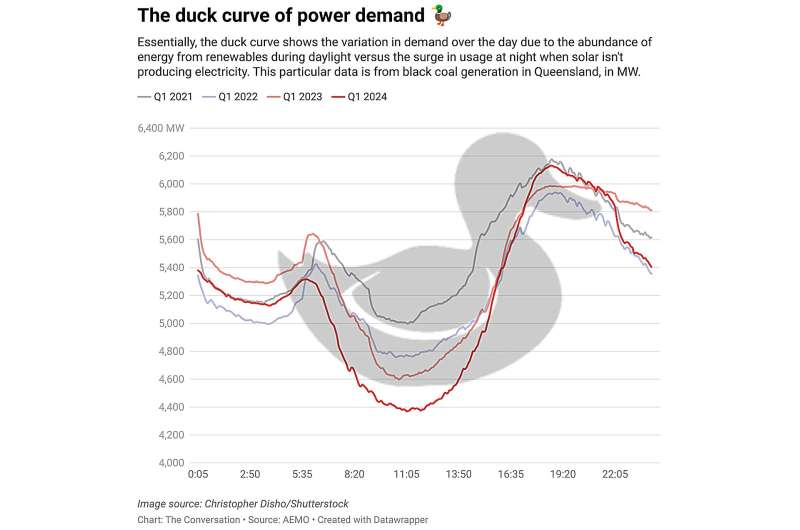

When you graph electricity demand in power grids with lots of solar panels, it looks a bit like a duck, with high points in the morning and evening (when people are relying on the grid) and a big dip in the middle of the day (when many people use their own solar instead and need less from the grid). This is known as the "duck curve." While it sounds cute, it's become a significant challenge for energy utilities worldwide.

That's because solar stops supplying power to the grid just before the evening surge in demand, when people get home from work. That puts more strain on the grid, and props up the case for fossil fuel generators, creating economic challenges for utilities.

In the United States, California is showing there is a clear solution—use grid-scale batteries to store excess solar power for use later that evening.

This year, the Golden State has enough battery storage to begin pushing gas out of the grid in the evenings.

This should embolden Australian authorities, who have begun building large-scale battery storage to soak up cheap solar.

What does California's experience show us?

Authorities in California have been wrestling with the duck curve for years. The state is an economic giant—the fifth largest economy in the world—and has one of the world's largest state grids, with a large and mature solar market.In 2019, large-scale batteries started appearing in California's grid. The sector has seen tremendous growth, soaring 1,250% in five years, from 770 million watts to 10 billion watts). We can now see the results. The famous duck curve is being reshaped. Abundant solar is being shifted to the evening peak.

Solar and batteries are a natural fit. Pairing them offers a win-win model for future energy grids, turning cheap but time-limited electricity from solar into a much more versatile commodity: electricity on demand.

How grid storage duration is assessed and why it matters.

For two hours on one evening this April, batteries set a new record, becoming the largest source of power on the grid by discharging about 6.7 billion watts of power.

California's rapid scaling of utility-scale battery storage is due to ambitious procurement mandates and a market structure permitting batteries to help meet energy needs. Utility-scale battery storage in the US is concentrated in Texas and California, with some form of energy storage policies adopted in another 16 states.

The state's rapid ramp-up of battery storage is a good sign for Australia. With large solar farms and millions of rooftop solar arrays, Australian energy market operators have become familiar with the duck curve.

Last year, renewables supplied close to 40% of power to our main grid, the National Energy Market, covering eastern and southern states, and Western Australia's largest grid, the South West Integrated System. Ten major coal-fired power stations have retired in the last decade.

At the end of 2023, Australia had 2,600 million watts of utility-scale battery storage. But there's a lot more in the wings—11 billion watts are under construction.

Even so, more has to be done. Australia's market operator forecasts 20% of renewable energy production will be spilled or curtailed—that is, not make it to the grid—by 2050. This isn't necessarily a bad thing.

Timing is going to be crucial. We need new generation, storage and backup capacity in place before more coal plants can be retired.

How much storage is enough?

Cleaning up the electric grid is a huge job. We will need a lot of energy storage, which can be provided by batteries, pumped hydro and even abandoned mineshafts. Grid batteries have the advantage of being here, now. You can install them in a matter of weeks. By contrast, building new pumped hydro will take years.If we overestimate the role of energy storage, we risk destabilizing the grid. But if we underestimate it, we could slow investment and delay the shift to clean energy.

As California is demonstrating, battery storage can play a significant role in grid reliability by balancing supply and demand fluctuations and providing backup power during outages, while also integrating intermittent renewable energy sources effectively. But it's no silver bullet—it has inherent limitations.

Assessing storage capacity is complicated by its finite nature, with duration a key factor determining its capacity contribution. Home batteries provide up to two hours of dispatchable energy, meaning discharging at their maximum power capacity. For grid-scale installations, shallow storage offers up to 4 hours, medium storage 4–12 hours, and deep storage over 12 hours.

Adding big batteries isn't as simple as plugging one in and charging it from the sun. They make it easier to bring more renewable power into the grid by soaking up solar or wind which otherwise might not have been used. But their value to the grid can change significantly depending on where you place it and the time of day.

To maximize their use, we could, for instance, build large batteries in regions rich in renewables and make the most of scarce capacity on transmission lines or build them near areas with high energy demand to help manage peak demand by boosting network capacity.

California requires energy storage systems to provide full power for at least 4 hours. But in Australia, most large batteries can only last 2 hours or less, as they are designed to meet short-term energy needs.

This is beginning to change, with growing interest in longer-lasting storage to boost long-term grid reliability. Deep storage projects planned or underway in Australia's National Electricity Market include Snowy 2.0, which would have 7 days of storage supply.

New South Wales and Western Australia are accelerating the rollout of longer duration grid batteries, such as NSW's Richmond Valley Battery Energy Storage System (8 hours duration) and WA's Tesla-Neoen battery (4 hours).

Over the next few years, we can expect to see demand soar for longer-duration electricity storage. Once built, these batteries and other technologies will help Australia, too, banish the duck curve.

Authorities must set clear timelines for fossil fuel plant closure and invest in new power sources to replace it, as well as boosting storage.

Provided by The Conversation

This article is republished from The Conversation under a Creative Commons license. Read the original article.