basically work a super high paying job for 15 years and invested in the stock market when it crashed during the recession

39-year-old retired millionaire: 'Budgets don't work'—do this instead

Kathleen Elkins | @kathleen_elk

11:41 AM ET Wed, 26 Dec 2018

How this average 38-year-old became a millionaire and retired early

39-year-old retired millionaire: 'Budgets don't work'—do this instead

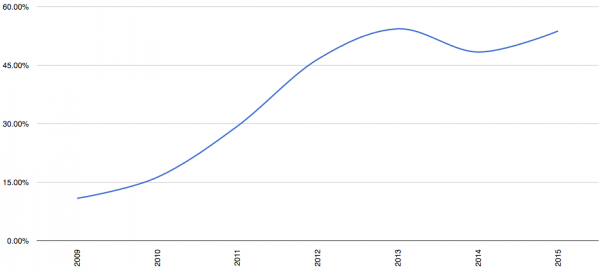

In 2016, Chris Reining quit his IT job at age 37 with more than $1 million in the bank by living a modest lifestyle, saving and investing more than half his income and putting his money to work. For nearly three years, he's been living comfortably off of his investments in Madison, Wisconsin.

Achieving such a high savings rate didn't require that he follow a strict budget, though. In fact, "budgets don't work," the self-made millionaire and early retiree writes on his blog. "I don't believe in them mostly because people can't stick to them."

He compares budgeting to dieting: "How many people do you know that are always going on new diets, trying this and that, and never succeeding?"

Doing what actually works can require a mindset shift, he says. "Reaching financial independence, like dieting, is about being conscious, making changes slowly, setting yourself up for success with measurable and attainable goals and making this your lifestyle."

That's why, instead of creating a highly-detailed budget that allocates money for different categories, he recommends tracking your money — what's coming in and what's going out.

Holly Whittlef

Chris Reining

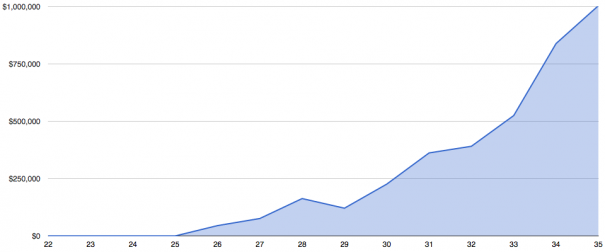

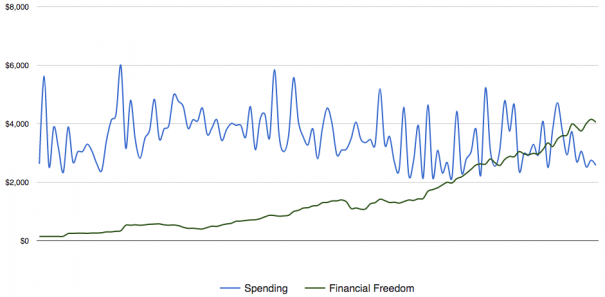

Reining, now 39, has been tracking his income, spending and investments in a spreadsheet since 2006. He's also been graphing what he calls his "cross-over point": when monthly investment income crosses above monthly expenses. "When this point happens is when you can seriously consider retiring because you are officially financially independent!" he writes. "No more income is needed from a job."

Turning your financial goals into something visual such as a graph is crucial, says Reining, because "it drives home the point that you can, in fact, retire early."

He tells CNBC Make It: "Once you start tracking this stuff and seeing it month to month and then year to year, you really start to understand, 'If I spend less, that means I'm saving and investing more. And if I'm saving and investing more, I'm going to be able to walk away sooner. I'm going to be able to have financial independence sooner, because these numbers all work together.'"

Experts agree that budgeting may not be mandatory. You can take control of your finances in other ways.

As long as you establish how much you need to save each month for retirement and other major purchases, and you actually set that amount aside, you don't have to budget at all, says Nick Holeman, certified financial planner at Betterment.

Set your goals, make sure that you're saving enough to reach them and don't worry about the day-to-day expenses, he tells Make It: "As long as you know how much you need to be saving and you're saving enough each month, who really cares where the rest of the money goes?"

"As long as you know how much you need to be saving and you're saving enough each month, who really cares where the rest of the money goes?" -Nick Holeman, certified financial planner

Kimmie Greene, money expert at Intuit and spokeswoman for Mint.com, offers similar advice: "People can get really hyper-focused on spending and think, 'How much am I spending on Uber versus taking the bus?' Or, 'How much am I spending on coffee?'" she tells Make It.

Rather than scrutinizing daily expenses, she encourages people to keep the big picture in mind. Tell yourself, "as long as I can save this much per month or quarter or year, it doesn't really matter how I spend my money. I just have to know that I'm getting to the savings goal that matters for me at this point in my life."

As long as you're reaching your savings goal, feel free to spend on lattes, shoes, a big wedding or whatever brings you joy.

If you think you need to budget to limit your spending, rather than sitting down and outlining one, try "the envelope system," says Reining: "Let's say after a few months of tracking your dollars you now have a pretty good handle on how much you're spending. And you're shocked to find that you're spending hundreds of dollars on clothes. Here's what you do: you give yourself $50 a month for clothes and put that cash in an envelope with the word 'Clothes' written on it.

"You can do this for all your expenses. Have an entertainment, food and household envelope each with the amount of dollars in it that you want to spend every month. When the money is gone from the envelope, that's it."

39-year-old retired millionaire: 'Budgets don't work'—do this instead

Kathleen Elkins | @kathleen_elk

11:41 AM ET Wed, 26 Dec 2018

How this average 38-year-old became a millionaire and retired early

39-year-old retired millionaire: 'Budgets don't work'—do this instead

In 2016, Chris Reining quit his IT job at age 37 with more than $1 million in the bank by living a modest lifestyle, saving and investing more than half his income and putting his money to work. For nearly three years, he's been living comfortably off of his investments in Madison, Wisconsin.

Achieving such a high savings rate didn't require that he follow a strict budget, though. In fact, "budgets don't work," the self-made millionaire and early retiree writes on his blog. "I don't believe in them mostly because people can't stick to them."

He compares budgeting to dieting: "How many people do you know that are always going on new diets, trying this and that, and never succeeding?"

Doing what actually works can require a mindset shift, he says. "Reaching financial independence, like dieting, is about being conscious, making changes slowly, setting yourself up for success with measurable and attainable goals and making this your lifestyle."

That's why, instead of creating a highly-detailed budget that allocates money for different categories, he recommends tracking your money — what's coming in and what's going out.

Holly Whittlef

Chris Reining

Reining, now 39, has been tracking his income, spending and investments in a spreadsheet since 2006. He's also been graphing what he calls his "cross-over point": when monthly investment income crosses above monthly expenses. "When this point happens is when you can seriously consider retiring because you are officially financially independent!" he writes. "No more income is needed from a job."

Turning your financial goals into something visual such as a graph is crucial, says Reining, because "it drives home the point that you can, in fact, retire early."

He tells CNBC Make It: "Once you start tracking this stuff and seeing it month to month and then year to year, you really start to understand, 'If I spend less, that means I'm saving and investing more. And if I'm saving and investing more, I'm going to be able to walk away sooner. I'm going to be able to have financial independence sooner, because these numbers all work together.'"

Experts agree that budgeting may not be mandatory. You can take control of your finances in other ways.

As long as you establish how much you need to save each month for retirement and other major purchases, and you actually set that amount aside, you don't have to budget at all, says Nick Holeman, certified financial planner at Betterment.

Set your goals, make sure that you're saving enough to reach them and don't worry about the day-to-day expenses, he tells Make It: "As long as you know how much you need to be saving and you're saving enough each month, who really cares where the rest of the money goes?"

"As long as you know how much you need to be saving and you're saving enough each month, who really cares where the rest of the money goes?" -Nick Holeman, certified financial planner

Kimmie Greene, money expert at Intuit and spokeswoman for Mint.com, offers similar advice: "People can get really hyper-focused on spending and think, 'How much am I spending on Uber versus taking the bus?' Or, 'How much am I spending on coffee?'" she tells Make It.

Rather than scrutinizing daily expenses, she encourages people to keep the big picture in mind. Tell yourself, "as long as I can save this much per month or quarter or year, it doesn't really matter how I spend my money. I just have to know that I'm getting to the savings goal that matters for me at this point in my life."

As long as you're reaching your savings goal, feel free to spend on lattes, shoes, a big wedding or whatever brings you joy.

If you think you need to budget to limit your spending, rather than sitting down and outlining one, try "the envelope system," says Reining: "Let's say after a few months of tracking your dollars you now have a pretty good handle on how much you're spending. And you're shocked to find that you're spending hundreds of dollars on clothes. Here's what you do: you give yourself $50 a month for clothes and put that cash in an envelope with the word 'Clothes' written on it.

"You can do this for all your expenses. Have an entertainment, food and household envelope each with the amount of dollars in it that you want to spend every month. When the money is gone from the envelope, that's it."

"

" ?

?