..... Beef

But back in 1951, we had less than half the number of mouths to feed. And a devastating pig virus that has never been seen in the United States before has already killed up to 6 million pigs in this country and continues to spread like wildfire. What all of this means is that the supply of meat is going to be tight for the foreseeable future even as demand for meat continues to go up. This is going to result in much higher prices, and so food is going to put a much larger dent in American family budgets in the months and years to come.

One year ago, the average price of USDA choice-grade beef was $4.91. Now it is up to

Come grilling season, expect your sirloin steak to come with a hearty side of sticker shock.

Beef prices have reached all-time highs in the U.S. and aren’t expected to come down any time soon.

Extreme weather has thinned the nation’s beef cattle herds to levels last seen in 1951, when there were about half as many mouths to feed in America.

,” said Dennis Smith,a commodities brokerfor Archer Financial Services inChicago.“

The outlook for pork is even worse. The price of bacon is 13 percent higher than it was a year ago, and porcine epidemic diarrhea

A virus never before seen in the U.S. has killed millions of baby pigs in less than a year, and with little known about how it spreads or how to stop it, it’s threatening pork production and pushing up prices by 10 percent or more.

Scientists think porcine epidemic diarrhea, which does not infect humans or other animals, came from China, but they don’t know how it got into the country or spread to 27 states since last May.

It is estimated that up to 6 million pigs may have died already, and it is being projected that U.S. pork production could be down by 7 percent this year. That would be the largest decline in more than 30 years.

But even if someone brought an end to this pig virus tomorrow, we would still be facing a very serious food crisis in this nation.

The reason for this is the multi-year drought which is crippling farming and ranching in much of the western half of the country.

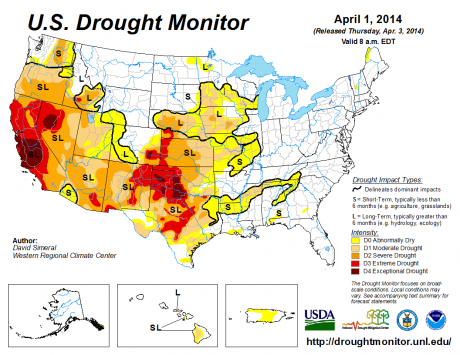

As you can see from

the latest U.S. Drought Monitor update, the drought shows no signs of letting up…

Hopefully this drought will end soon.

But I wouldn’t count on it.

In fact, CBS News recently interviewed one scientist that says that the state of California could potentially be facing “

a century-long megadrought“…

Scientist Lynn Ingram, author of “The West without Water: What Past Floods, Droughts, and Other Climatic Clues Tell Us about Tomorrow,” uses sediment cores inside tubes to study the history of drought in the West.

“We’ve taken this record back about 3,000 years,” Ingram says.

That record shows California is in one of its driest periods since 1580.

While a three-to-five-year drought is often thought of as being a long drought, Ingram says history shows they can be much longer.

“

If we go back several thousand years, we’ve seen that droughts can last over a decade, and in some cases, they can last over a century,” she says.

So what will we do if this drought just keeps going and going and going?

As the article quoted above noted, last century was far wetter than usual. During that time, we built teeming cities in the desert and we farmed vast areas that are usually bone dry…

Scientists say their research shows the 20th century was one of the wettest centuries in the past 1,300 years. During that time, we built massive dams and rerouted rivers. We used abundant water to build major cities and create a $45 billion agriculture industry in a place that used to be a desert.

So what happens if the western half of the country returns to “normal”?

What will we do then?

Meanwhile, drought is devastating many other very important agricultural areas around the world as well. For example, the horrible drought in Brazil could soon send the price of coffee

through the roof…

Coffee futures prices are up

more than 75 percent this year due to a lack of appreciable rain in the coffee growing region of eastern Brazil during January and February, which are critical months for plant development, according to the

International Coffee Organization, a London-based trade group.

At this point,

142 Brazilian cities are rationing water, and it wouldn’t just be coffee that would be affected by this drought. As a recent

RT article explained, Brazil is one of the leading exporters in a number of key agricultural categories…

Over 140 Brazilian cities have been pushed to ration water during the worst drought on record, according to a survey conducted by the country’s leading newspaper. Some neighborhoods only receive water once every three days.

Water is being rationed to nearly 6 million people living in a total of 142 cities across 11 states in Brazil, the world’s leading exporter of soybeans, coffee, orange juice, sugar and beef. Water supply companies told the Folha de S. Paulo newspaper that the country’s reservoirs, rivers and streams are the driest they have been in 20 years. A record heat wave could raise energy prices and damage crops.

Some neighborhoods in the city of Itu in Sao Paulo state (which accounts for one-quarter of Brazil’s population and one-third of its GDP), only receive water once every three days, for a total of 13 hours.

Most people just assume that we will always have massive quantities of cheap, affordable food in our supermarkets.

But just because that has been the case for as long as most of us can remember, that does not mean that it will always be true.

Times are changing, and food prices are already starting to move upward aggressively.

Yes, let us hope for the best, but let us also prepare for the worst.

....... real stuff.....I'll add stuff later

....... real stuff.....I'll add stuff later

)

)